Students take on the role of financial strategists and traders, pricing, buying, and selling options to hedge, speculate, and construct strategic payoffs in our Options Simulation.

Call and Put Options: Mechanics, payoffs, and terminology

Option Strategies: Spreads, straddles, collars, protective puts, covered calls

The Greeks: Delta, Gamma, Theta, Vega, and Rho in practical decision-making

Implied vs Historical Volatility

Options Pricing: Intrinsic vs time value, Black-Scholes assumptions

Risk Management with Options: Limiting downside, managing leverage

Market Reactions: How news events and earnings announcements affect options portfolios

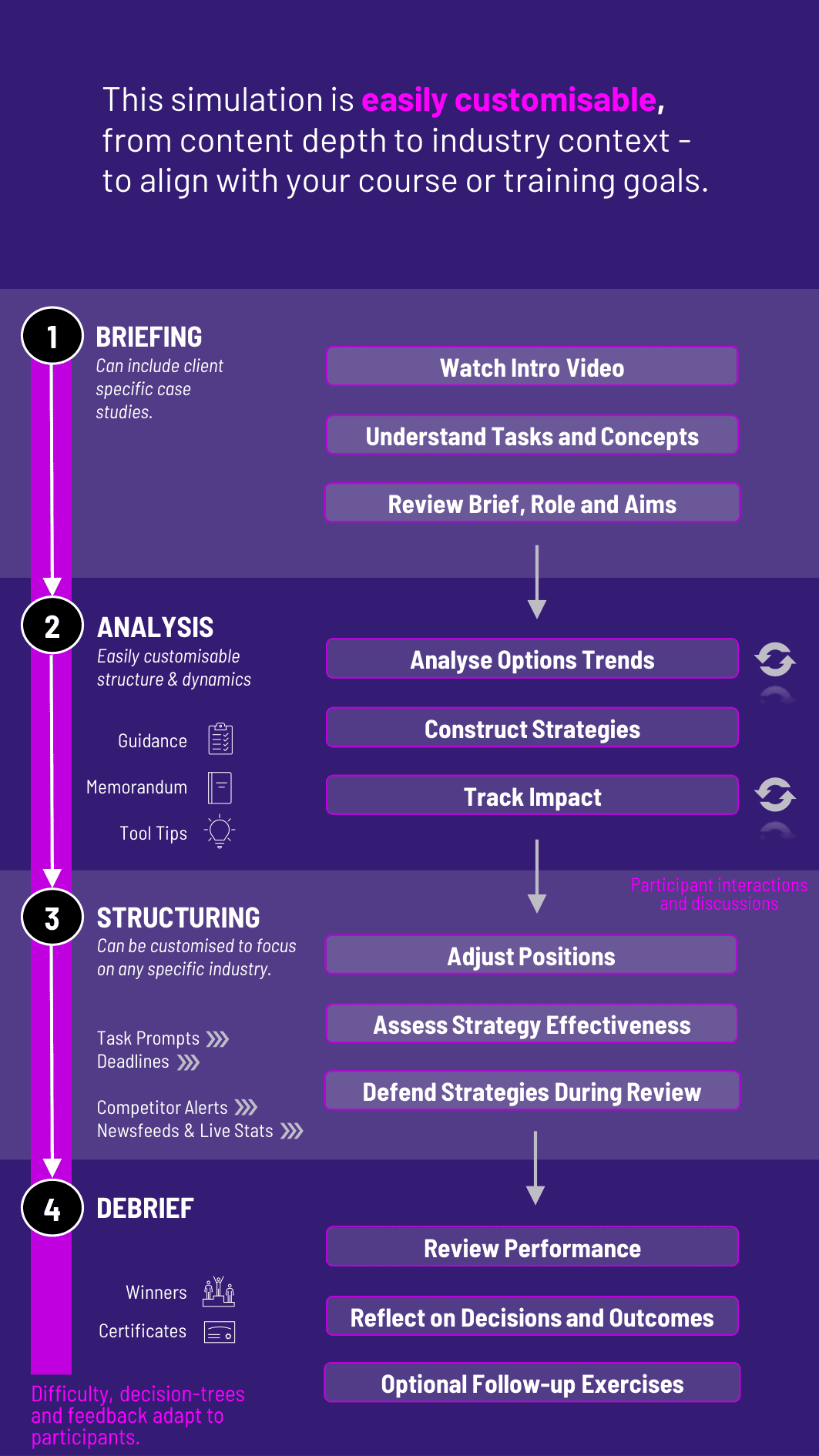

Analyze underlying asset behavior and volatility trends

Construct options strategies to hedge or speculate

Track the impact of time decay and market changes on portfolio value

Adjust positions in response to simulated events and market movement

Calculate payoff diagrams and assess strategy effectiveness

Defend their strategies in a final review or trading debrief

By participating in this simulation, students gain deep, intuitive understanding of options through application. They learn to:

Select appropriate options strategies based on market outlook and objectives

Understand how each of the Greeks affects a position’s performance

Recognize how time, volatility, and price movement interact in options pricing

Communicate options decisions in structured, professional terms

Respond confidently to changes in market sentiment and pricing models

Do students need prior options experience? Basic familiarity with financial instruments is helpful, but the simulation includes a structured onboarding module to introduce key options concepts.

Can it handle complex strategies? Yes. The simulation supports multi-leg strategies and dynamically calculates risk and return. It can be tailored to beginner or advanced cohorts.

What asset classes are covered? The simulation includes equity options, with optional extensions into index or FX options depending on course needs.

How long does the simulation take? A typical session runs 2–3 hours, but can be extended into a multi-round competition or cumulative project.

How is student performance evaluated? Performance is based on profitability, risk-adjusted return, strategy alignment with stated objectives, and communication of investment rationale.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.