This Lease Accounting Simulation is an intensive, online simulation that places participants in the role of a financial analyst at a growing company.

Lease Identification

Lease Classification

Discount Rate Selection

Initial Measurement

Subsequent Measurement

Lease Modifications and Remeasurement

Financial Statement Impact

Disclosure Requirements

In the simulation, participants will:

Analyze a portfolio of real-world lease contracts for a simulated company.

Identify and extract critical lease data, such as terms, payments, and options.

Classify each lease correctly as either a Finance Lease or an Operating Lease.

Calculate the initial ROU Asset and Lease Liability using present value techniques.

Prepare journal entries for lease commencement, monthly payments, and amortization.

Handle a mid-term lease modification, recalculating the updated liability and asset.

Generate key financial reports and disclosures required under ASC 842/IFRS 16.

Analyze and present the overall impact of lease accounting on the company's financial health.

Interpret and apply the core principles of ASC 842 and IFRS 16 to various lease arrangements.

Demonstrate proficiency in the technical accounting for both Finance and

Operating Leases from inception to termination.

Evaluate the significant impact that lease capitalization has on a company's financial statements and key performance indicators (KPIs).

Build a structured lease accounting model to calculate and record journal entries accurately.

Develop critical thinking skills to address complex, real-world scenarios such as lease modifications and impairments.

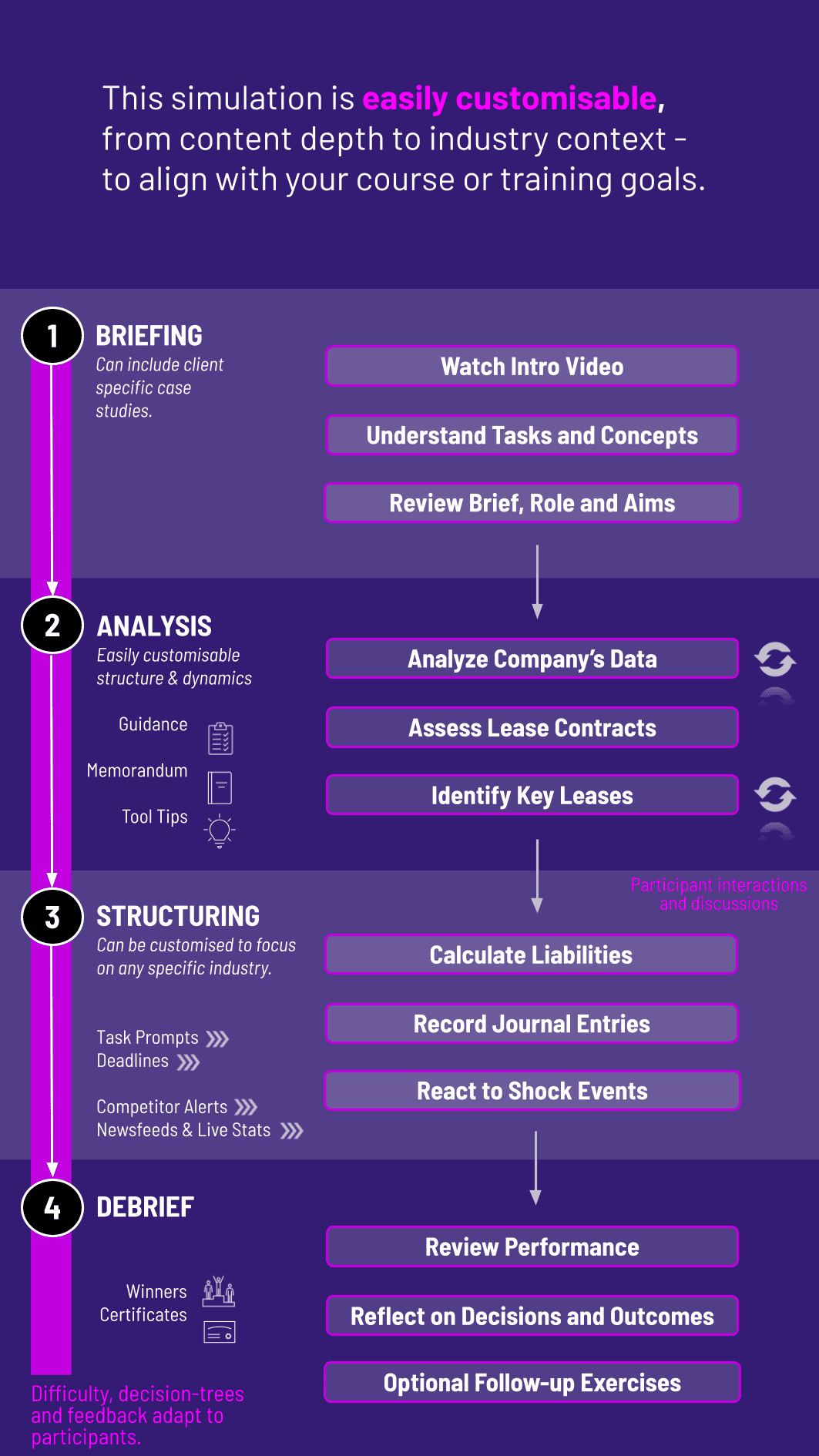

1. Introduction and Case Background You are introduced to your role and the simulated company preparing for its first audit under the new lease standard.

2. Lease Analysis Phase You are given a set of lease contracts (for warehouses, vehicles, equipment) and must identify the leases and their key terms.

3. Classification and Initial Recording Using the provided data, you classify each lease and perform the initial calculations to record the ROU Asset and Lease Liability on the balance sheet.

4. Subsequent Accounting and Modifications Over several simulated periods, you record monthly journal entries. A trigger event then requires you to account for a lease modification, testing your understanding of remeasurement.

5. Reporting and Analysis You consolidate your work into a simplified set of financial statements and prepare the necessary note disclosures.

6. Debrief and Feedback A comprehensive debrief session is held, comparing different approaches and highlighting key learning takeaways.

Who is the target audience for this Lease Accounting Simulation? This simulation is designed for accounting and finance students, early-career professionals in accounting firms or corporate finance departments, and anyone needing a practical understanding of ASC 842 or IFRS 16.

Do I need prior experience with lease accounting to participate? While some basic accounting knowledge is helpful, the simulation includes foundational learning materials and guidance to bring all participants up to speed on the core concepts before starting the practical tasks.

Is the simulation based on ASC 842, IFRS 16, or both? The core simulation is built on the principles common to both standards (like balance sheet recognition). However, it highlights key differences where they exist (such as lease classification for lessees), making it valuable for a global audience.

How long does it take to complete the simulation? The simulation is designed to be completed in approximately 2-4 hours, depending on the participant's pace and depth of analysis.

Can this simulation be used for corporate training? Absolutely. The simulation is an excellent tool for corporate training programs, ensuring that your entire finance team has a consistent and practical understanding of the new lease accounting standards.

What makes this simulation different from a traditional online course? Unlike passive video-based courses, our simulation is active and experiential. You learn by doing, making critical accounting decisions and seeing their immediate impact, which leads to better knowledge retention.

Is technical accounting software required? No specialized software is needed. The simulation runs entirely through a standard web browser, with built-in tools for calculations and journal entry preparation.

Participants’ journal entries and calculations.

Correct lease classification, accurate PV calculations, and proper journal entries.

Successful completion of all required steps, from initial analysis to final reporting.

Quality of the financial analysis and the accuracy of the prepared disclosures.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.