In this hands-on Leadership in Financial Crises Simulation, participants act as senior executives navigating high-stakes decisions, stakeholder pressure, and ethical dilemmas amid financial turmoil, strategic uncertainty, and public scrutiny.

Crisis leadership and decision-making under pressure

Financial distress and turnaround strategies

Internal and external communication in high-stakes settings

Stakeholder prioritization: investors, regulators, employees

Ethical and reputational risk management

Liquidity management and cost-cutting

Strategic agility in unpredictable environments

Public confidence and media response

Psychological safety and team morale

Scenario planning and contingency frameworks

Assess liquidity, solvency, and operational risks

Decide which areas to cut, save, or double down on

Negotiate with lenders, regulators, or activist investors

Deliver bad news or reframe the narrative

Manage internal tensions and board expectations

Justify difficult trade-offs in front of critical audiences

By the end of the simulation, participants will be able to:

Lead with clarity during ambiguous and volatile conditions

Prioritize strategic goals while managing public perception

Make defensible financial and operational decisions under pressure

Communicate transparently while maintaining leadership presence

Manage stakeholder relationships in crisis scenarios

Balance ethical responsibility with business needs

Structure decision-making frameworks under stress

Respond to feedback and adapt with agility

Collaborate under high stakes in cross-functional teams

Reflect on the personal toll and leadership maturity required in crises

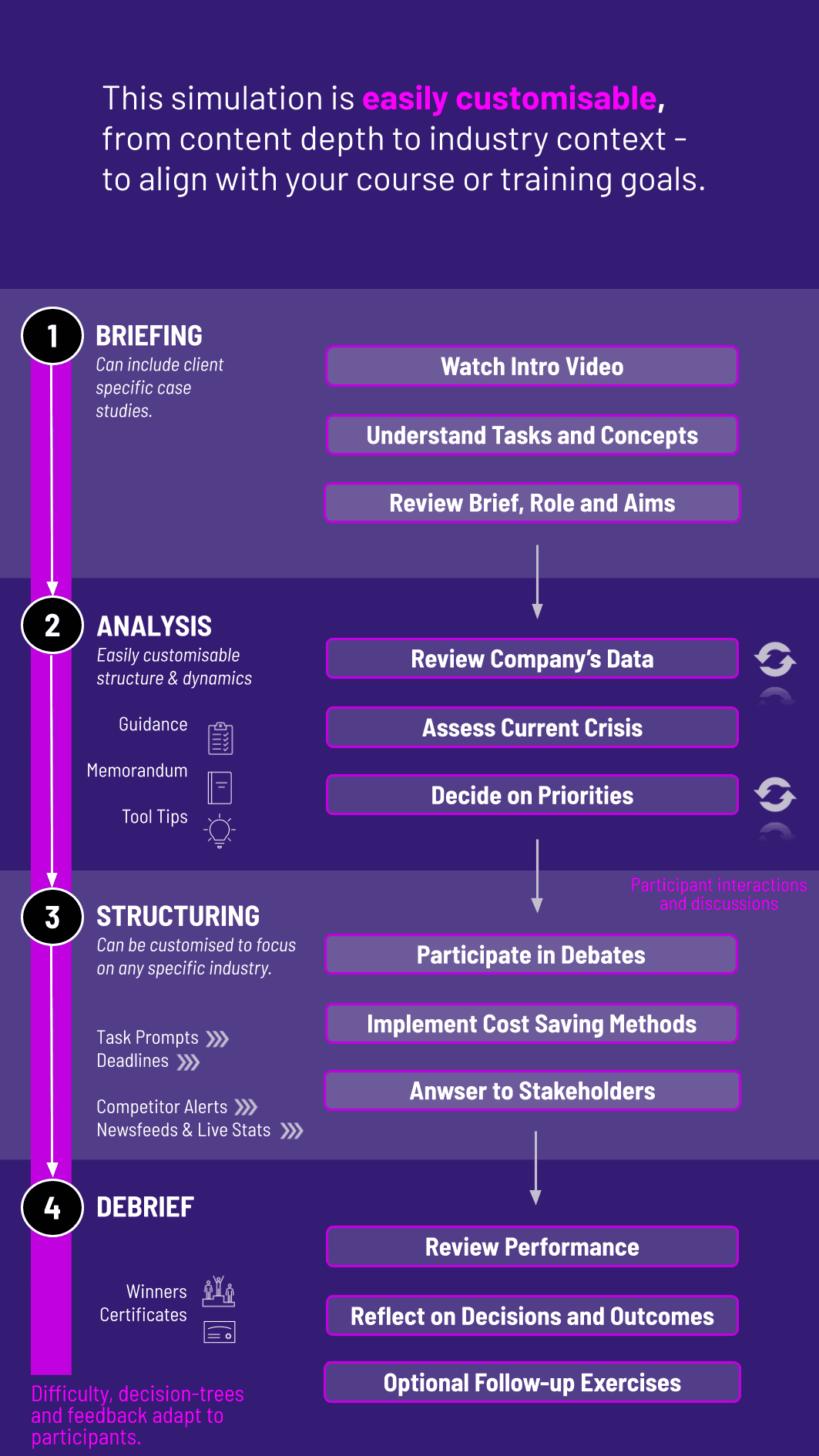

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation is suitable for business schools, executive programs, crisis management workshops, and senior leadership training. Each round reflects an evolving phase of the crisis - from sudden onset to long-term recovery.

1. Receive a Brief: Each round begins with a new crisis development, key facts, stakeholder reactions, and urgent objectives. Participants quickly assess where things stand.

2. Analyse and Prioritise: Participants review financials, sentiment data, internal reports, and media snippets to define their approach - deciding what to act on and what to communicate.

3. Make Critical Leadership Decisions: They choose cost cuts, investor responses, media statements, and stakeholder strategies - often with no perfect option available.

4. Collaborate or Challenge (Optional Team Format): In group settings, participants debate decisions, role-play boardroom conversations, or divide tasks across CEO/CFO/Comms teams.

5. Communicate and Reflect: Each team shares a memo, press release, or board update explaining their response. Real-time feedback highlights trade-offs and stakeholder reactions.

6. Move to the Next Round: Each round reveals new consequences - positive or negative - and participants must adapt their leadership strategy accordingly.

Do I need prior finance knowledge? No. Key financial terms are introduced during the simulation. The focus is on leadership, not technical accounting.

Can this be run for teams or individuals? Both. Team formats allow role-playing and collaboration; individual formats highlight personal leadership under pressure.

Is this based on real events? Yes. Scenarios are inspired by real corporate or systemic crises - but anonymized and adjusted for learning.

What industries are covered? The simulation can be tailored to banking, corporate, public sector, or cross-industry crisis cases.

Is media and PR response part of it? Yes. Participants must often write public statements or internal memos.

Does this work for online delivery? Yes. It’s flexible for in-person, hybrid, or fully remote formats.

How long does the simulation take? It can run as a short 2-hour exercise or across a multi-day training session.

Can this be run in a boardroom setting? Absolutely. It’s designed to feel like a high-level crisis room.

Improvement in financial performance across rounds

Strategic alignment of cost-cuts and investments

Communication clarity in crisis contexts

Ethical decision-making and stakeholder sensitivity

Learning agility and responsiveness to feedback

Peer and self-assessments to capture collaboration and iteration

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.