Move beyond the textbook and step into the role of a management accountant. Translate theoretical concepts into actionable business strategy in a dynamic, risk-free environment.

Cost Behavior and Cost-Volume-Profit Analysis

Job-Order and Activity-Based Costing

Relevant Costing for Decision Making

Budgeting and Forecasting

Variance Analysis

Performance Measurement

Working Capital Management

In the simulation, participants will:

Analyze product cost structures using different costing methodologies.

Set optimal product prices based on cost data, market conditions, and desired profit margins.

Create a comprehensive master budget, including sales, production, and cash flow forecasts.

Make critical operational decisions on production levels, supplier contracts, and marketing spend.

Interpret monthly financial statements.

Perform variance analysis to identify areas of operational inefficiency and implement corrective actions.

Present a strategic plan to the "board" based on your financial analysis.

Apply different costing systems to determine accurate product costs and profitability.

Analyze cost behavior and utilize CVP analysis to inform pricing and production decisions.

Construct an integrated master budget to effectively plan and control business operations.

Evaluate company performance by calculating and interpreting budget variances.

Recommend sound business decisions using relevant costing and differential analysis.

Synthesize financial and non-financial data to assess overall business health.

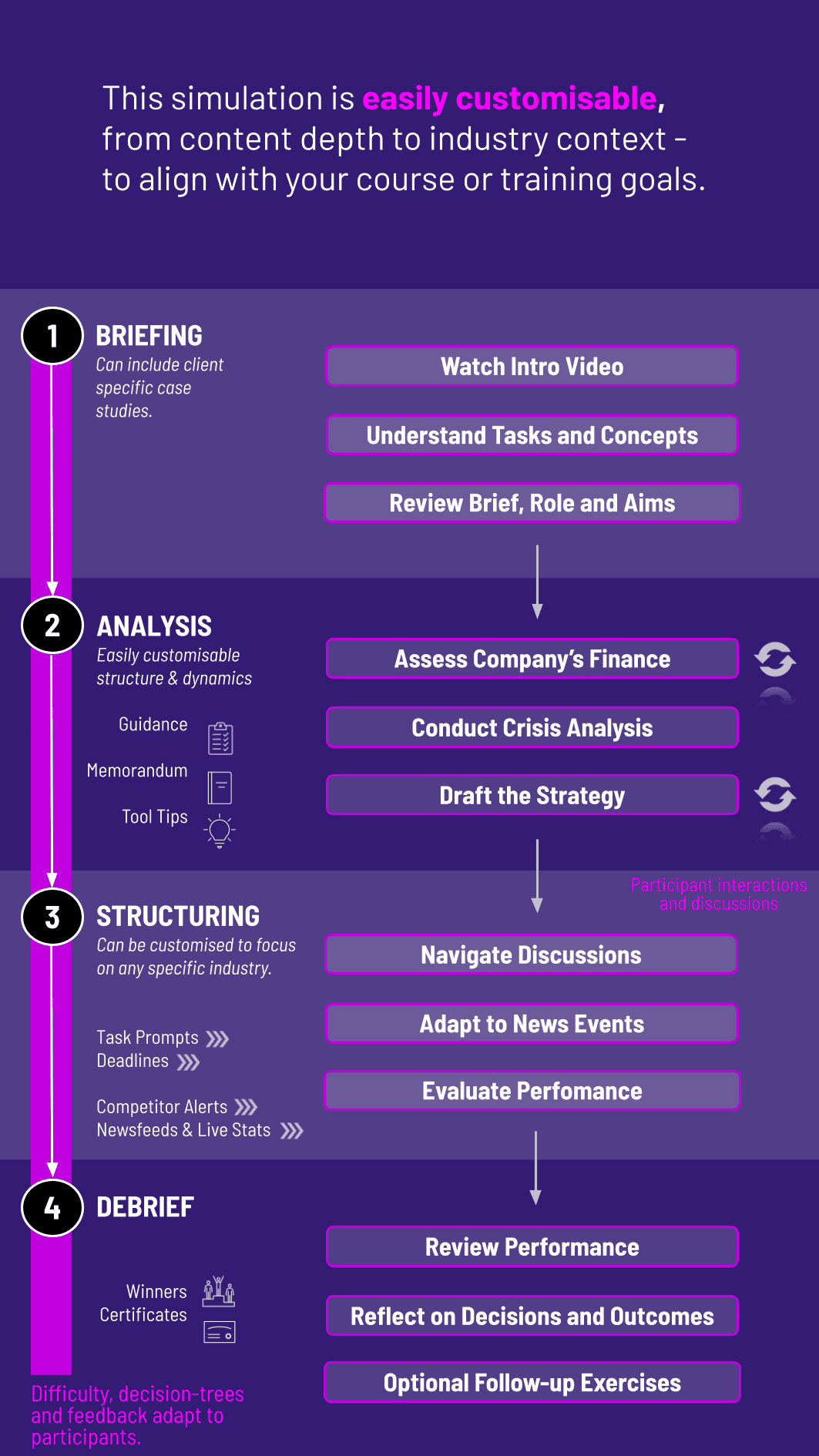

1. Form Teams and Get Briefed Participants are grouped into management teams. Each team receives the company background, initial financial data, and market overview.

2. Make Strategic Decisions Based on the initial data, teams make their first set of decisions regarding production, pricing, and budgeting.

3. Analyze and Adapt Teams review their results, perform variance analysis, and identify what drove their success or shortfalls.

4. Iterate and Compete The process repeats for several rounds, with each new period introducing new market dynamics. Teams must adapt their strategy to outperform their competitors.

5. Debrief and Present The simulation concludes with a debriefing session where teams present their strategy, results, and key learnings.

Who is this Managerial Accounting Simulation for? Although this simulation is ideal for MBA students, undergraduate business majors, and corporate trainees in finance, management, and operations roles who need to understand and use internal financial data, but can be adapted to any need.

Is it online-compatible? Yes. It works in digital, hybrid, and in-person formats.

Do I need to be an accounting expert to succeed? No. The simulation is designed to reinforce core managerial accounting concepts. It is most effective when used alongside a course or training program, as it provides a practical application for the theory.

How long does the typical simulation last? Typically between 2 to 4 hours. It can be shortened or expanded to fit class schedules or training blocks.

Is this simulation focused on financial accounting or reporting? While financial statements are a key output, the focus is squarely on internal decision-making. The simulation emphasizes cost analysis, budgeting, and performance metrics used by managers, not the creation of external GAAP-compliant reports.

Can we customize the theme? Yes. You can tailor the simulation to healthtech, edtech, consumer, or B2B ventures.

Financial Performance

Budgeting Accuracy

Strategic Decisions and Analysis

Final Presentation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.