Participants partake in mergers, acquisitions, divestitures, joint ventures and strategic partnerships, employing advanced negotiation tactics to drive value, manage conflicts and secure favourable terms.

BATNA (Best Alternative to a Negotiated Agreement)

ZOPA (Zone of Possible Agreement)

Anchoring and framing

Concession strategies

Multi-issue bargaining

Stakeholder alignment

Power asymmetry and dynamics

Communication & persuasion tactics

Deal structuring & risk mitigation

Impasse management

Post-deal relational thinking

Analyze the brief: company profiles, strategic rationale, valuation metrics, stakeholder interests, risk maps.

Conduct preparatory work: analyze alternatives, set objectives, identify BATNA, map interests of counter-party.

Engage in negotiation rounds: exchange offers, respond to counter-offers, make tactical decisions about timing, information sharing, concessions.

Manage multiple issues simultaneously: price, payment terms, transitional support, governance, integration commitments.

Monitor and adapt to counterpart behaviour and evolving information

Work as a team – coordinate internal strategy, review negotiation progress, make mid-course corrections.

Reach either an agreement, an impasse, or a temporary stalemate (and then decide next steps).

Review outcomes, reflect on tactics, compare to peers, extract lessons learned and prepare an action plan for future negotiations.

Define and apply their BATNA and estimate the counterpart’s BATNA.

Identify the ZOPA and negotiate within and around its boundaries.

Develop and execute a negotiation strategy that balances value creation, risk allocation and stakeholder alignment.

Use anchoring, concessions, framing and timing effectively to influence outcomes.

Manage multi-issue bargaining: trade price, structure and governance to optimise deal terms.

Adapt negotiation tactics in response to evolving information, counterpart moves and power asymmetries.

Communicate clearly and persuasively, leveraging active listening, questioning and emotional intelligence.

Interpret when to walk away, pause, restructure the negotiation or revisit underlying assumptions.

Translate negotiation outcomes into actionable deal structure components (agreements, governance, integration planning).

Reflect on negotiation performance, draw lessons, and embed improved behaviour in future corporate deals.

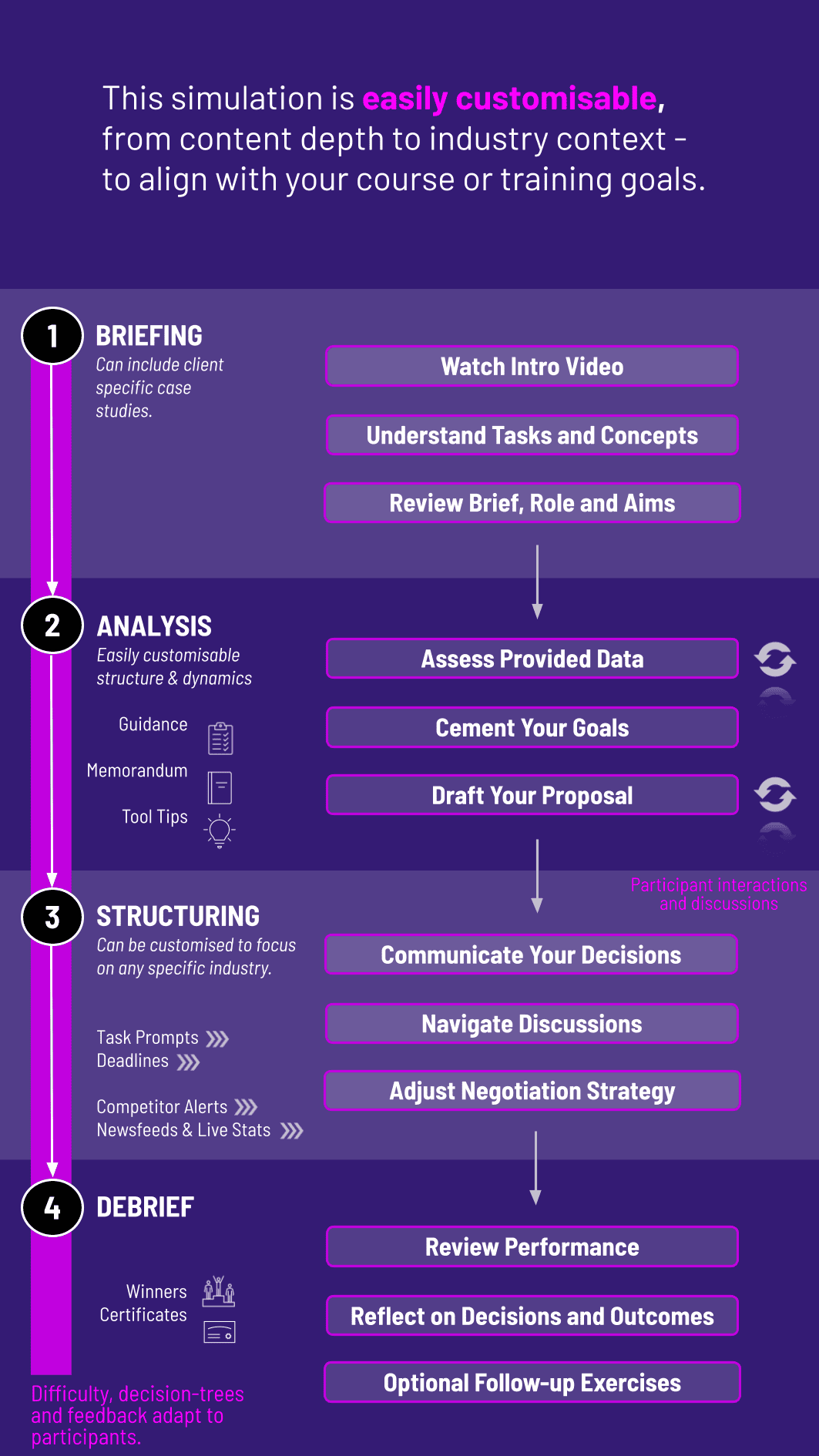

1. Receive the Brief Participants receive role assignments and briefing documents ahead of time. These include strategic context, objectives, risk profile and initial information.

2. Preparation Participants formulate their negotiation strategy, define their priorities (must-haves vs nice-to-haves), estimate the counterpart’s agenda, discuss internal team alignment (if applicable).

3. Negotiation Dynamics The negotiation begins. The buyer and seller (and advisors) make their initial offers, exchange information, open with anchoring proposals, set tone and cadence.

4. Adjusting the Negotiation Strategy Participants evaluate responses and counter-offers across price, structure, terms, governance. New information may be introduced (e.g., surprising diligence result, regulatory snag) to test adaptability.

5. Finalization Teams attempt to close the deal (or decide to walk away). They formalise agreement terms, commit to next-steps or recognise an impasse.

6. Review and Reflect Feedback highlights participants’ flexibility, ability to communicate clearly, and strategic thinking under the pressure.

How long does the simulation take? The simulation is typically run for 3 to 4 hours, or optionally over a full day including extended debrief and reflection. It can also be adapted to shorter or modular formats.

Can the simulation be customised for our organisation or industry? Yes — the scenario can be tailored to your industry sector (technology, manufacturing, services, private equity, etc), transaction type and complexity level.

What prior knowledge do participants need? No advanced prerequisites are required; the simulation will build tactical negotiation skills regardless of prior experience.

How is performance assessed in the simulation? Performance is evaluated based on outcomes (deal vs no deal), value created/claimed, stakeholder alignment, and the application of negotiation tactics. A debriefing and reflection assessment consolidate the learning.

Can it be delivered online/hybrid? Yes — the simulation is fully compatible with online classrooms, virtual teams, or hybrid setups. Decision-submission, dashboards and feedback loops work in virtual environments.

What equipment or infrastructure is required? A computer/laptop per participant or team, access to the simulation interface (browser-based), facilitator screen and projection (in-class or virtual). No special financial modelling tools are required.

Why use a simulation over a lecture on negotiation tactics? Research shows simulation-based training engages participants more deeply, allows experimentation of strategies in a safe environment, and leads to better retention and transfer of negotiation skills into real behaviour.

Return generated, risk-adjusted return, drawdown, volatility relative to benchmark.

Quality of asset allocation choices, alignment with mandate, responsiveness to unexpected events.

Clarity of decision rationale, investor-update presentations or memos, team collaboration and role clarity.

Submission of a short post-simulation reflection or memo: “which biases did I fall victim to? What will I do differently next time?”

Participants rate their own and their teammates’ contribution, highlighting negotiation strengths and blind spots.

Assessment can combine numeric scoring, qualitative feedback, peer review, and instructor debriefing. This flexibility allows the simulation to serve both graded university courses and corporate finance training environments.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.