Students take charge of national economic policy - setting interest rates, adjusting government spending, and responding to economic shocks - in our immersive Macroeconomics Simulation.

Fiscal Policy: Government spending, taxation, and budget balance

Monetary Policy: Interest rate setting, inflation targeting, and money supply control

Business Cycles: Responding to booms, recessions, and stagflation

GDP Components: Consumption, investment, government spending, and net exports

Inflation and Unemployment: Phillips curve dynamics and policy trade-offs

International Trade: Exchange rates, trade balances, and global shocks

Policy Lags and Expectations: Dealing with time delays and forward-looking behavior

Interpret macroeconomic indicators and forecasts (e.g., GDP, inflation, unemployment)

Adjust interest rates or government spending to meet macro targets

Simulate real-time policy announcements and observe public and market reactions

Debate economic priorities in light of political or global constraints

Manage economic outcomes over multiple quarters or years

Justify their choices to peers, instructors, or simulated stakeholder panels

This simulation helps students move from passive theory to active decision-making in macroeconomics. They will learn to:

Apply macroeconomic models to real-world policy dilemmas

Analyze and synthesize large sets of economic data

Understand the trade-offs and unintended consequences of policy tools

Communicate complex economic decisions clearly and persuasively

Navigate the uncertainty, lags, and pressure that define public economic leadership

Reflect on the ethical and social impact of macroeconomic choices

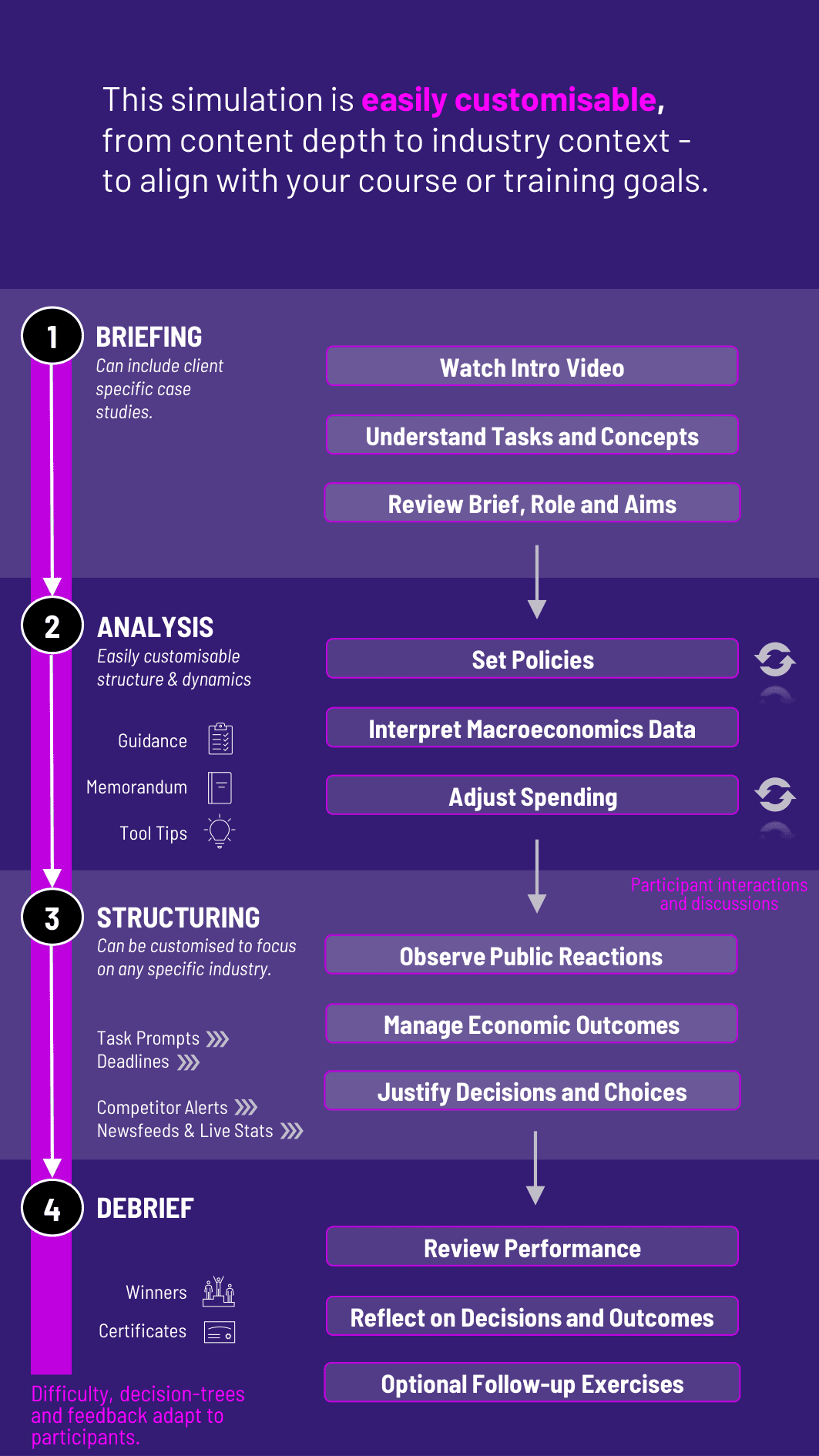

Do students need prior macroeconomics knowledge? A basic foundation is helpful, but the simulation can be adapted to both introductory and advanced levels with guided briefings.

Can the simulation focus on specific themes (e.g., monetary vs fiscal policy)? Yes. Instructors can tailor the focus to fit learning goals - ranging from central bank independence to global trade dynamics.

How long does the simulation take? Typically 2–3 hours for a full macroeconomic cycle, though it can be shortened or extended across multiple class periods.

Is it more suited to individuals or teams? Both formats are effective. Team play adds collaborative complexity and mimics real-world policy committees.

How is student performance assessed? Through simulation scoring (based on inflation, unemployment, and growth), decision logs, economic rationales, and team presentations.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.