Students structure, analyze, and price mortgage-backed securities - balancing prepayment risk, credit quality, and investor returns - in our Mortgage-Backed Securities Simulation.

Mortgage Pool Analysis: FICO scores, LTV ratios, geographic concentration, and default risk

Cash Flow Modeling: Scheduled payments, prepayments, delinquencies, and defaults

Prepayment Risk: PSA models, refinance behavior, and interest rate sensitivity

Tranching Structures: Senior-subordinate tranches, sequential vs pro rata pay, interest-only and principal-only tranches

Credit Enhancement: Overcollateralization, excess spread, reserve funds, subordination

Investor Considerations: Duration, convexity, yield, and risk appetite

MBS Market Context: Agency vs non-agency MBS, and post-crisis reforms

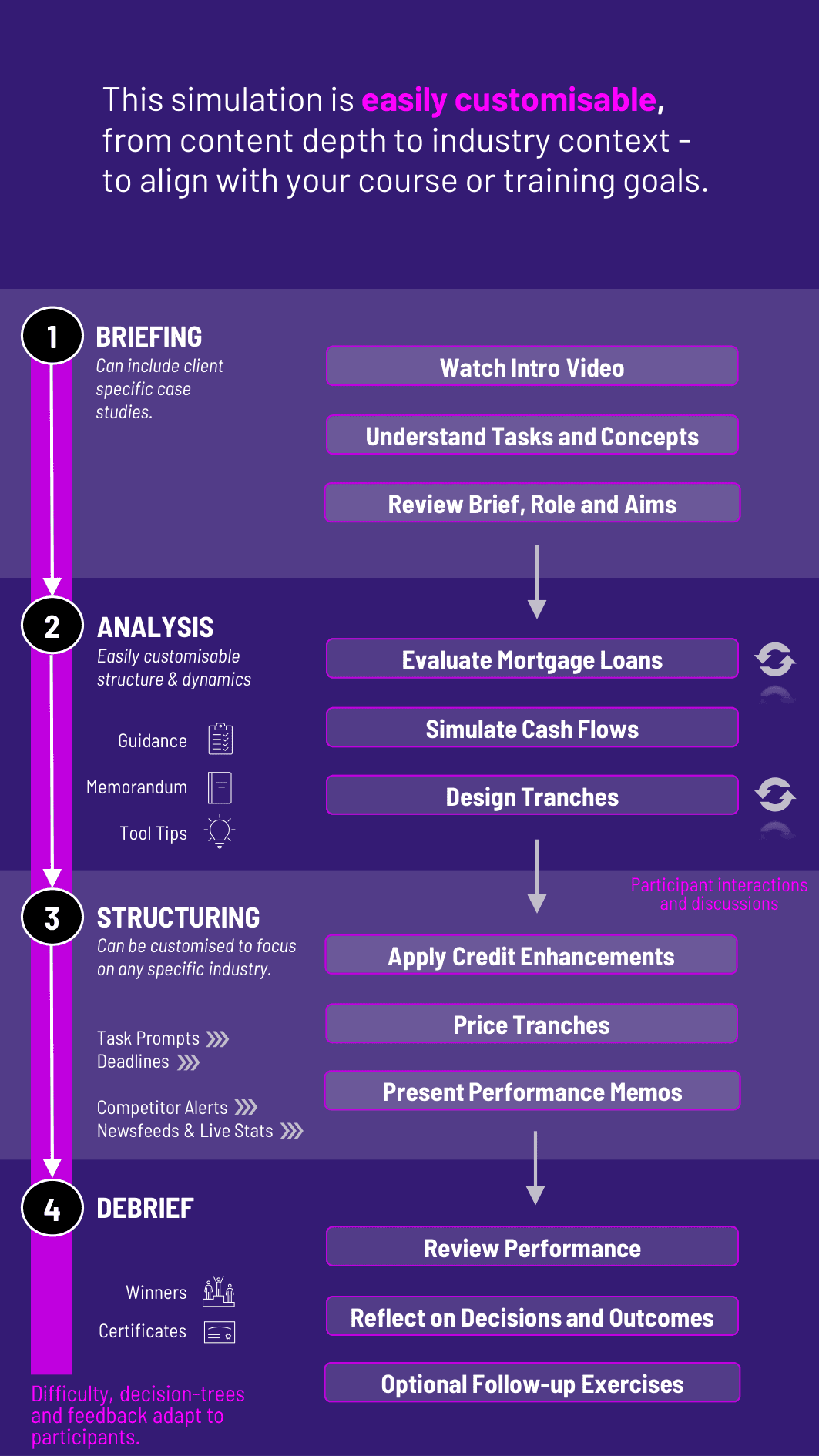

Evaluate a pool of residential mortgage loans using credit and geographic data

Simulate cash flows under different prepayment and default scenarios

Design tranches with different risk-return profiles

Apply credit enhancements to improve creditworthiness and ratings

Price the tranches based on investor appetite and market conditions

Prepare investor presentations or internal memos justifying their structure

Through this simulation, students gain an applied understanding of mortgage-backed securities, including how to:

Assess the credit quality and risks embedded in mortgage loan pools

Use prepayment models to forecast principal flows

Build and defend structured bond tranches based on investor needs

Balance returns, liquidity, and risk across senior and subordinate tranches

Communicate complex financial structures with clarity and transparency

Reflect on the regulatory and systemic role of MBS in financial markets

Do students need prior knowledge of structured finance or MBS? No. The simulation introduces all key concepts, including amortization, tranching, and prepayment behavior, through intuitive onboarding.

What types of mortgage loans are included? The simulation includes both prime and subprime residential mortgage pools, with varied borrower profiles and geographic distributions.

How is prepayment modeled? Students can use PSA speeds or adjust prepayment assumptions manually to see how behavior affects cash flows and tranche timing.

Can students simulate defaults and delinquencies? Yes. The platform allows scenario-based stress testing and lets students examine the effects of higher delinquency rates and economic downturns.

Does the simulation include regulatory content? Yes. There are optional modules exploring agency vs non-agency MBS, post-crisis reforms, and capital treatment under Basel rules.

Is it better for individual or team-based play? Both work well. Teams often reflect real-world structuring desks, with students taking on roles like modeling, credit, and investor relations.

What is the typical duration of the simulation? 2.5 to 4 hours for a complete MBS structuring cycle. It can also be broken into modules over several sessions.

How is student performance assessed? Assessment is based on tranche design, pricing logic, structural soundness, risk-adjusted return, and clarity of presentation.

Does the simulation require Excel or programming? No coding is required. All calculations, modeling, and scenarios are managed within the simulation interface.

Can instructors customize mortgage pool inputs? Yes. Instructors can select from a library of mortgage pools or upload custom loan data for their specific teaching context.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.