Our Pension Fund Management Simulation places your team in the role of trustees and CIOs of a large pension fund, tasked with fulfilling long-term liabilities while managing risk, stakeholder expectations, and volatile markets.

Funding Ratio and Solvency

Asset-Liability Management

Strategic Asset Allocation

Liability-Driven Investing

Risk Budgeting

Stakeholder Management

Total Fund Cost Management

Fiduciary Duty and Governance

In the simulation, participants will:

Analyze the fund’s current financial and demographic status.

Develop and approve a Statement of Investment Principles.

Decide on strategic and tactical asset allocation.

Choose specific investment products.

Manage annual cash flows, including benefit payouts and sponsor contributions.

Rebalance the portfolio in response to market movements.

Present quarterly reports to the “Board of Trustees,” justifying performance and strategy.

Respond to stochastic crises (market crashes, inflation spikes, sponsor bankruptcy risk).

Explain the primary objectives and constraints of a pension fund.

Construct a strategic asset allocation aligned with a fund’s liability profile and risk tolerance.

Evaluate the risk-return-impact trade-offs of different asset classes, including alternative investments.

Implement basic LDI principles to hedge key liability risks.

Interpret a fund’s performance relative to its benchmark and funding status.

Articulate investment decisions and performance clearly to a fiduciary board.

Assess the impact of costs, fees, and turnover on long-term net returns.

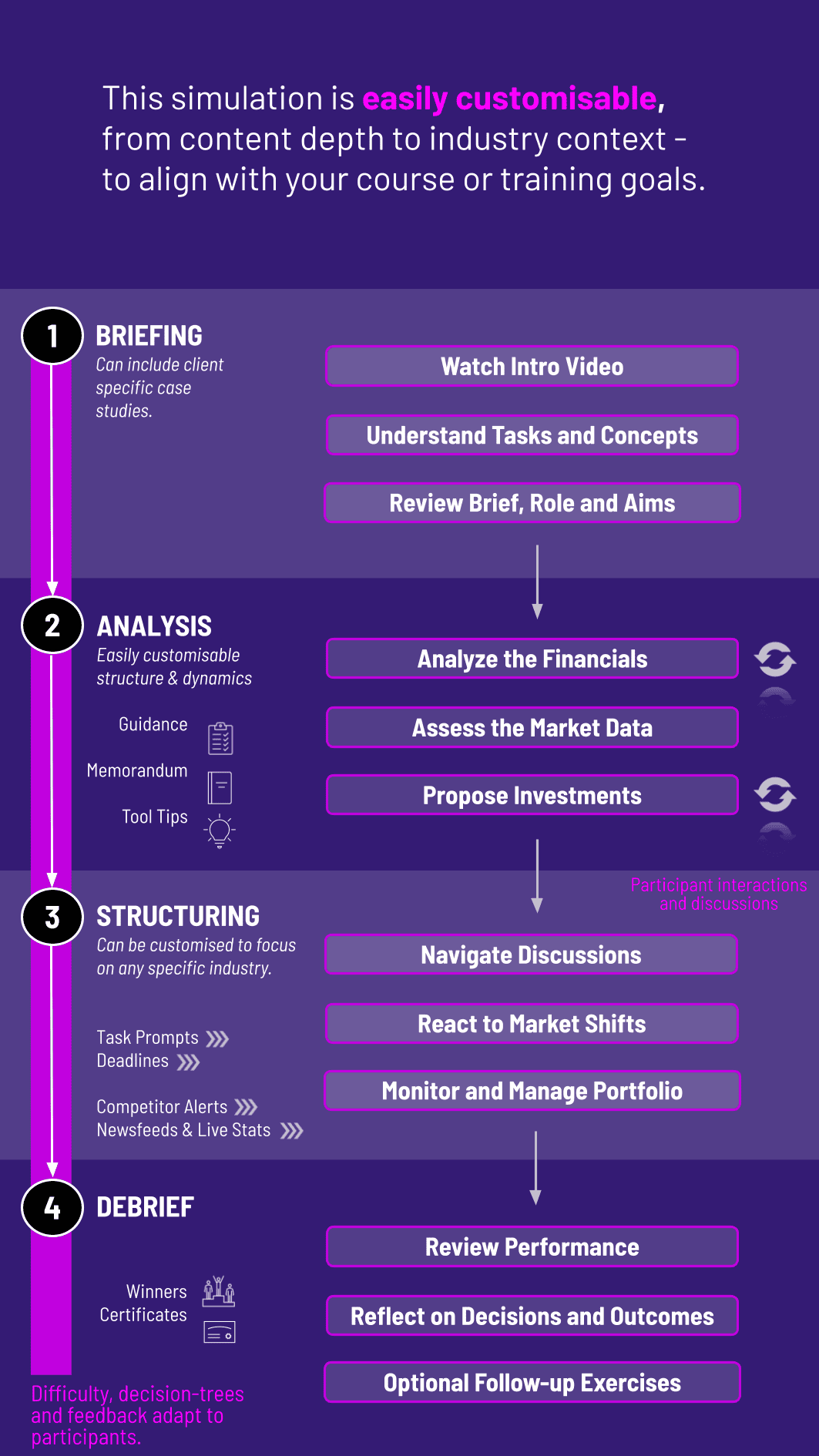

1. Team Formation and Briefing Teams of 3-5 are appointed as the investment committee. They receive the fund’s charter, current portfolio, liability study, and market data.

2. Decision Rounds Each round represents a fiscal quarter. Teams submit their investment decisions.

3. Simulation Engine The platform processes decisions using sophisticated financial models and stochastic event generators, producing updated portfolio valuations, funding ratios, and risk metrics.

4. Trustee Board Meetings Teams present their results and strategy, receiving feedback and facing challenging questions from the simulated Board (instructors/facilitators).

5. Market and Event Updates Each round includes new economic data, market movements, and potential “surprise” events that teams must incorporate into their strategy.

6. Final Review The simulation concludes with a multi-year performance debrief, analyzing which strategies succeeded in improving the fund’s long-term health.

Who is this simulation designed for? It is ideal for MBA students, finance masters candidates, aspiring asset managers, investment consultants, and corporate finance professionals seeking to understand institutional investing.

Do I need prior pension fund experience? No. The simulation is designed as a learning tool. Basic knowledge of finance and asset classes is helpful, but all necessary concepts are introduced and contextualized.

What makes this simulation different from an asset management simulation? While asset management focuses on maximizing returns for a given risk level, pension fund management is fundamentally constrained by specific liabilities. This simulation emphasizes the liability hedge, funding ratio, and fiduciary duty aspects unique to pensions.

How long does a typical simulation run take? Programs can be tailored from intensive 1-day workshops to multi-week courses integrated into a semester curriculum, depending on the depth of coverage.

Can the simulation be customized for our institution? Yes. We can customize parameters such as initial funding status, liability profile, allowable asset classes, and regional market focus to align with your specific learning goals.

Is this relevant for defined contribution (DC) plans like 401(k)s? The core principles of asset allocation, risk management, and cost control are directly relevant. The simulation’s defined benefit (DB) focus provides a deeper understanding of ALM, which informs best practices for designing DC plan investment menus.

What technical requirements are needed to run it? The simulation is cloud-based. Participants only need a modern web browser (Chrome, Safari, Edge) and a stable internet connection. No specialized software is required.

Did the team’s decisions improve the fund’s solvency over the simulation period, net of costs?

Adherence to policy limits, effectiveness of hedging, and management of drawdowns and volatility.

Quality of the Statement of Investment Principles, clarity and justification of decisions in Trustee presentations, and response to stakeholder concerns.

Assessment of individual contribution and collaboration within the investment committee team.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.