Students step into the role of corporate finance leaders, managing short-term funding decisions, negotiating with creditors, and navigating liquidity crises under pressure in our Liquidity Risk Management Simulation.

This simulation brings key corporate finance and treasury concepts to life, including:

Cash Flow Forecasting: Tracking inflows and outflows across operating, investing, and financing activities

Liquidity Ratios: Interpreting current ratio, quick ratio, and operating cash flow ratios

Working Capital Management: Adjusting payables, receivables, and inventory levels

Short-term vs Long-term Financing: Evaluating trade credit, lines of credit, commercial paper, and equity injections

Liquidity Risk Assessment: Managing covenant breaches, creditor confidence, and reputational risk

Stress Testing: Simulating external shocks such as delayed payments, supply chain disruptions, and interest rate changes.

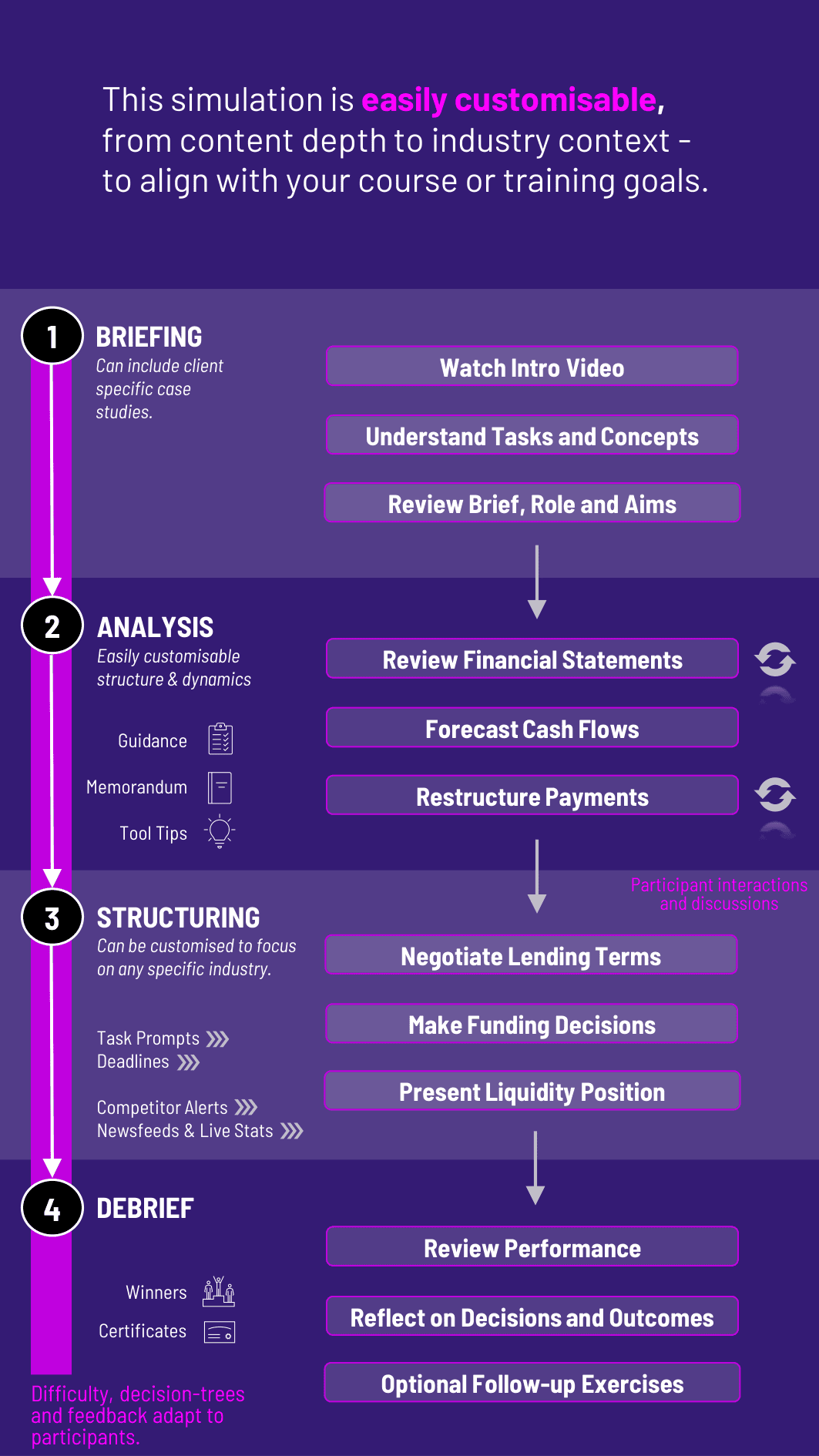

Review real-time financial statements, debt covenants, and short-term obligations

Create rolling 13-week cash flow forecasts based on operational data

Prioritize payments and restructure payment schedules under liquidity constraints

Negotiate with banks and investors for bridge loans or working capital support

Make funding decisions: internal cash, short-term borrowing, or equity

Respond to news events that impact liquidity, such as client defaults or supplier delays

Present a final liquidity position to the board, justifying decisions and future readiness

Through this simulation, students develop practical financial judgment and real-world crisis-management capabilities. They will learn how to:

Diagnose liquidity stress before it becomes a solvency issue

Manage trade-offs between operational needs and financial prudence

Make funding decisions based on urgency, cost, and risk exposure

Understand the interplay between liquidity risk and reputational risk

Communicate under pressure to internal and external stakeholders

Balance short-term survival with long-term financial health

What prior knowledge is required? Students should be familiar with basic financial statements and concepts such as working capital, debt, and cash flow. No advanced modeling required.

Is the simulation individual or group-based? It can be run as a single-player exercise or as a group simulation with teams representing different internal stakeholders (e.g., treasury, operations, investor relations).

How long does it take? The simulation typically runs across 3–5 rounds and can be completed in a 2.5–3 hour class session, or extended into a multi-day workshop.

What devices or platforms are needed? The simulation runs on any modern browser - no downloads required. It works on laptops and tablets.

How is student performance evaluated? Evaluation includes simulation scoring (cash balance, covenant compliance, stakeholder trust), decision logs, and group presentations or written board memos.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.