Our Investment Appraisal Simulation plunges participants into the high-stakes world of corporate finance, where allocating capital effectively is the key to driving growth and creating shareholder value.

Time Value of Money

Discounted Cash Flow Analysis

Net Present Value

Internal Rate of Return

Payback Period and Discounted Payback Period

Profitability Index

Risk Analysis and Sensitivity Analysis

Scenario Planning

Capital Rationing

Cost of Capital

Strategic vs. Financial Fit

Project Portfolio Management

In the simulation, participants will:

Analyze detailed project proposals with forecasted cash flows and strategic data.

Build dynamic financial models to calculate key investment metrics.

Perform sensitivity and scenario analysis to assess project risk and viability.

Debate the strategic merits and risks of each project in a team setting.

Make "Build, Buy, or Partner" decisions under conditions of uncertainty.

Manage a limited capital budget, making tough trade-offs between competing projects.

Present and defend their final investment portfolio to the board (instructor/facilitator).

Adapt their strategy based on in-simulation economic shifts and project performance updates.

Apply core investment appraisal techniques to evaluate potential projects.

Interpret the results of DCF models to make informed go/no-go decisions.

Quantify and manage project risk using sensitivity and scenario analysis.

Construct a balanced investment portfolio that aligns with strategic goals under capital constraints.

Articulate the financial and strategic rationale behind investment choices.

Understand the impact of macro-economic and competitive factors on project outcomes.

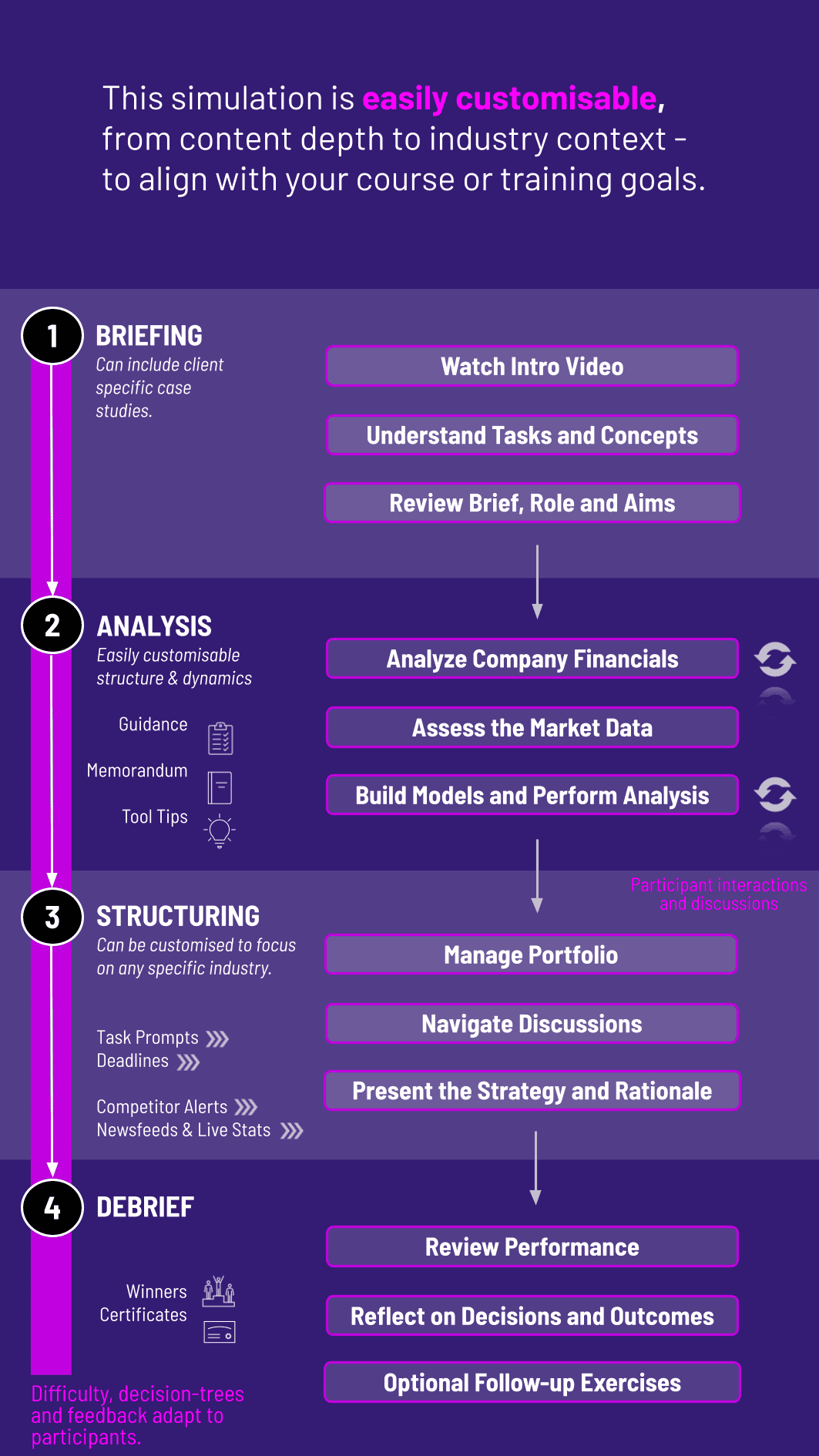

1. Introduction and Briefing Teams receive the company's strategic background, financial constraints, and a set of initial investment opportunities.

2. Analysis Phase Teams work collaboratively to model and appraise each project. They must calculate investment metrics and assess strategic alignment.

3. Decision Phase Teams must decide which projects to approve, reject, or defer, ensuring their total portfolio stays within the capital budget.

4. Round Debrief and New Inputs After submitting their decisions, the simulation engine generates results. Teams see the outcome of their choices and receive a new set of opportunities and challenges for the next round.

5. Final Presentation The simulation culminates with teams presenting their overall investment strategy and portfolio performance, justifying their decisions to a panel.

6. Instructor-led Debrief A comprehensive review connects the simulation experience to theoretical concepts, highlighting best practices and key learnings.

What is an Investment Appraisal Simulation? It is an immersive learning tool that replicates the process of evaluating and selecting long-term investment projects within a corporation, allowing participants to apply financial theory in a risk-free, dynamic environment.

Who is this simulation designed for? It is ideal for MBA students, finance undergraduates, and corporate trainees in roles related to finance, strategy, project management, and executive leadership.

Do I need advanced Excel skills to participate? While basic Excel proficiency is helpful, the simulation is designed to be accessible. The focus is on financial decision-making, not advanced modeling. Templates and guides are often provided.

How long does the simulation typically last? Formats are flexible, ranging from a 3-hour intensive workshop to a multi-session module run over several days or weeks.

Is this simulation relevant for entrepreneurs and small business owners? Absolutely. The principles of evaluating an investment's return and risk are fundamental to any business, regardless of size. The simulation teaches disciplined decision-making crucial for growth.

What makes this different from a standard case study? Unlike a static case study, our simulation is dynamic. Your decisions impact future rounds, and you must adapt to changing market conditions, providing a more realistic and engaging experience.

Can the simulation be customized for our company's specific industry? Yes, we offer customization options to tailor project examples, financial metrics, and market conditions to reflect the specific challenges of your industry.

How does the simulation assess performance? Performance is measured holistically, based on the financial returns of the chosen portfolio, strategic coherence, risk management, and the quality of the team's final presentation and rationale.

The financial success of the team's investment portfolio, measured by metrics like overall NPV created and return on invested capital

Evaluation of the team's strategic rationale, risk assessment, and ability to defend their choices during the final presentation.

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.