Master the human element of high-stakes finance. Interpersonal skills are what defines career trajectories as deals are not won on spreadsheets alone.

Persuasive Communication

Influence and Negotiation

Client Relationship Management

Cross-Cultural Communication

Constructive Feedback

Emotional Intelligence

Conflict Resolution

Team Leadership and Dynamics

In the simulation, participants will:

Role-play complex scenarios as a banker, fund manager, or corporate executive.

Negotiate term sheets with potential investors, balancing assertiveness with cooperation.

Pitch a deal to a skeptical board of directors, adapting messaging on the fly.

Manage an underperforming team member through a difficult feedback conversation.

Navigate a cross-border M&A negotiation, being mindful of cultural and communication differences.

Analyze detailed feedback reports on their communication style, persuasion effectiveness, and emotional perception.

Debrief with peers and instructors to solidify learning and develop personal action plans.

Articulate complex financial concepts clearly and persuasively to both technical and non-technical audiences.

Employ advanced negotiation strategies to achieve better outcomes in deals and internal discussions.

Demonstrate heightened emotional intelligence by recognizing emotional cues and adapting communication accordingly.

Construct and deliver constructive feedback that fosters development and maintains positive relationships.

Navigate interpersonal conflicts and challenging conversations with confidence and professionalism.

Build stronger, more trusted relationships with clients, colleagues, and counterparts.

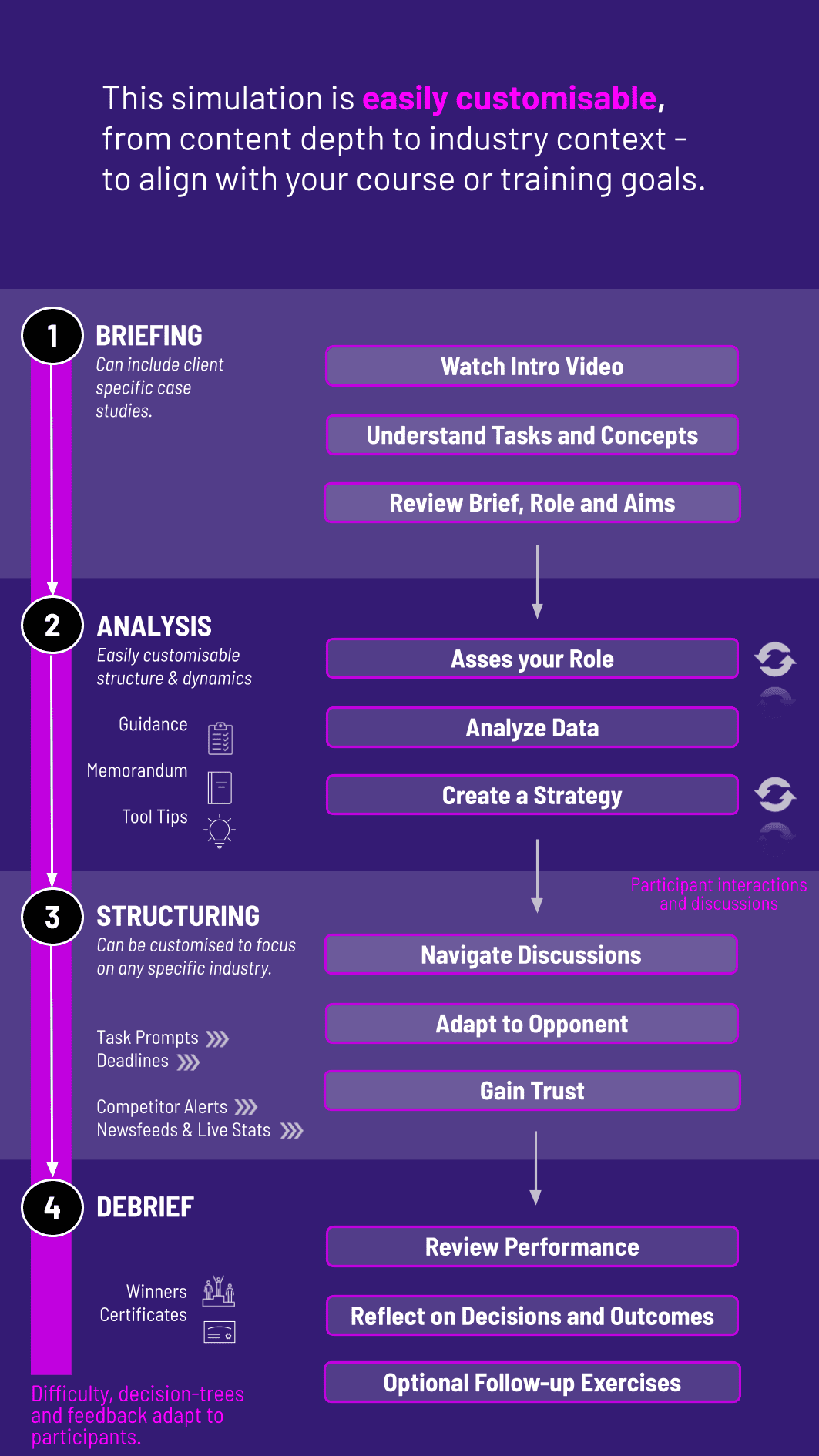

1. Introduction and Briefing Participants are introduced to the simulation platform and receive their first scenario brief, outlining their role, objectives, and constraints.

2. Role-Play and Interaction Through the online platform, participants engage in dynamic conversations. This involves live multiplayer negotiations with other participants.

3. Real-Time Feedback During interactions, the platform provides subtle cues and metrics (trust meter, persuasion score).

4. Comprehensive Debrief After each scenario, participants receive a feedback report analyzing their performance across key interpersonal dimensions, such as clarity, empathy, assertiveness, and influence.

5. Guided Reflection Instructors lead a structured debriefing session, allowing participants to share experiences, discuss alternative approaches, and solidify key learnings.

What makes this simulation different from a traditional communication workshop? Unlike passive workshops, our simulation is experiential and hands-on. You practice skills in realistic, high-pressure finance scenarios and receive objective, data-driven feedback, not just subjective opinions.

Do I need any specific finance knowledge to participate? A basic understanding of finance is helpful, as the scenarios are set in authentic contexts (M&A, fundraising). However, the primary focus is on the interpersonal dynamics, not complex financial modeling.

Is this simulation suitable for experienced finance professionals? Absolutely. The scenarios are designed to be complex and challenging, forcing even seasoned professionals to refine their approach to negotiation, leadership, and client management.

Can the simulation be customized for our corporate training program? Yes, we offer extensive customization. We can tailor scenarios to reflect your firm's specific culture, deal types, and the exact interpersonal challenges your teams face.

What is the ideal group size for the simulation? The simulation is highly scalable. It works effectively for small teams of 10 as well as large cohorts of 100+, with participants grouped for multiplayer activities.

What kind of technical requirements are needed? Participants only need a standard computer or laptop with a modern web browser (Chrome, Firefox, Safari) and a stable internet connection. A microphone is recommended for voice interactions.

How is participant performance assessed and graded? Performance is measured against a robust competency framework. The platform generates quantifiable metrics on key skills, and instructors can use our integrated assessment rubrics to evaluate performance, making it easy to track development and justify training ROI.

Performance Analytics

Peer Feedback

Pre- and Post-Simulation Self-Assessment

Final Integrated Project

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.