Move beyond theory and make critical financial decisions in a dynamic, risk-free environment that mirrors real-life economic challenges and opportunities.

Cash Flow Management

Debt Strategy

Investment Fundamentals

Emergency Fund Planning

Retirement Planning

Major Lifecycle Financing

Credit Health

Behavioral Finance

In the simulation, participants will:

Create and manage a detailed monthly budget based on a simulated salary.

Allocate savings across various investment vehicles (stocks, bonds, ETFs, mutual funds).

Take on and pay down different types of debt, observing the impact of interest rates.

Navigate random "Life Events" such as a job loss, medical emergency, or unexpected windfall.

Make strategic decisions about major purchases like a car or a house.

Adjust their financial plan in response to simulated bull and bear markets.

Compete with peers to see who can achieve the highest net worth and financial health score.

Construct a sustainable personal budget that balances income, expenses, and savings goals.

Evaluate different debt instruments and create an effective plan for debt repayment.

Design a diversified investment portfolio aligned with personal risk tolerance and time horizon.

Analyze the long-term impact of compounding returns and regular savings on net worth.

Develop a proactive financial plan that accounts for both expected and unexpected life events.

Apply behavioral finance principles to avoid common financial decision-making pitfalls.

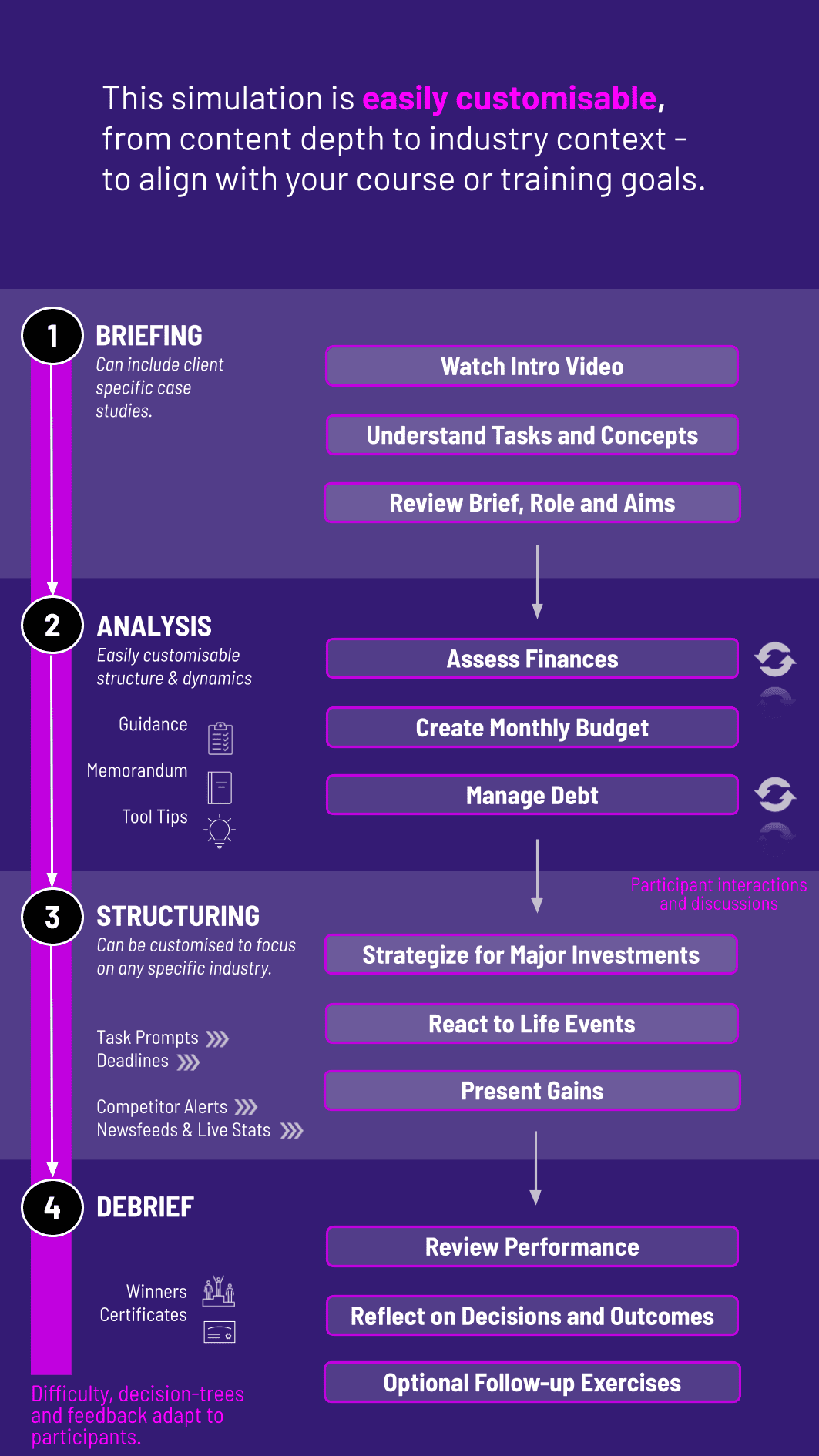

1. Setup and Briefing Participants are assigned a profile (age, career starter, initial savings, student debt) and introduced to the simulation dashboard.

2. Descision-Making Each simulated "period" participants receive a paycheck and must allocate funds towards expenses, debt repayment, investments, and the emergency fund.

3. Experience Consequences The simulation engine processes participants’ decisions, updating their net worth, credit score, and investment balances. Market performance and random life events are introduced, forcing them to adapt.

4. Review and Adapt Detailed reports and dashboards provide instant feedback on participants’ financial health. Participants see the direct results of their strategies and can adjust their approach for the next period.

5. Debrief At the conclusion, a comprehensive summary report highlights participants’ financial journey, key decisions, and final outcomes, facilitating powerful group discussion and self-reflection.

Do I need a finance background to participate? Not at all. The simulation is designed to be intuitive for beginners, with built-in tutorials and glossaries to explain key concepts as you go.

How long does the simulation take to complete? A typical simulation session runs for 4-6 rounds, which can be completed in 2-3 hours. However, you can often replay it to test different strategies.

Is this a stock market game? While investing in the stock market is a key component, it is only one part of a holistic financial picture. The simulation equally emphasizes budgeting, debt management, and planning for large expenses.

What makes this better than a free budgeting app? This is a learning tool, not just a tracker. It forces you to make trade-offs and experience the long-term consequences of your decisions in a compressed timeframe, which a passive app cannot do.

Can the simulation be customized for a corporate wellness program? Absolutely. We can customize salary levels, debt scenarios, and specific learning modules to align with your organization's financial wellness goals.

What technology do I need to run it? You only need a standard web browser and an internet connection. There is no special software to install.

After completing a simulation the data generated from participant’s decisions is constructed into the final Financial Health

Score based on key metrics like Net Worth, Debt-to-Income Ratio, Credit Score, and Savings Rate. This provides a clear, numerical assessment of the participant's strategic success.

A short knowledge check before and after the simulation measures the growth in understanding of core financial concepts. Instructors or facilitators can review the participant's journey, evaluating the quality and consistency of their budgeting, investing, and debt management choices.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.