In this hands-on Lean Startup Course, participants act as startup founders who test, iterate, and pivot their way toward product-market fit while managing limited resources and high uncertainty.

Problem-Solution Fit

Minimum Viable Product (MVP)

Customer Segmentation and Validation

Hypothesis Testing and Learning Loops

Pivot vs. Persevere Decisions

Startup Metrics

Rapid Experimentation

Founder-Team Dynamics

Burn Rate and Runway Management

Investor Readiness and Pitching

Select a startup idea from a set of real-world problems

Conduct customer discovery interviews and identify core pain points

Define and test initial business hypotheses

Design and deploy MVPs to gather early traction data

Analyze feedback and make pivot or persevere calls

Refine pricing, positioning, and go-to-market approaches

Manage cash burn and runway through tight financial decisions

Respond to investor inquiries and prepare short pitches

Iterate on the product-market fit across multiple course rounds

Reflect on entrepreneurial lessons and founder resilience

By the end of the course, participants will:

Grasp the fundamentals of the lean startup methodology.

Apply customer discovery techniques to validate market needs.

Build and test hypotheses using MVPs and feedback cycles.

Make data-informed decisions on pivots or product changes.

Measure key startup metrics and understand early-stage financials.

Adapt to ambiguity, failure, and competitive uncertainty.

Balance vision, feasibility, and viability in startup decision-making.

Manage limited resources under pressure and prioritize ruthlessly.

Communicate clearly with team members, mentors, and investors.

Build entrepreneurial resilience and develop iterative thinking habits.

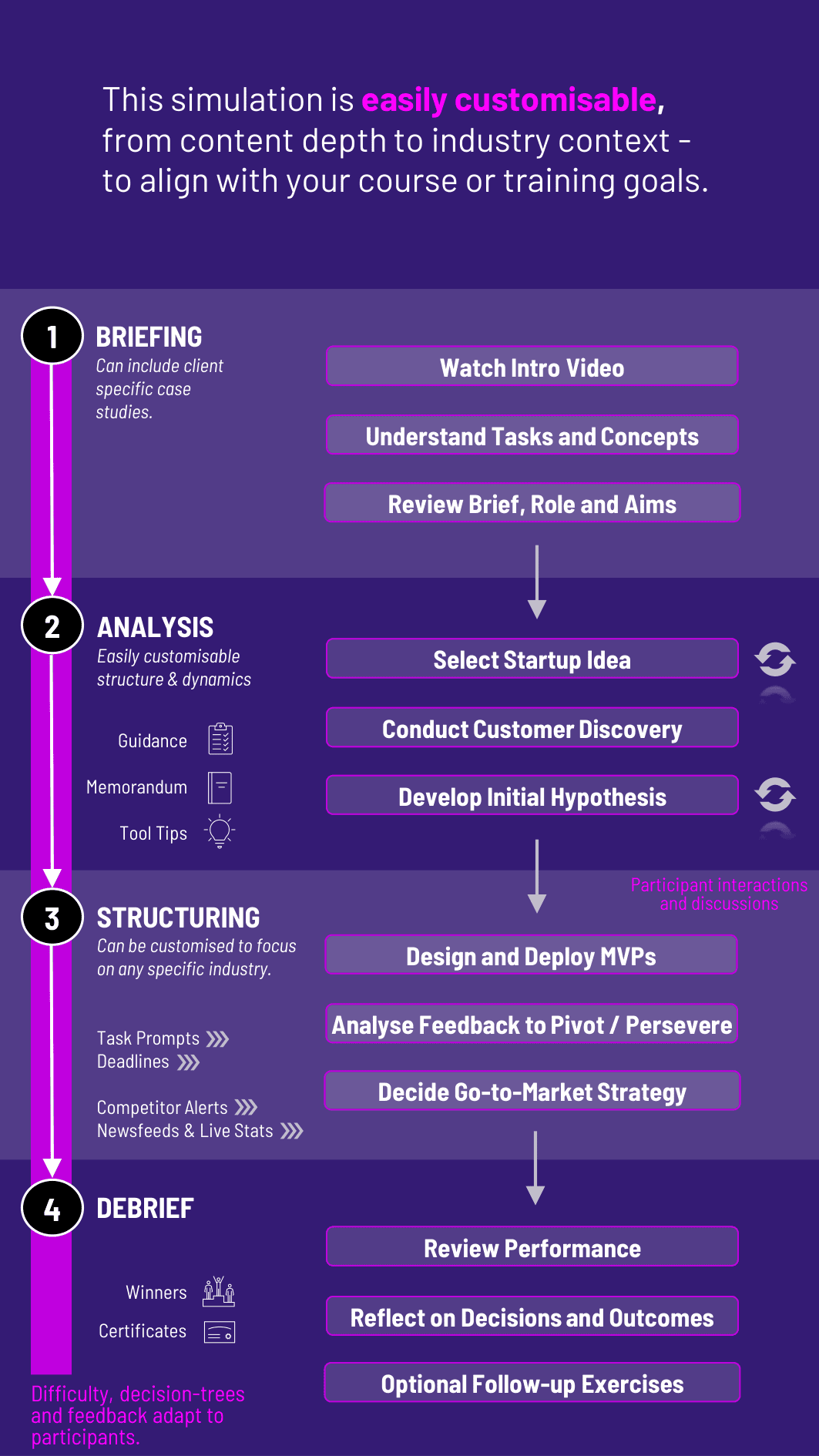

The course’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program.

Participants progress through real startup scenarios over several rounds, each introducing new customer insights, investor challenges, or competitive pressures.

1. Identify a Market Problem and Define Hypotheses Participants select from a curated list of market problems or submit their own. They frame core assumptions about the problem, customer, and solution.

2. Conduct Customer Discovery They engage in simulated interviews or surveys, gathering feedback on need, willingness to pay, and feature expectations. Responses vary depending on how questions are framed.

3. Build and Deploy MVPs Participants choose MVP formats - landing pages, prototypes, concierge models - and test them with different user groups. Cost, speed, and learning yield vary by format.

4. Analyze Data and Decide on Pivot vs. Persevere Using real startup metrics (signups, churn, feedback), they decide whether to stay the course, pivot the business model, or change the target market.

5. Manage Finances and Team Dynamics They allocate limited resources - time, money, energy - while keeping burn rate low and team morale high. Missteps lead to tighter runway or friction.

6. Pitch to Investors and Adapt Based on Feedback At the end of each round, participants face mock investor questions. Their decisions and communication quality influence available capital or mentorship support.

Do participants need a startup idea in advance? No. The course provides a range of validated startup ideas or allows participants to bring their own.

Is this suitable for non-business backgrounds? Yes. It’s perfect for engineers, creatives or any other user-background learning business fundamentals.

Can we customize the startup domains? Yes. You can tailor the course to healthtech, edtech, consumer, or B2B ventures.

How many rounds does the course run? Typically 4 - 5 rounds, but you can expand or compress depending on course structure.

Can teams collaborate like real co-founders? Yes. Team play enhances decision-making and mirrors startup dynamics.

Is investor interaction part of the course? Yes. Participants receive simulated investor questions and funding offers based on traction.

Are there financials involved? Yes. Participants must manage runway, experiment costs, and basic early-stage cash flow.

Can this be used in accelerators or startup bootcamps? Absolutely. It’s ideal for short intensives or multi-week startup courses.

What teaching materials come with the course? Facilitator guides, debrief slides, and optional prep content are all included.

What kind of feedback do learners receive? They get round-by-round performance metrics, peer comparisons, and investor-style responses.

Hypothesis clarity and testing logic

Relevance and insight of customer discovery

MVP design quality and learning outcome

Pivot decisions and rationale

Financial discipline and burn rate control

Team collaboration and stakeholder engagement

Strategic alignment with market needs

Investor communication and pitch delivery

Reflection on failure and resilience

Iterative improvement across rounds

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.