Inventory is more than just products on a shelf; it's a critical asset that directly impacts a company's reported profitability and tax liability. Learn how your accounting choices ripple through and shape the financial health of your company.

Inventory Valuation Methods

Cost of Goods Sold and Gross Profit

Impact on Financial Statements

LIFO Reserve and LIFO Liquidation

Tax Implications

Inventory Management

Financial Ratio Analysis

In the simulation, participants will:

Manage a company competing in a simulated market.

Make strategic purchasing decisions for raw materials under changing price conditions.

Set production levels based on demand forecasts and inventory targets.

Choose and apply an inventory valuation method.

Analyze generated financial statements each period.

Benchmark performance against competitor companies using key financial ratios.

Adjust strategies in response to market shocks, such as rapid inflation or a supply chain disruption.

Justify financial performance to a simulated board of directors based on their accounting choices.

Apply the core mechanics of FIFO, LIFO, and Weighted Average inventory valuation methods.

Analyze and explain how each method affects a company's reported profitability, asset valuation, and tax burden.

Evaluate the strategic trade-offs between tax minimization, reported earnings, and cash flow.

Interpret the impact of inventory valuation on key financial ratios used by investors and creditors.

Synthesize financial data to make informed operational decisions (purchasing, production) that align with corporate financial goals.

Critique a company's financial health with a deeper understanding of the accounting choices behind the numbers.

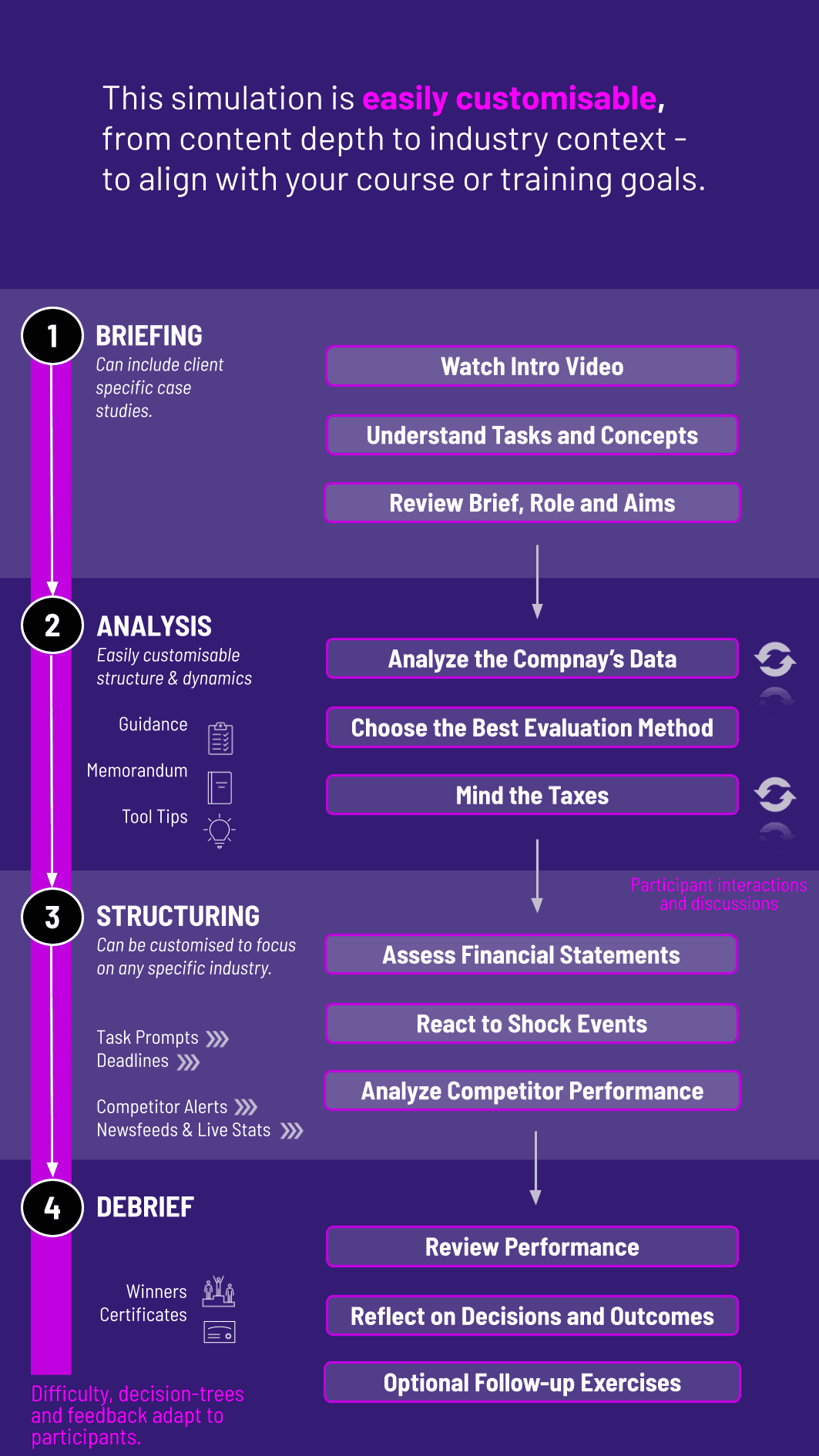

1. Setup Participants are assigned to teams and introduced to their virtual company and the market environment.

2. Decision Rounds The simulation progresses through multiple rounds, each representing an accounting period. In each round, teams analyze market data and price trends, decide how much raw material to purchase and at what price points, set their production schedule.

3. Automated Calculation The platform processes all team decisions. It uses the team's chosen inventory method to calculate COGS, ending inventory value, and generates complete financial statements for the period.

4. Results and Analysis Teams review their Income Statement, Balance Sheet, and a dashboard of key metrics. They can see how they rank against competitors.

5. Debriefing An instructor-led debrief connects the simulation experience to accounting theory, highlighting the "why" behind the financial results and facilitating a discussion on strategic implications.

Is this simulation suitable for beginners in accounting? Absolutely. The simulation is designed with an intuitive interface and guided learning path, making it ideal for students new to accounting principles. It serves as a powerful tool to cement their understanding of core concepts.

Can participants change their inventory valuation method during the simulation? Typically, the method is chosen at the start and must be consistently applied throughout the simulation to reflect real-world accounting standards. However, advanced scenarios can allow for a method change, exploring the financial restatement process.

What is the ideal team size and simulation duration? The simulation works well with teams of 2-5 participants. A standard simulation runs over 4-8 decision rounds, which can be completed in a 3-hour workshop or spread across several class sessions.

How does the simulation handle real-world complexities like obsolescence or spoilage? Bespoke versions of the simulation can introduce factors like inventory shrinkage and obsolescence, adding another layer of realism to the inventory management challenge.

Do you provide teaching materials and support for instructors? Yes. We provide a comprehensive instructor's manual, slide decks, pre-configured scenarios, and dedicated technical support to ensure a seamless integration into your curriculum.

How does the simulation demonstrate the impact of inflation? In an inflationary market, teams using LIFO will report higher COGS and lower profits (thus lower taxes) compared to teams using FIFO, who will report higher ending inventory and higher profits. The simulation makes this contrast visually and numerically clear.

Is this relevant for finance majors, or only accounting majors? It is highly relevant for both. Accountants learn the application of standards, while finance professionals learn how to interpret the results and make investment or lending decisions based on them. It bridges the two disciplines.

How is the simulation delivered and what are the technical requirements? The simulation is 100% web-based, requiring only an internet connection and a modern web browser (Chrome, Firefox, Safari). No software installation is needed.

Based on the cumulative financial health of the company (profitability, liquidity, and efficiency ratios) at the end of the simulation.

Short quizzes on the theoretical concepts of inventory valuation, ensuring individual accountability.

A final report where teams analyze their company's performance, explain the financial outcomes driven by their inventory method, and justify their strategic decisions.

Assessment of individual contribution within the team to ensure collaborative engagement.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.