In this hands-on Investor Psychology Simulation, participants act as investors navigating biases, market sentiment, and behavioural traps - balancing rational analysis with emotional pressures to make sound investment decisions under uncertainty.

Behavioral finance and cognitive biases

Herd behavior and market sentiment

Overconfidence and excessive risk-taking

Anchoring, framing, and decision shortcuts

Loss aversion and the disposition effect

Emotional responses to volatility and uncertainty

Media influence and rumor-driven trading

Investor memory and recency bias

Long-term vs short-term thinking

Debiasing techniques and rational frameworks

Allocate assets across equities, bonds, and alternatives

Respond to market shocks, news, and analyst commentary

Experience behavioural traps such as herd effects or anchoring

Make buy, sell, or hold decisions under time pressure

Debate decisions in teams to reveal bias in group dynamics

Reflect on their own cognitive patterns and decision outcomes

By the end of the simulation, participants will be able to:

Recognize common investor biases and their impact on markets

Apply behavioral finance concepts to real-world decision-making

Balance rational analysis with awareness of psychological influences

Develop strategies to mitigate overconfidence and herd mentality

Communicate investment reasoning under pressure

Manage emotions during volatility and uncertainty

Understand how media and sentiment shape investor behaviour

Strengthen long-term investment discipline despite short-term noise

Collaborate and debate investment ideas constructively

Reflect on personal tendencies and improve decision-making frameworks

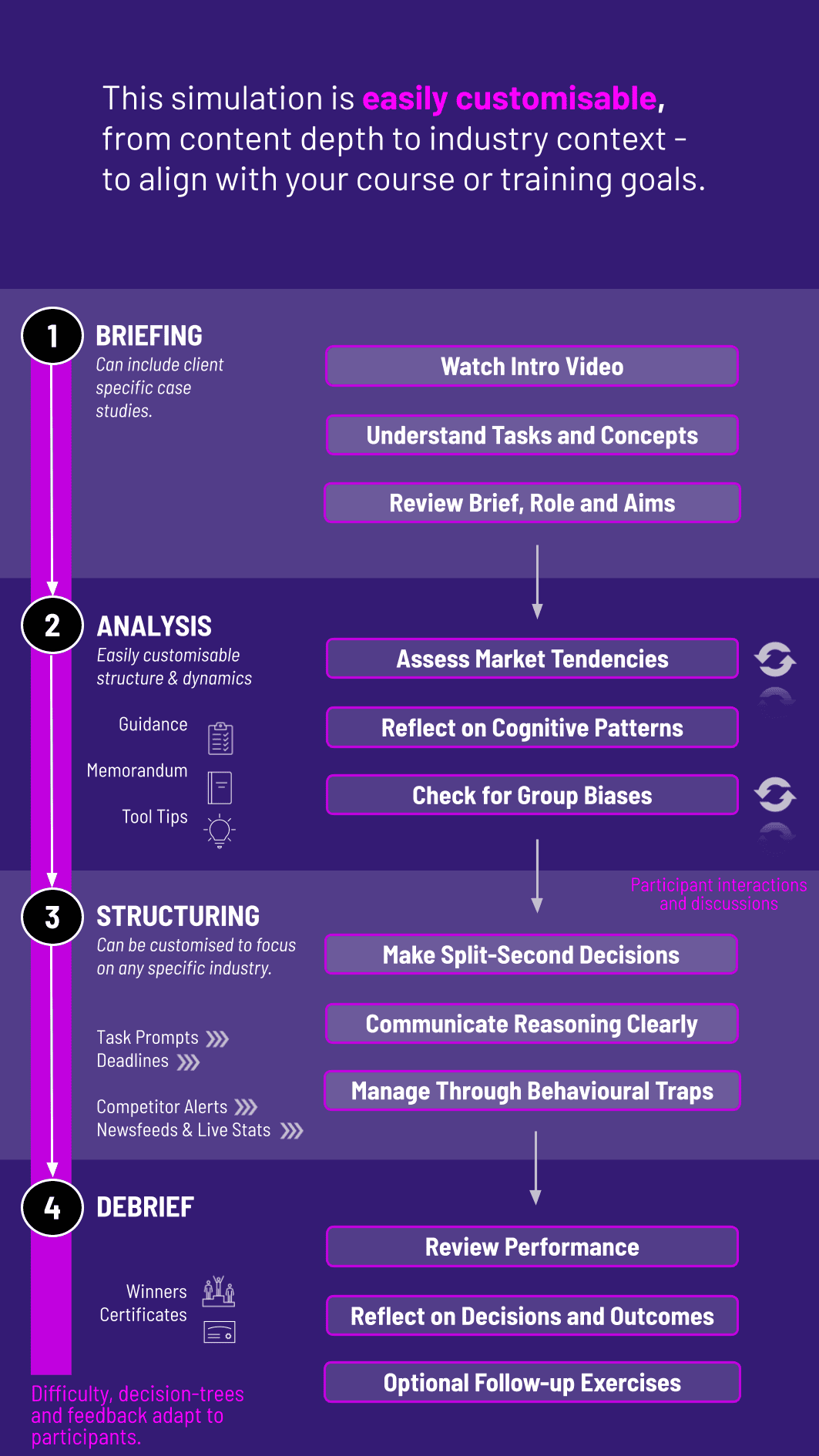

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can run in classrooms, workshops, or corporate programs, individually or in teams. Each cycle represents a decision-making round in a volatile market.

1. Receive a Scenario or Brief: Participants are given a market update with asset options, sentiment indicators, and analyst commentary.

2. Analyse the Situation: They review fundamentals, technicals, and sentiment while filtering out psychological distractions.

3. Make Investment Decisions: Participants buy, sell, or hold assets under time pressure, influenced by real-world behavioural triggers.

4. Collaborate and Debate: In teams, participants defend their investment logic and challenge biases in group settings.

5. Review Results and Reflect: Outcomes reveal performance, biases triggered, and lessons learned.

6. Iterate with New Rounds: New market shocks, rumours, and sentiment changes force participants to adapt strategies and confront recurring biases.

Do participants need prior finance knowledge? Basic familiarity helps, but the simulation introduces all key concepts as part of gameplay.

What behavioral biases are included? Overconfidence, herd behaviour, loss aversion, anchoring, and framing, among others.

Is this simulation only about trading? No. It also explores long-term strategy, communication, and team decision dynamics.

Can it be tailored for professionals? Yes. It’s widely used in corporate training for investment teams, banks, and asset managers.

Is media influence part of the simulation? Yes. Participants face news items, rumours, and sentiment indicators to test reactions.

Can it run online? Yes. It works in in-person, hybrid, and fully digital formats.

How long does it take? It can be a 2-hour session or part of a multi-day program.

Does it involve group dynamics? Yes. Teams can debate and align decisions to highlight group biases.

Is it useful for executive programs? Absolutely. It sharpens awareness of how psychology influences high-stakes investment decisions.

How is performance measured? Through portfolio returns, bias management, and decision consistency.

Recognition and management of biases

Consistency in investment rationale

Responsiveness to volatility and sentiment

Communication clarity under uncertainty

Peer/self-assessments for collaboration and reflection

You can also include memo writing and debrief presentations as part of the assessment structure. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.