The Management Buyout Simulation takes participants into the high-stakes world of corporate acquisitions, where they step into the shoes of a management team aiming to buy out the company they run

Leveraged Buyout Modeling

Company Valuation

Debt Structuring

Financial Sponsorship

Sources and Uses of Funds

Debt Capacity and Leverage Ratios

Financial Covenants

Management Equity Rollover and Incentives

Stakeholder Management

Post-Acquisition Business Plan

In the simulation, participants will:

Build a comprehensive LBO model from scratch to determine valuation and investment returns.

Pitch the investment opportunity to a private equity firm to secure equity sponsorship.

Negotiate term sheets with banks and other lenders to secure the optimal debt package.

Structure the management equity pool, deciding on the amount of personal capital to roll over.

Analyze and negotiate the final purchase price with the seller.

Present the final deal proposal to a board of directors, justifying its financial and strategic merits.

Defend their financial assumptions and deal structure under scrutiny from instructors and peers.

Construct a detailed, three-statement LBO model to evaluate deal feasibility.

Value a target company using appropriate valuation methodologies under a leveraged scenario.

Critique different capital structures and assess their impact on risk and return.

Articulate the roles and motivations of all parties involved in a leveraged buyout.

Negotiate key deal terms, including valuation, debt covenants, and equity splits.

Synthesize a complete MBO proposal, integrating financial, strategic, and legal considerations.

Evaluate the potential risks and rewards for the management team post-buyout.

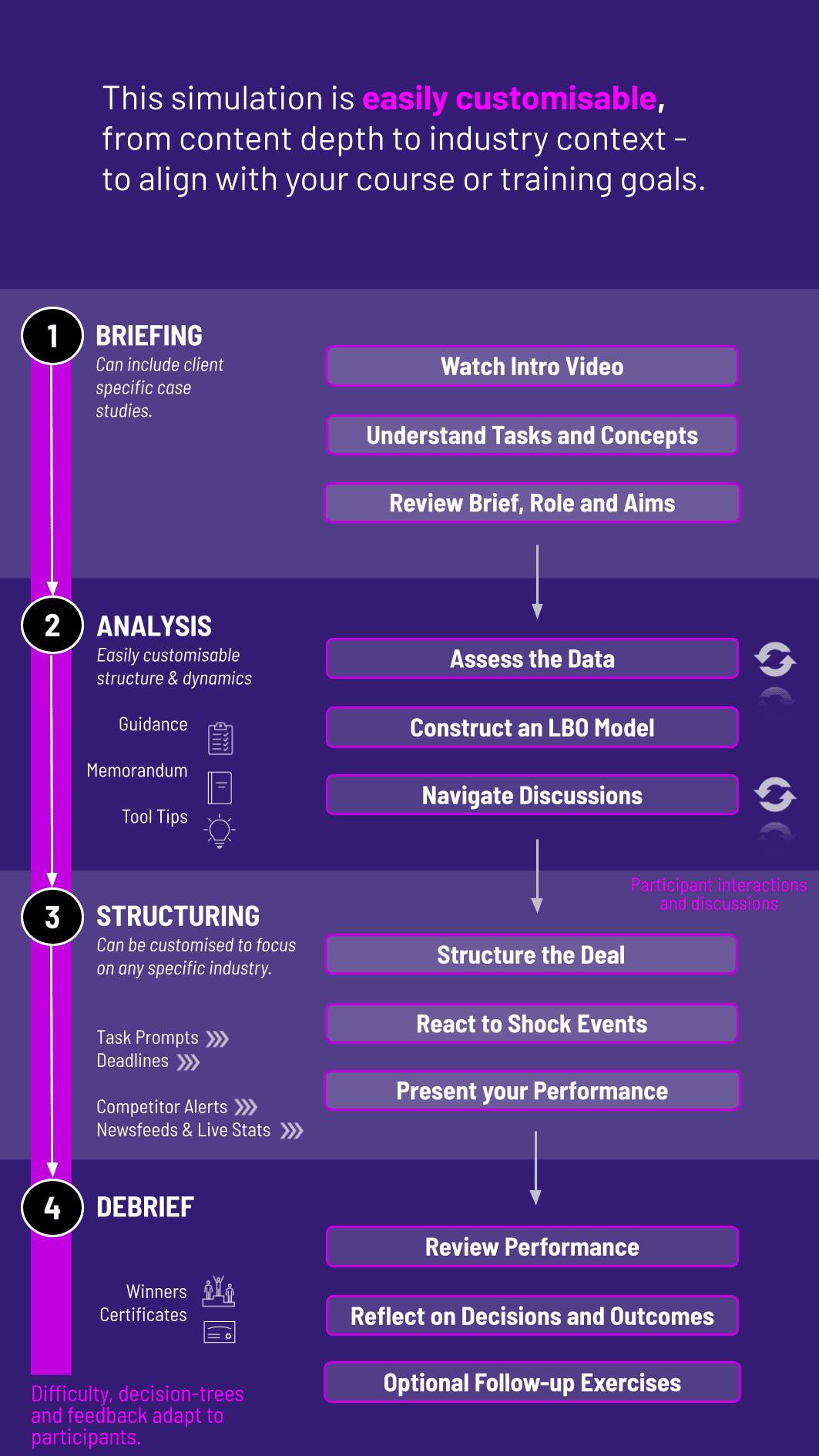

1. Introduction and Team Formation Participants are briefed on the target company's background and financials. They form management teams.

2. Financial Modeling Phase Teams work to value the company and build an initial LBO model to determine their bidding strategy.

3. Sponsor and Lender Negotiations Teams "shop the deal," presenting to simulated Private Equity Sponsors and Bank syndicates to secure financing commitments and term sheets.

4. Deal Structuring and Refinement Using feedback and term sheets, teams refine their model, optimizing the capital structure and preparing their final offer.

5. Final Presentation and Deal Defense Each team presents its final MBO proposal to a simulated "Board of Directors" (played by instructors), followed by a rigorous Q&A session.

6. Debrief and Awards Instructors lead a comprehensive debrief, comparing team strategies and outcomes, and announcing the team that structured the most compelling deal.

What is the difference between an MBO and a standard LBO? An MBO is a specific type of LBO where the existing management team is the acquirer, often partnering with a financial sponsor. This introduces unique dynamics, such as management's insider knowledge and the rollover of their own equity.

Do I need advanced Excel or finance experience for this simulation? While a basic understanding of corporate finance is helpful, the simulation is designed to be educational. We provide templates, guided instruction, and support to help participants of all levels build the necessary financial models.

How long does the simulation typically last? The simulation can be tailored to run as a 1-day intensive workshop, a multi-day seminar, or integrated into a full-course curriculum over several weeks.

Is this simulation relevant for entrepreneurs? Absolutely. The principles of valuation, debt financing, and deal structuring are directly applicable to entrepreneurs seeking to buy a business, finance growth, or understand how financial sponsors evaluate companies.

What kind of company is used as the case study? We use a detailed case study of a mature, cash-flow generative company in a stable industry, typical of traditional LBO/MBO targets. All necessary financial statements and market data are provided.

How is the winner of the simulation determined? The winning team is selected based on the robustness of their financial model, the persuasiveness of their pitch, the favorability of their negotiated terms, and their ability to defend their strategic decisions.

Can this simulation be customized for corporate training? Yes, we can customize the simulation to reflect your company's industry or specific learning objectives, making the experience directly relevant to your team's development needs.

Accuracy, completeness, and justification of the financial model and capital structure.

Effectiveness in securing favorable financing terms and demonstrating deal credibility.

Clarity, persuasiveness, and depth of knowledge displayed during the final presentation and defense.

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.