In today's data-rich world, intuition is no longer enough. Master the power of data-driven decision-making in a competitive business environment.

Data Literacy and Exploration

Predictive Modeling

Model Validation and Accuracy

Feature Engineering

Trade-off Analysis

From Insight to Action

ROI of Analytics

In the simulation, participants will:

Analyze rich datasets containing historical sales, customer demographics, operational metrics, and market conditions.

Build and refine multiple predictive models to forecast key business outcomes like demand, customer churn, and conversion rates.

Make strategic decisions each period based on their model's forecasts, adjusting tactics in real-time.

Compete against other teams in a simulated market, where the accuracy of their predictions directly influences their financial results.

Iterate and improve their models based on performance feedback and changing market dynamics within the simulation.

Present their analytical approach and strategic rationale, defending their data-driven choices.

Interpret the core principles and business value of predictive analytics.

Construct a basic predictive model using a provided dataset and analytical software.

Evaluate the quality and accuracy of different predictive models.

Formulate business strategies that are directly informed by data-driven forecasts.

Articulate the financial and competitive advantages gained through the application of predictive analytics.

Collaborate effectively within a team to solve complex business problems using data.

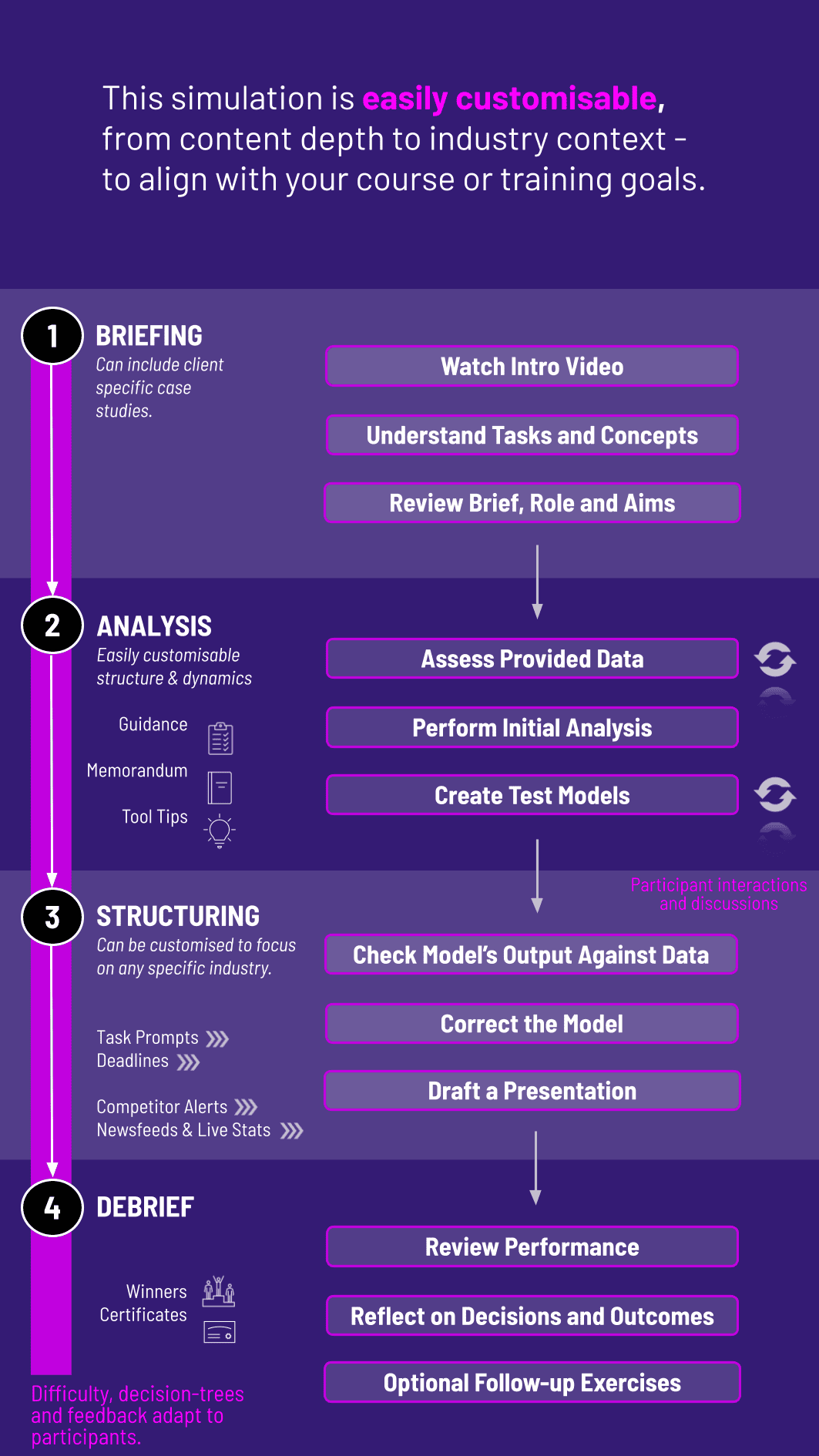

1. Introduction and Tool Training Participants are formed into teams, each running a virtual company. They receive training on the simulation interface and the integrated analytical tools.

2. Data Immersion Teams are given access to financial data. They perform initial analysis to understand market trends, customer behavior, and key performance drivers.

3. Model Building and First Decision Teams build their first predictive model and submit their initial strategic decisions.

4. Results and Market Feedback The simulation processes all team decisions, generating results that show market share, profitability, and other KPIs. Teams receive new data reflecting the market outcome.

5. Iterative Refinement Teams analyze the new results, refine their predictive models for improved accuracy, and submit a new set of decisions for the next round. This cycle repeats for several rounds.

6. Debrief and Presentation The simulation concludes with a comprehensive debrief. Teams present their analytical journey, key learnings, and how their data-driven strategies led to their final results.

Accuracy and robustness of financial models

Application of multiple valuation methods

Responsiveness to shocks and assumption changes

Clarity in communicating recommendations

Collaboration in building and presenting analyses

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.