Our Municipal Finance Simulation immerses participants in the high-stakes role of city treasurers and financial advisors, tasked with funding critical infrastructure while maintaining fiscal health and creditworthiness.

Debt Issuance Process

Credit Analysis and Bond Ratings

General Obligation Bonds vs. Revenue Bonds

Debt Capacity and Coverage Ratios

Tax-Backed vs. Enterprise Funds

Capital Planning and Budgeting

Arbitrage and Tax Compliance

Investor Targeting and Marketing

Political and Stakeholder Considerations

Refunding Opportunities and Debt Restructuring

In the simulation, participants will:

Analyze a city’s capital improvement plan and balance sheet.

Model the debt service impact of different bond structures and tenors.

Present a financing proposal to a simulated "City Council" (instructors/other teams).

Negotiate with a simulated "Rating Agency" to defend the city's credit rating.

Participate in a competitive bond pricing auction, reacting to live market moves.

Structure a Public-Private Partnership (P3) for a specific infrastructure asset.

Prepare a final investor memorandum and debrief.

Understand the drivers of municipal credit strength and bond ratings.

Differentiate between and appropriately apply various municipal bond structures.

Build a pro-forma debt service model and calculate key coverage ratios.

Navigate the key steps in the municipal bond issuance timeline.

Articulate the trade-offs between cost, risk, and political acceptability in financing decisions.

Appreciate the role of financial advisors, underwriters, and rating agencies.

Evaluate the suitability of alternative financing methods like P3s.

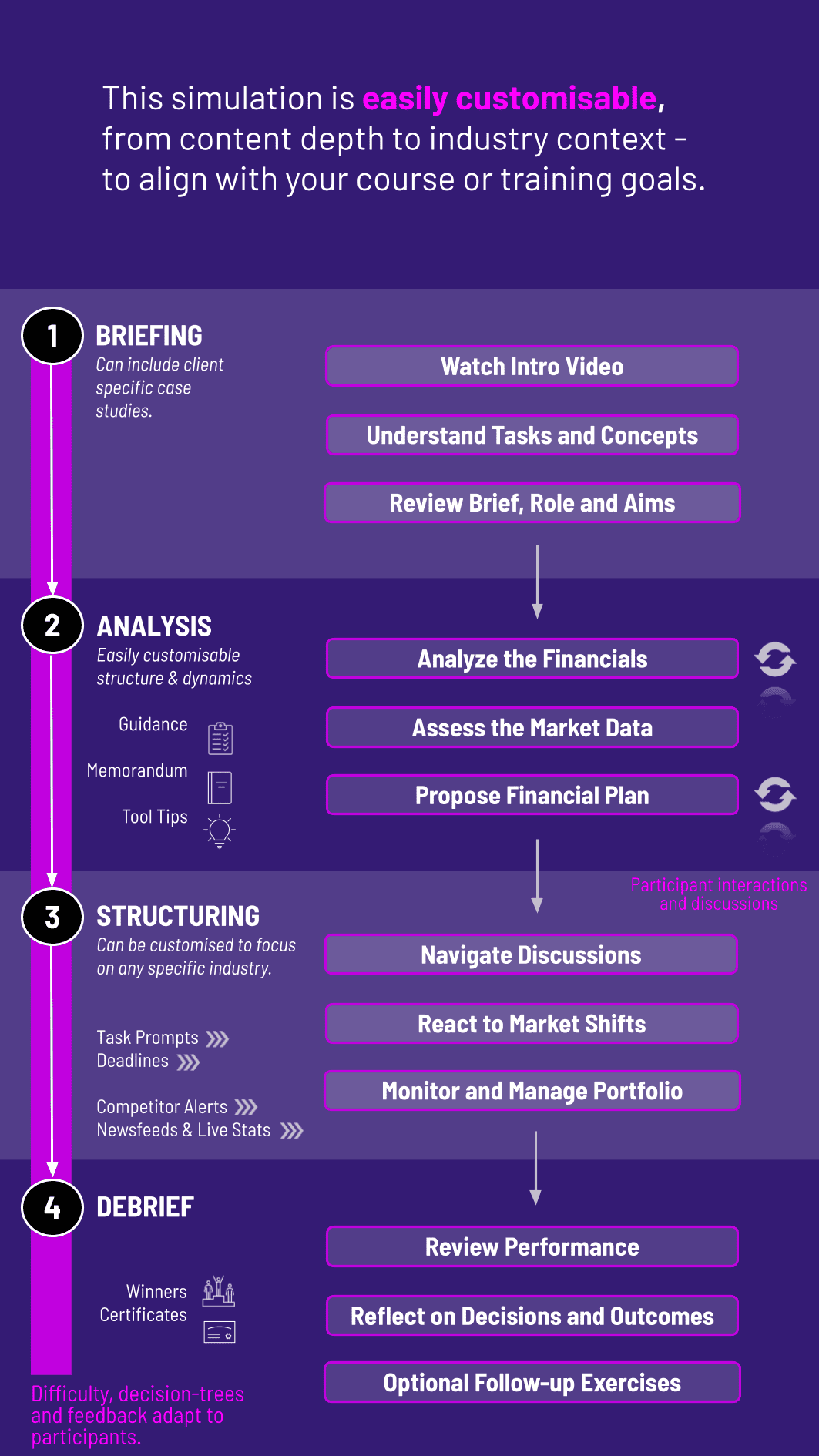

1. Diagnosis and Strategy Teams analyze financials, prioritize projects, and choose a preliminary financing mix.

2. Structuring and Ratings Teams submit a formal financing plan, receive a preliminary rating based on their choices, and can appeal with a presentation.

3. Pricing and Execution A live market screen displays changing Muni-AAA yields. Teams must decide when to "go to market" and bid for their bonds, aiming for the lowest true interest cost (TIC).

4. Synthesis Teams finalize their comprehensive financing solution, incorporating feedback from all rounds, and present to a panel.

What background knowledge is needed for this simulation? A basic understanding of corporate finance (time value of money, bonds) is helpful but not required. All necessary concepts are introduced in pre-simulation materials.

Is this simulation specific to the U.S. municipal bond market? The core principles of public sector financing are universal. The simulation uses a U.S. framework, but the concepts of credit, project financing, and stakeholder management are directly applicable to other countries.

How long does the simulation typically take to run? The core experience can be completed in 3-4 hours. We offer extended versions with deeper analysis and presentation rounds that span 6-8 hours or multiple sessions.

Is this suitable for undergraduate students? Absolutely. We have versions tailored for advanced undergraduates in finance, public policy, and economics, as well as more complex versions for MBA and executive education.

Do participants need any specialized software? No. The simulation runs through a standard web browser. Teams use provided spreadsheet templates for modeling, which can be done in Excel or Google Sheets.

Can the simulation be customized for our specific course or training program? Yes. We can customize the city's profile, projects, and market scenarios to align with your specific learning objectives, whether for a public administration, urban planning, or applied finance course.

How is the simulation delivered for online or hybrid classes? The platform is fully web-based. Teams can collaborate remotely via their own video conferencing tools, while instructors manage rounds and view dashboards via the simulation portal.

What makes this simulation different from a standard case study? It's dynamic and experiential. Unlike a static case, participants make decisions that trigger immediate consequences (rating changes, market costs), see real-time results from other teams, and adapt their strategy in a competitive yet realistic environment.

Final all-in cost of capital, debt service coverage, and preservation of credit rating.

Coherence of the financing strategy, clarity of trade-off analysis, and quality of stakeholder communication.

Based on contributions during team negotiations and Q&A sessions with the "rating agency" and "city council."

Post-simulation analysis of key learnings and decision-making processes.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.