This simulation places you at the heart of a leading investment bank, challenging you to structure and syndicate debt for a major Leveraged Buyout. Can you balance the competing demands of clients, investors, and market forces to close a profitable deal?

Capital Structure Optimization

Leveraged Buyout Modeling

Debt Capacity Analysis

Senior Secured Loans

High-Yield Bonds

Mezzanine Financing and PIK Instruments

Debt Covenants and Credit Agreements

Credit Ratings and Spreads

Loan Syndication and Distribution

Fee Structuring and Economics

Market Timing and Investor Appetite

Risk Assessment and Mitigation

In the simulation, participants will:

Assess the target company's cash flows, debt capacity, and ability to service debt.

Determine the right mix of senior loans, high-yield bonds, and subordinated debt.

Set appropriate interest rates and yields based on credit risk and market conditions.

Draft and negotiate financial maintenance and incurrence covenants with the sponsor.

Develop a book-building strategy, interact with virtual investors, and allocate the debt.

Present your financing proposal to the private equity sponsor (simulated by the instructor).

React to dynamic market events that impact investor demand and pricing.

Review the final syndication results, fees earned, and the performance of the capital structure.

Analyze a company's financial profile to determine its optimal debt capacity for an LBO.

Design a multi-layered leveraged finance structure that balances risk and return.

Evaluate the impact of different debt instruments (loans, bonds, mezzanine) on a company's cost of capital and financial flexibility.

Interpret key debt covenants and understand their role in protecting lenders.

Execute a syndication strategy in a dynamic market, adjusting pricing and allocation to ensure a successful deal.

Articulate the economic trade-offs in a leveraged finance transaction to both clients and internal stakeholders.

1. Team Formation and Role Assignment Participants are divided into teams, each representing a competing investment bank. Roles such as Deal Captain, Syndicate Manager, and Structuring Analyst may be assigned.

2. Deal Kick-off and Initial Analysis Teams receive a confidential information memorandum detailing the LBO target, the sponsor's equity contribution, and financial projections.

3. Structuring and Pricing Phase Using the simulation's financial engine, teams build their capital structure, select debt instruments, set initial price talk, and draft term sheets.

4. Sponsor Negotiation and Mandate Award Teams present their proposals to the private equity sponsor. The most compelling structure and terms may be awarded a "lead mandate".

5. Syndication Phase Teams enter the virtual market to sell their debt to institutional investors. They must adjust pricing based on real-time feedback and demand.

6. Market Dynamics and Closing Random economic events and competitor actions force teams to adapt their strategy. The simulation concludes when the debt is fully allocated or the deal is pulled.

What are the technical prerequisites? A strong understanding of accounting, corporate finance, and financial modeling is recommended. No specific software coding knowledge is required as the simulation runs on a proprietary web-based platform.

How long does the simulation take to complete? The core simulation can be run in a 4-8 hour session. For university courses, it can be extended over multiple weeks with preparatory readings and a detailed wrap-up report.

Do we need to build an LBO model from scratch? No. The simulation provides a core LBO model and financial projections. Your focus is on structuring the debt that funds the LBO, not the equity component.

How realistic is the market environment? The simulation features a dynamic market engine with virtual investors who have different risk appetites. Market conditions can change, mirroring real-world volatility and its impact on debt issuance.

Is this a competition? Yes, teams compete for the financing mandate and for the most successful syndication, measured by metrics like fees earned, speed of distribution, and the final pricing achieved.

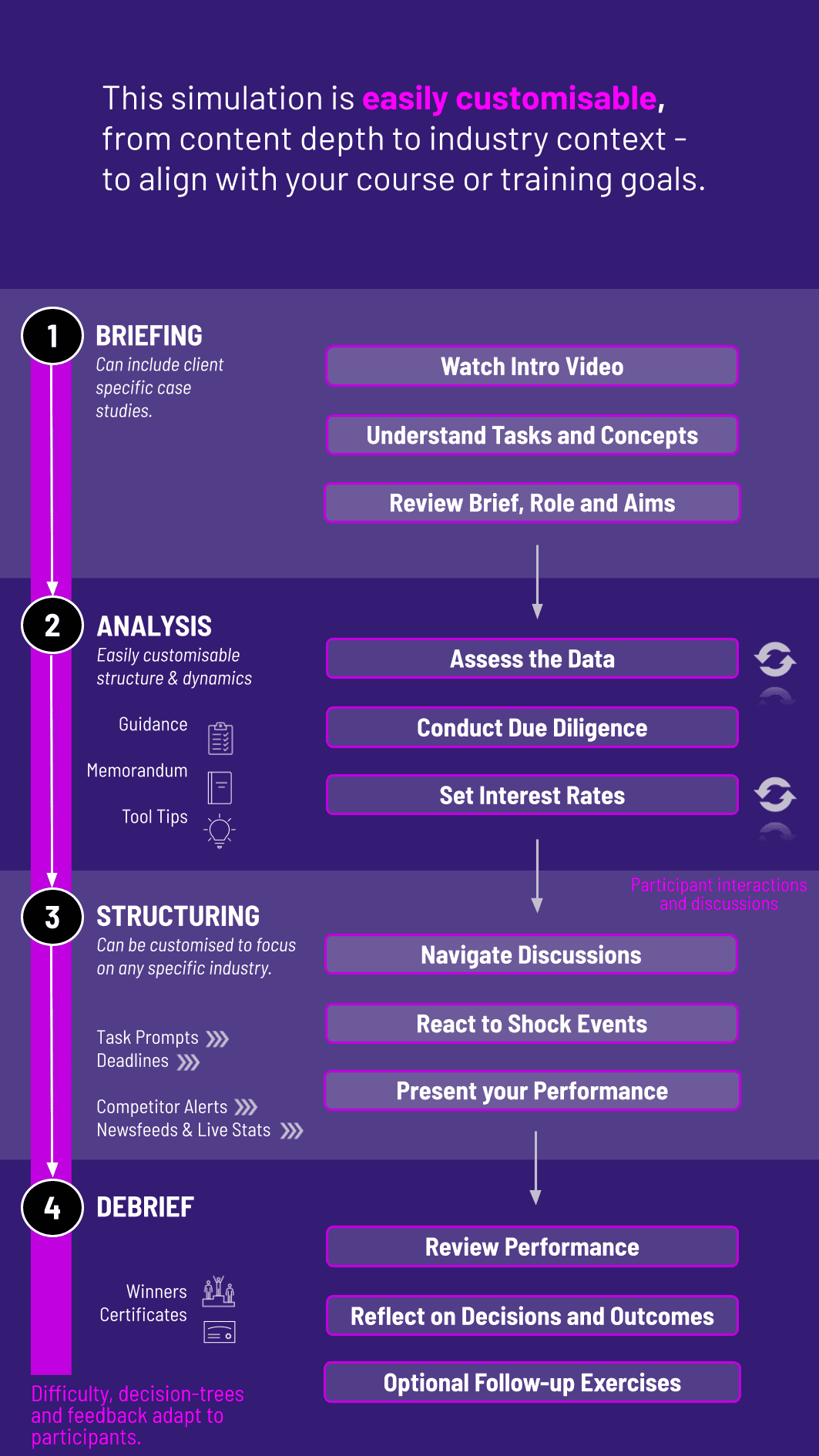

Can this simulation be customized for a corporate training program? Absolutely. We can tailor the case study, company profile, and market scenarios to align with your institution's specific training goals, such as focusing on specific industries or debt instruments.

What makes this simulation different from a traditional case study? Unlike a static case study, this simulation is dynamic and interactive. Your decisions have consequences, you must react to competitors and market events, and you experience the entire deal process in a compressed, risk-free environment.

Final Syndication Results

Capital Structure Memo

Sponsor Presentation and Negotiation

Simulation Performance

Strategic Review Report

Peer Evaluation

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.