In this simulation, participants step into the role of Treasury and Financial Managers at a multinational corporation, making critical decisions on currency exposure, international financing, investment, and risk management.

Foreign Exchange Risk Management

Hedging Instruments

International Capital Budgeting

Global Cost of Capital and Financing

Money Market Hedging and Arbitrage

Political and Country Risk

Multinational Working Capital Management

International Tax Considerations

In the simulation, participants will:

Analyze live market data feeds within the simulation (exchange rates, interest rates, credit spreads).

Forecast currency movements and assess the firm's integrated financial exposure.

Execute hedging transactions in a simulated derivatives market to protect cash flows and earnings.

Structure the global capital stack, choosing between bond issuances in different currencies and equity markets.

Approve or Reject major cross-border investment projects, building a global asset portfolio.

Manage intra-company flows and liquidity across subsidiaries.

React to randomized economic and geopolitical shocks ("Black Swan" events).

Compete against other MNCs for the highest risk-adjusted shareholder return.

Identify, quantify, and formulate strategies to manage the three main types of foreign exchange exposure.

Apply appropriate financial instruments to hedge specific currency risks and articulate the cost/benefit trade-off of each.

Evaluate international projects and investments, adjusting for country-specific risks and financing side effects.

Explain how sourcing capital globally can lower a firm's overall cost of capital and optimize its capital structure.

Develop a coherent international financial management strategy that aligns with corporate goals and risk tolerance.

Interpret the impact of global macroeconomic events on a multinational firm's financial performance.

1. Team Formation Participants are grouped into management teams of 3-5, each running a competing MNC with operations in the Americas, Europe, and Asia.

2. Initial Analysis Each round begins with an economic briefing, market data, and the company's financial position. Teams analyze their net exposures.

3. Decision Rounds Over 6-8 simulated quarters, teams submit comprehensive financial plans: hedging orders, financing choices, investment approvals, and working capital adjustments.

4. Market Resolution The simulation engine processes all team decisions against randomized market events, calculating new financial statements, exposures, and share prices.

5. Feedback and Competition Teams receive detailed performance reports (EPS, cash flow volatility, Sharpe ratio) and see their ranking on a live leaderboard.

6. Debrief A final session links simulation outcomes to theoretical frameworks, solidifying the learning experience.

Is this simulation suitable for students without a finance background? Yes, while a basic understanding of corporate finance is helpful, the simulation includes primer materials and guided tutorials. It is designed as a capstone experience for International Finance courses but is structured to be accessible to motivated MBA students and professionals looking to apply core concepts.

What is the typical duration of the simulation? The core simulation can be run intensively over 2-3 full days or extended across 4-6 weekly sessions as part of a semester-long course. The platform is flexible to accommodate different schedules.

Do participants need prior experience with financial derivatives? No. The simulation is a safe environment to learn by doing. The platform includes a practice round and clear explanations of how each instrument (forwards, options) works before real capital is risked.

How does the simulation handle team vs. individual performance? Performance is primarily tracked and scored at the team level. However, instructors have access to engagement metrics and can assign individual roles to ensure accountability.

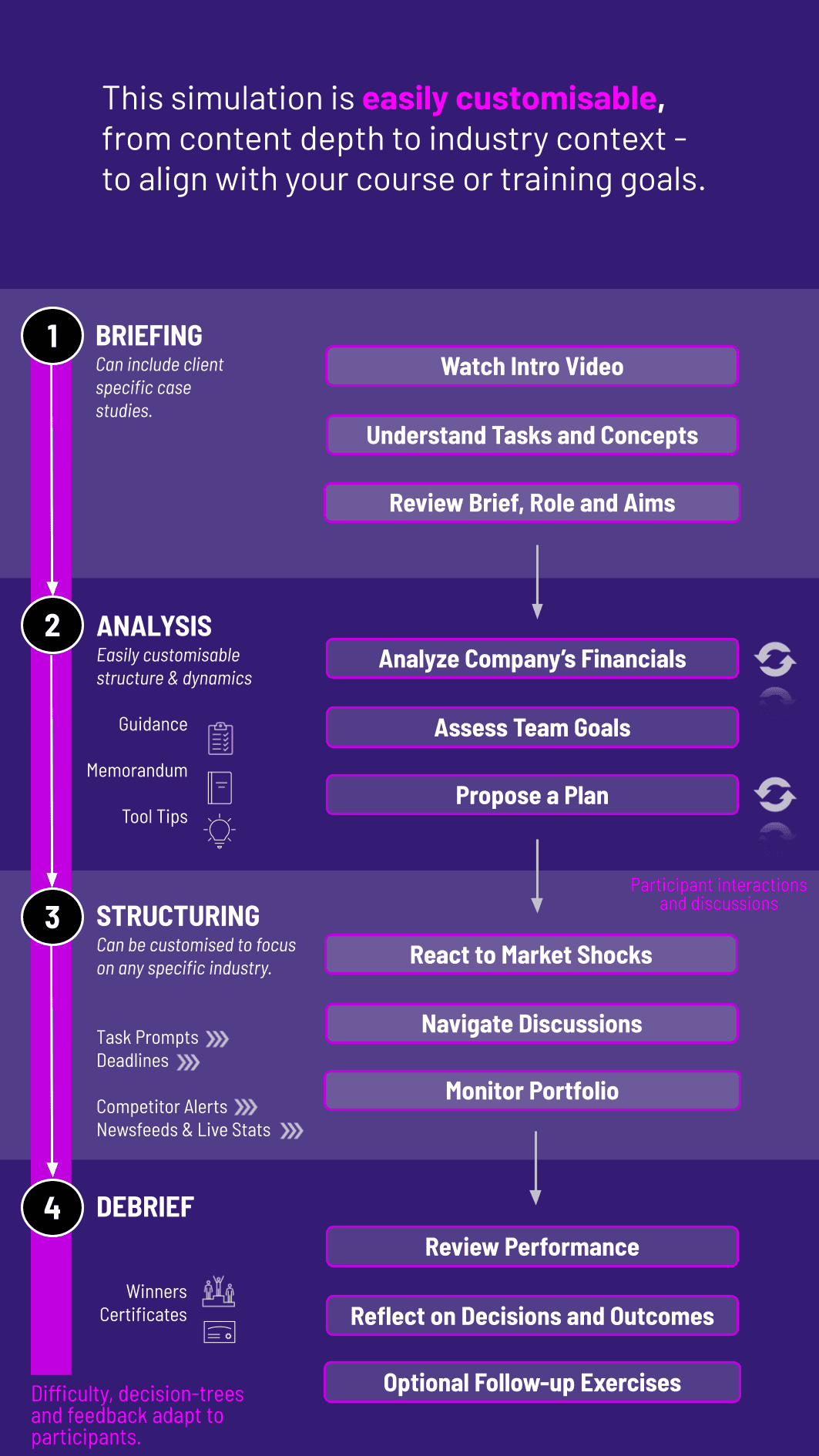

Can the simulation be customized for our specific course focus? Absolutely. Key parameters like starting currencies, market volatility, available financial instruments, and even specific case scenarios can be tailored to fit your curriculum.

What kind of support is provided during the simulation? We provide comprehensive facilitator guides, technical support, and optional live briefings from our simulation moderators. A dedicated helpdesk is available for the duration of your program.

How does the simulation incorporate real-world data? The platform uses realistic historical volatility and correlations for currencies and interest rates. It can also be configured to import real-time or historical data feeds, making the environment as realistic as desired.

What are the technical requirements to run it? The simulation is 100% cloud-based. Participants only need a modern web browser (Chrome, Firefox, Safari) and a stable internet connection. No specialized software or downloads are required.

Cumulative shareholder return, risk-adjusted returns, and earnings stability

The rationale behind hedging, financing, and investment choices against theory

Internal assessment of contribution, collaboration, and role fulfillment

Ability to adapt and revise valuations in light of news shocks or changes

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.