Participants take on the role of corporate bankers, assessing borrower needs, structuring loans, and balancing risk with relationship goals in this hands-on Loan Structuring Simulation. They navigate credit, pricing, covenants, and negotiations.

Credit Analysis: Cash flow analysis, debt capacity, and financial ratios

Loan Structuring: Term loans, revolvers, amortization profiles, bullet repayments

Collateral Evaluation: Asset coverage, personal guarantees, risk-adjusted pricing

Covenants: Financial, affirmative, and negative covenant selection and impact

Pricing Strategy: Risk-based pricing, yield targets, and cost of funds

Negotiation: Aligning bank risk tolerance with borrower demands

Risk Appetite: Lending limits, industry exposure, credit ratings

Client Relationship: Balancing deal terms with long-term trust and business growth

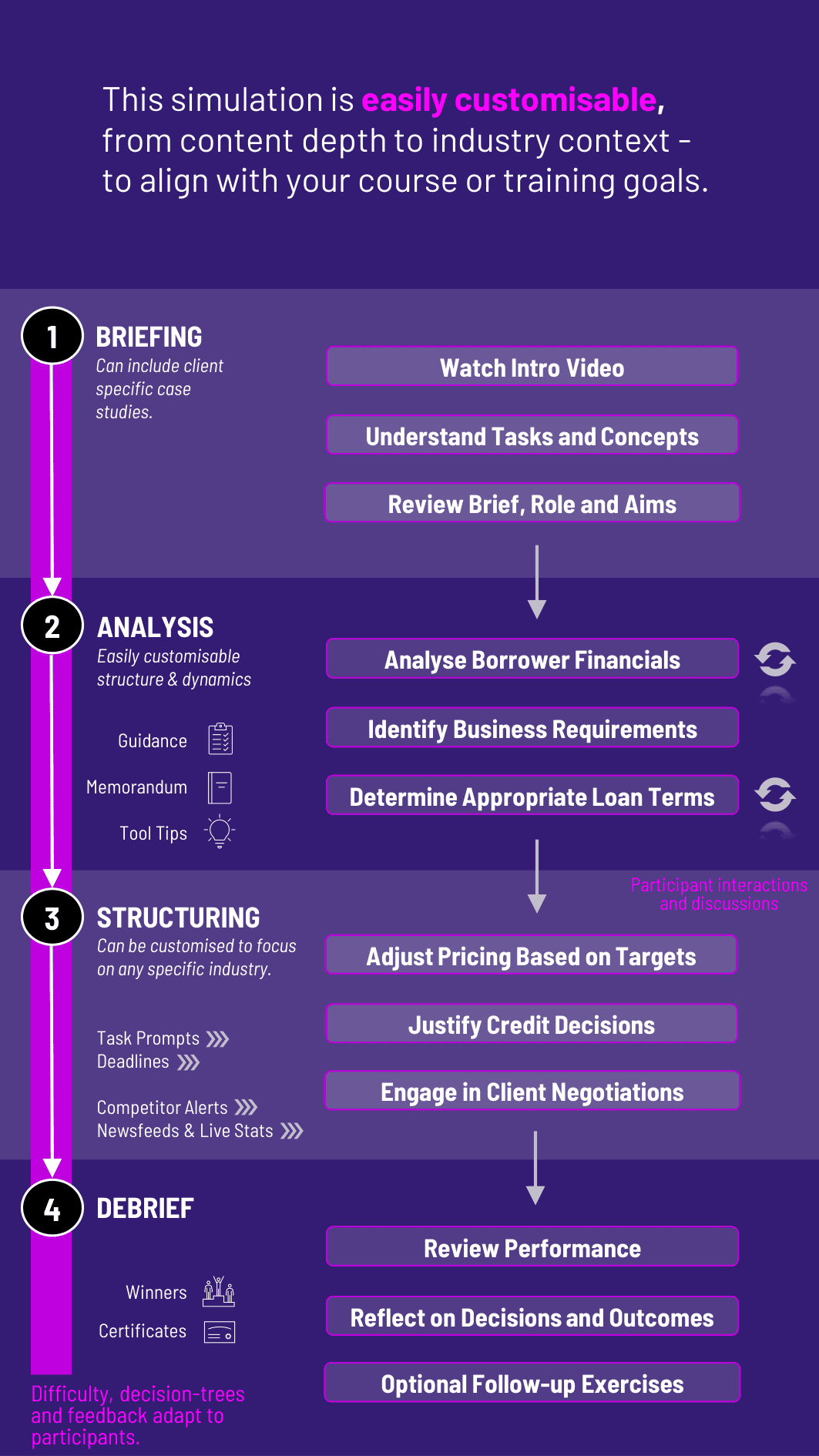

Analyze borrower financials and industry context

Identify the business’s financing needs and propose structures

Determine appropriate loan terms, tenors, repayment schedules, and covenants

Adjust pricing based on risk and return targets

Justify credit decisions to internal committees

Engage in client negotiations to reach a mutually acceptable deal

Respond to shifting client positions, regulatory updates, or risk alerts

By the end of the simulation, participants will be more confident in:

Structuring loans that meet both borrower and lender needs

Assessing creditworthiness with an analytical, risk-based lens

Balancing profitability, relationship value, and credit risk

Choosing the right repayment structure, tenor, and covenant mix

Communicating credit decisions with clarity and confidence

Negotiating persuasively while maintaining sound credit principles

Understanding the internal dynamics of loan approvals

Linking macro factors and sector risk into credit structuring

Working cross-functionally between relationship, risk, and treasury teams

Responding to complex, real-time borrower scenarios

Whether used in corporate banking, risk management, or finance courses, the simulation helps learners build core credit and structuring skills. The flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Client Brief Participants start with a scenario: a company seeking funding, with financial data, background, and objectives. The brief includes loan ask, purpose, and business history.

2. Analyse the Situation Participants evaluate financial health, calculate debt servicing ability, assess industry risk, and determine if the ask aligns with credit policy.

3. Structure a Loan Package Using the simulation interface, they decide on loan amount, tenor, type, collateral, pricing, and covenants. Trade-offs and stress tests guide thinking.

4. Negotiate or Revise Terms Participants receive feedback from a simulated borrower or internal committee, requiring revised structures, deeper justification, or alternative proposals.

5. Present and Defend Their Proposal In memo or verbal format, they pitch their solution - balancing bank returns with relationship integrity.

6. Iterate Across Rounds Each round adds new complexity - competitor offers, credit downgrades, refinancing asks - forcing participants to evolve their strategies.

Throughout the experience, they are encouraged to reflect, collaborate, and practice the real-world art of credit structuring under pressure.

Do participants need prior experience in lending or credit? No. The simulation introduces all key concepts with guided tools. Familiarity with basic financial ratios is helpful.

Are the scenarios based on real companies? The scenarios are realistic composites based on real market data, with diverse industry examples (e.g. manufacturing, tech, services).

Can the loan types be customized? Yes. The simulation includes term loans, working capital facilities, bullet loans, and revolving lines.

How are covenant decisions handled? Participants select financial and operational covenants, each with trade-offs explained through risk flags and borrower reaction.

Is the simulation quantitative? Moderately. It blends financial analysis with judgment and negotiation - ideal for roles that combine both.

How long does it take to run? A standard session runs 4 - 5 hours. Extended formats allow multi-round deals, deeper presentations, or team review boards.

Can students play as both relationship managers and credit officers? Yes. Team formats allow role splits, encouraging internal debate and collaborative decision-making.

How is performance evaluated? Assessment includes deal profitability, risk alignment, client satisfaction, and clarity of communication.

Is there an option for real-time feedback or AI questioning? Yes. Simulated internal committees and borrower responses provide immediate challenges to improve learning.

Can it be used in both education and corporate settings? Absolutely. It’s designed for universities, business schools, and corporate training for early-career bankers and credit analysts.

Assessment is based on decision quality, credit logic, communication, and learning reflection. Evaluation methods can include:

Loan term sheets and internal memos

Verbal or recorded pitch presentations

Peer and instructor reviews

Real-time metrics: profitability, default risk, and client retention

Post-simulation debriefs and written reflections

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated into by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.