The Investment Decisions Simulation challenges participants to act as senior management, making critical capital budgeting and strategic investment choices to maximize firm value in a dynamic, competitive market.

Capital Budgeting

Discounted Cash Flow

Risk Analysis

Capital Rationing

Strategic Alignment

Cost of Capital

Real Options

In the simulation, participants will:

Analyze detailed project proposals with forecasted financials.

Build financial models to evaluate project viability.

Debate and prioritize projects under capital constraints.

Adjust decisions based on changing macroeconomic updates.

React to competitor moves and market share shifts.

Present and defend their final investment portfolio strategy.

Apply core capital budgeting techniques to real-world project proposals.

Construct and optimize a value-maximizing investment portfolio under capital constraints.

Quantify and incorporate risk into financial decision-making models.

Articulate the strategic rationale behind investment choices, linking finance to corporate strategy.

Interpret market feedback and adapt a long-term investment plan dynamically.

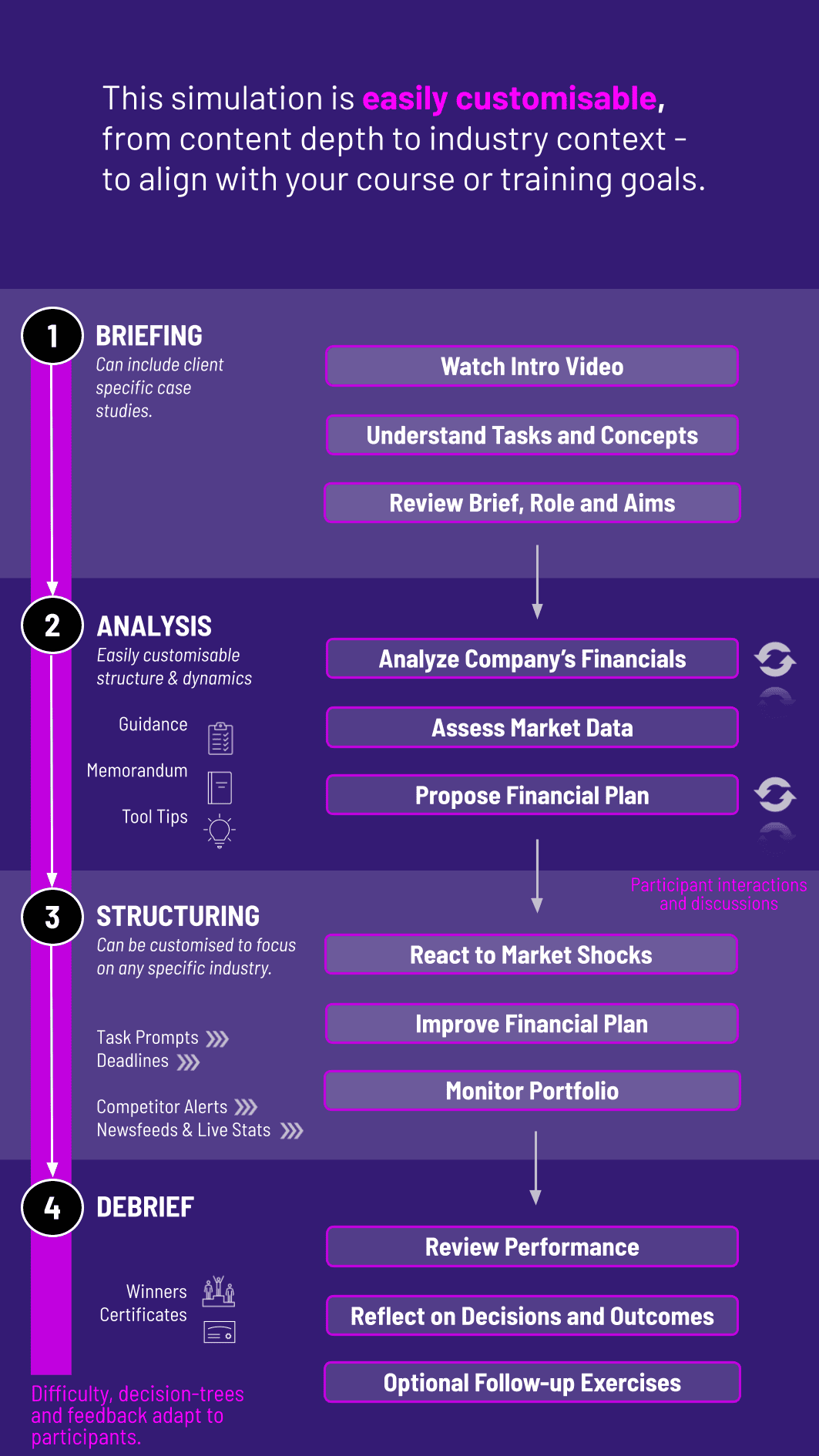

1. Form Teams and Receive Brief Teams are formed as the "Executive Committee" of a company. They receive the company's strategic goals, financial health, and a pipeline of potential investment projects.

2. Initial Analysis and Planning In Round 1, teams analyze project data, run financial calculations, and submit their first investment plan, allocating their initial capital budget.

3. Market Feedback and New Rounds After each decision round, the simulation engine provides results: updated company financials, market reactions, and competitor outcomes. New information and potential projects are introduced in subsequent rounds.

4. Portfolio Adjustment Teams must adapt their strategy, potentially abandoning underperforming projects or seizing new opportunities with their generated cash flows.

5. Final Review and Debrief The simulation culminates in a ranking based on key metrics like cumulative shareholder value creation. A guided debrief links in-simulation experiences to core financial principles.

Who is this simulation designed for? It is ideal for MBA students, finance undergraduates, corporate training programs, and any professionals seeking to improve their capital budgeting and strategic investment analysis skills.

What prior finance knowledge is required? A basic understanding of financial concepts (like time value of money and reading financial statements) is helpful, but the simulation includes foundational guides and is designed to be used within a course or workshop with instructor support.

How long does the simulation take to complete? The experience is flexible. A typical workshop runs 4-8 hours, but it can be condensed or extended across multiple sessions to fit your program schedule.

Is this a competition or collaborative exercise? It's both! Teams collaborate internally to make decisions, but they compete against other teams in the same simulated market, with performance ranked on a leaderboard.

What makes this simulation different from a standard case study? Unlike a static case, this simulation is dynamic. Decisions lead to immediate, quantified outcomes, and the market environment changes, requiring adaptive strategy—much like real business.

Can the simulation be customized for our specific company or industry? Yes, we offer customization options to tailor project examples, financial parameters, and industry context to align with your organization's specific training objectives.

What do I need to run the Investment Decisions Simulation? You only need an internet-connected device (laptop/tablet) per team. We host the platform, and our support team provides full technical assistance.

Accuracy in judgement of company’s assets and quality of assumptions

Depth and logic of scenario analysis

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.