Participants take on the role of mutual fund managers—constructing portfolios, managing investor flows, and aligning strategy with client expectations - in our Mutual Funds Course.

Fund Structures: Open-ended vs closed-ended, active vs passive

Portfolio Construction: Asset allocation, diversification, and investment mandates

Performance Metrics: Alpha, beta, Sharpe ratio, and tracking error

Investor Behavior: Subscription/redemption flows, sentiment, and fee sensitivity

Cash Management: Liquidity buffers, trade settlement, and market timing

Regulatory Considerations: Disclosure, fund mandates, and compliance constraints

Market Communication: Monthly factsheets, strategy notes, and investor calls

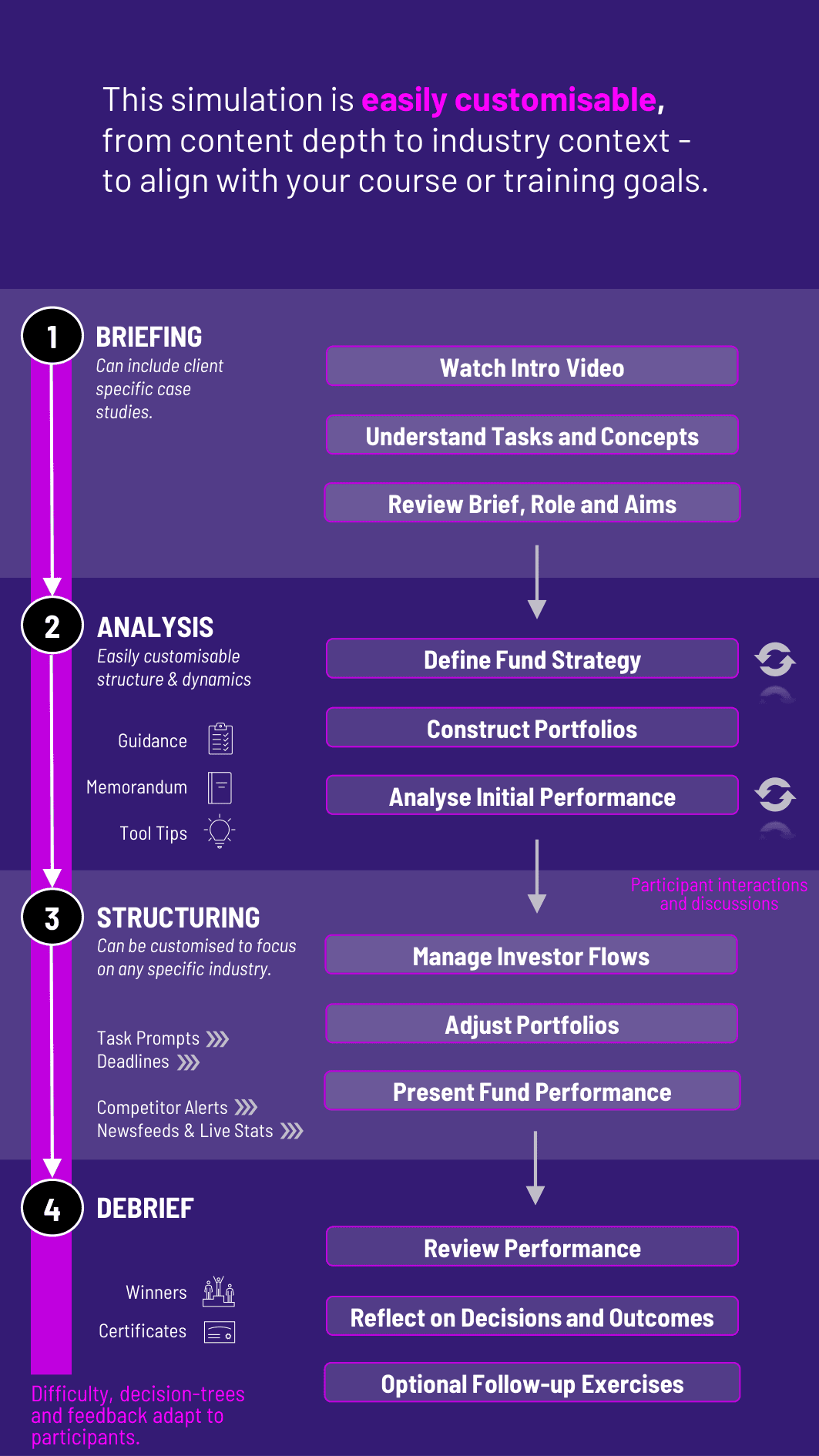

Define a fund strategy and target investor profile

Construct and rebalance a portfolio aligned with the stated objective

Respond to market shifts and evolving investor flows

Analyze fund performance relative to the benchmark and peers

Adjust cash holdings to meet liquidity needs during redemptions

Prepare a final investor report summarizing performance and decision rationale

Participants experience the practical realities of running a mutual fund, gaining insight into both technical and behavioural dimensions. They learn to:

Build portfolios that balance return potential with investor expectations

Manage inflows and outflows while protecting core fund strategy

Monitor and interpret key performance and risk metrics

Communicate investment decisions clearly and convincingly

Understand how client needs, market volatility, and operations intersect

Reflect on fund performance in terms of both outcomes and process

Do participants need prior experience in portfolio management? A basic understanding of asset classes and risk-return concepts is helpful, but the course includes onboarding to all key fund management principles.

Can participants choose different fund types? Yes. Instructors can assign equity funds, balanced funds, thematic funds, or sector-specific mandates.

How long does the course take? Typically 2–3 hours, though it can be extended across multiple rounds for longer-term strategy development and investor updates.

Individual or team-based play? Both options are available. Teams often take on roles such as portfolio manager, operations, and investor relations.

How is participants performance assessed? Based on portfolio returns, risk metrics, client retention, and quality of fund reporting and investor communication.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.