The Merger Modelling Simulation immerses participants in the role of an investment banker, tasked with analyzing, valuing, and negotiating a multi-billion dollar merger.

M&A Deal Rationale and Strategic Fit

Financial Statement Analysis

Discounted Cash Flow Valuation

Comparable Company and Precedent Transaction Analysis

Accretion/Dilution Analysis

Purchase Price Allocation and Goodwill Calculation

Sources and Uses of Funds

Synergy Identification and Modelling

Deal Structuring

Pro-Forma Financial Statement Consolidation

In the simulation, participants will:

Analyze the target and acquirer's financial statements and business models.

Value both companies using multiple valuation methodologies.

Build a dynamic, integrated merger model from scratch.

Analyze the accretion/dilution impact on EPS under various scenarios.

Model and sensitize the financial impact of operational synergies.

Structure the deal by deciding the mix of cash and stock.

Negotiate key terms, including the offer price and exchange ratio, with another team.

Prepare and deliver a final investment recommendation to justify the deal.

Construct a robust, three-statement merger model.

Evaluate the strategic and financial merits of a potential M&A deal.

Apply core valuation techniques to determine a fair acquisition price.

Calculate and interpret the EPS accretion/dilution of a transaction.

Integrate operational and financial synergies into a financial model.

Structure a deal, considering financing constraints and market conditions.

Communicate the investment thesis and model outputs effectively to stakeholders.

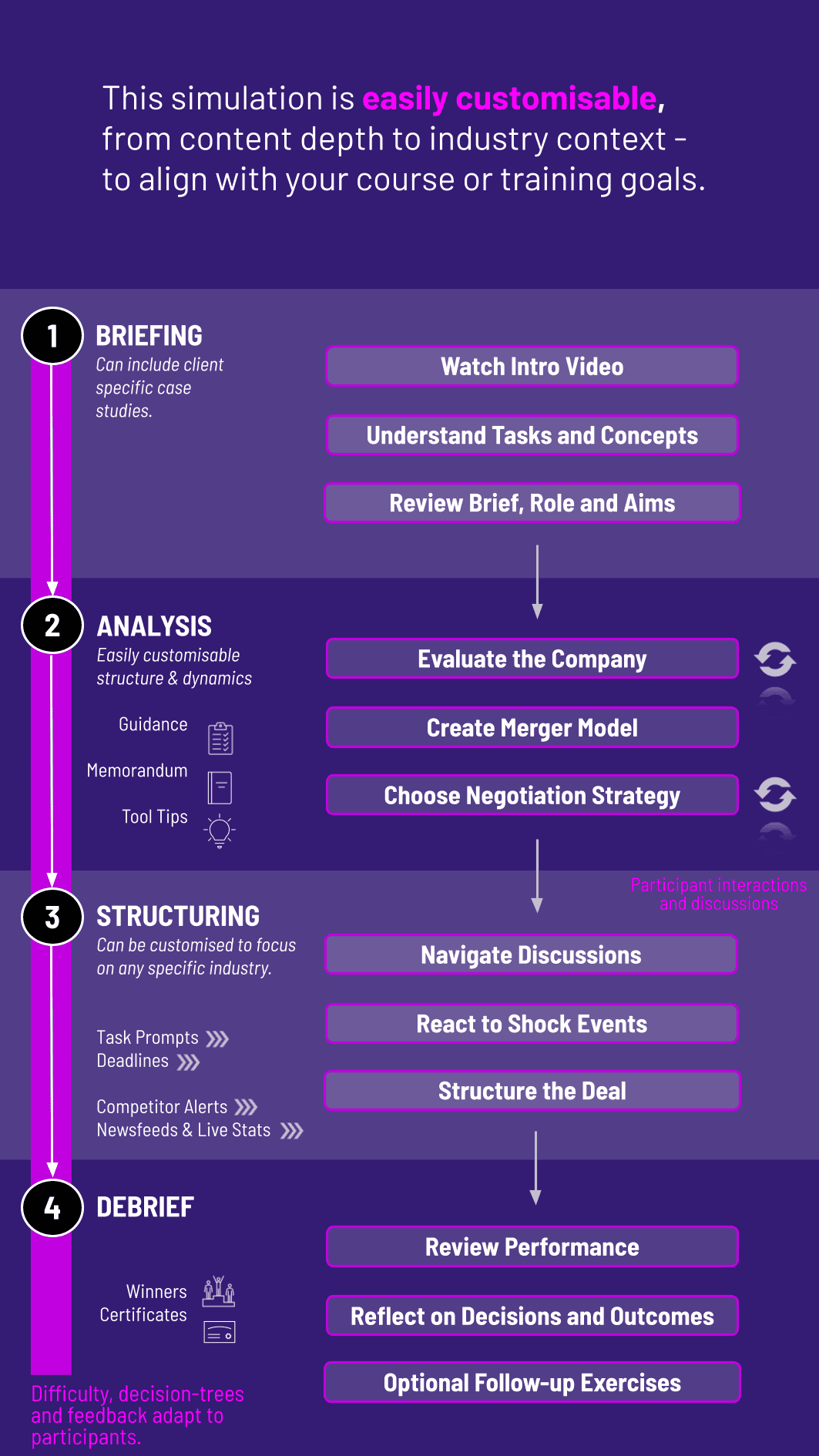

1. Team Formation and Briefing Participants are divided into teams (Acquirer Advisors) and receive confidential briefing books.

2. Financial Analysis Teams conduct in-depth analysis of the provided company financials and market data.

3. Valuation and Modelling Teams build a DCF model and a full merger model to analyze the deal.

4. Scenario Analysis Teams test their model under different financing mixes and synergy realization scenarios.

5. Negotiation Round Teams engage in a structured negotiation with another team to agree on a final offer price and structure.

6. Final Deliverable Teams refine their model and prepare a final presentation deck outlining their recommendation.

7. Debrief and Awards The facilitator leads a comprehensive debrief, comparing team strategies and outcomes, and announces the most successful team.

What prerequisites are needed for the Merger Modelling Simulation? No. The simulation includes embedded instruction, tooltips, and guidance for users at various levels.

Is this simulation suitable for undergraduate students? Absolutely. It is designed for advanced undergraduates, MBA students, and early-career professionals in finance, accounting, or corporate development who want to gain practical M&A experience.

How long does the simulation typically take to complete? The experience is flexible. It can be run as an intensive 1-2 day workshop or extended over several weeks as part of a semester-long course.

Do participants work individually or in teams? The simulation is designed as a team-based exercise to foster collaboration and replicate the real-world deal team environment, though individual participation can be accommodated.

How is the simulation different from a traditional case study? Unlike a passive case study, this is a hands-on, dynamic simulation. Participants don't just analyze a finished deal; they actively build the financial model, run scenarios, and negotiate terms, leading to a unique, team-driven outcome.

Can the simulation be customized for our specific program? Yes. We can customize the industry, company profiles, and deal complexity to align with your specific curriculum or corporate training objectives.

What kind of support is provided during the simulation? Participants receive full access to our simulation platform, detailed guides, tutorial videos, and dedicated support from our facilitation team throughout the experience.

Technical accuracy, structure, and functionality of the final merger model is graded. This includes the correct calculation of accretion/dilution, pro-forma statements, and synergy integration.

Teams are assessed on their ability to clearly and convincingly present their investment thesis, model conclusions, and negotiation outcome to a board of directors.

The financial terms achieved during the negotiation round (achieved premium, favorable exchange ratio) and the team's strategic approach are evaluated.

Individual contribution is measured through peer assessments and facilitator observations on teamwork, collaboration, and engagement throughout the simulation.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.