Participants take control of short-term funding and investment decisions - balancing liquidity, interest rates, and institutional risk - in our Money Markets Course.

Money Market Instruments: Treasury bills, commercial paper, certificates of deposit, repos, and interbank loans

Interest Rate Mechanics: Benchmark rates (e.g., LIBOR, SOFR), yield curves, and rate spreads

Liquidity Management: Forecasting inflows/outflows and maintaining solvency buffers

Credit and Counterparty Risk: Evaluating borrower risk and setting exposure limits

Monetary Policy Transmission: How central bank operations affect short-term funding markets

Pricing and Settlement: Day counts, discounting, and settlement timing

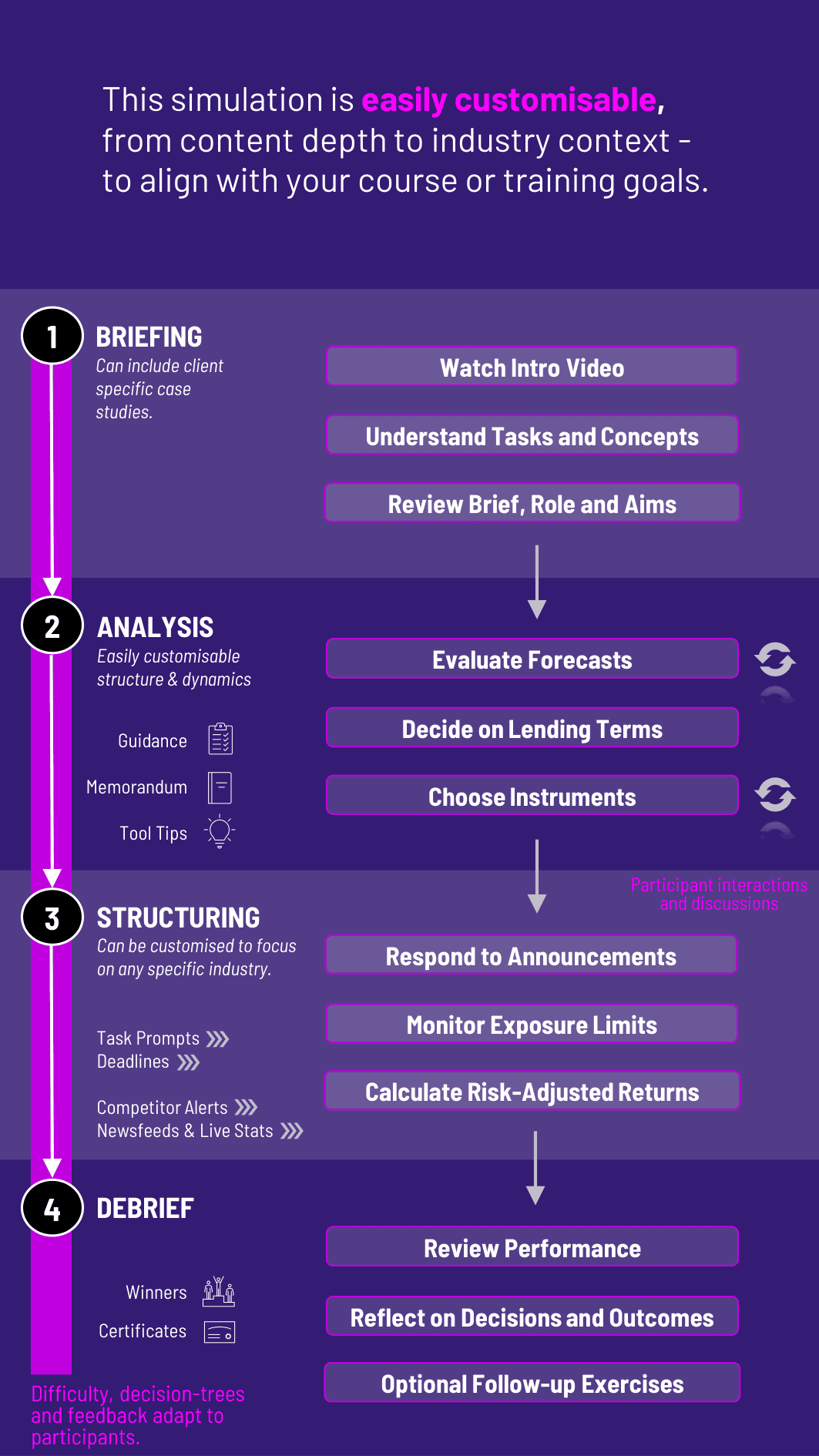

Evaluate cash positions and liquidity forecasts

Decide how to invest surplus funds or meet shortfalls through borrowing

Choose between instruments with varying rates, durations, and risk

Respond to central bank announcements, credit events, or liquidity shocks

Monitor exposure limits and manage counterparty relationships

Calculate returns, costs, and risk-adjusted decisions under time pressure

Participants learn how short-term markets function at the operational level - and why they matter. They will develop:

A working knowledge of major money market instruments and their use cases

The ability to make time-sensitive funding and investment decisions

Practical understanding of how monetary policy influences short-term rates

Risk awareness in assessing counterparties and balancing duration with liquidity

A systems-thinking view of how individual actors affect market-wide liquidity

Do participants need prior financial markets experience? No. A basic understanding of interest rates and cash flow is helpful, but the course includes onboarding to money market instruments and decisions.

Can the course reflect current market conditions? Yes. Scenarios can be adapted to reflect real events - e.g., rate hikes, liquidity crunches, or central bank interventions.

How long does the course take? Typically 2–3 hours for a full decision cycle, though it can be split into shorter rounds or extended for deeper portfolio strategies.

Individual or group play? Both formats are supported. Team roles can simulate corporate treasurers, bank dealers, or mutual fund managers.

How is participants performance assessed? Based on returns achieved, liquidity position management, exposure control, and ability to justify decisions under uncertainty.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.