Participants take on the role of international finance professionals, managing currency risks, evaluating global investments, and navigating geopolitical challenges under real-world pressures with our international finance training.

The international finance training places participants in the role of global financial decision-makers, navigating the complex terrain of international markets, exchange rates, cross-border investments, and geopolitical risk. Participants are challenged to make strategic financial decisions in real time, adapting to volatile currency fluctuations, shifting trade policies, and global economic trends.

Through a series of practical, scenario-based challenges, the international finance training enhances understanding of how financial principles operate across borders. Participants gain a deeper appreciation of the interconnectivity of global markets and develop essential skills in foreign exchange risk management, international capital budgeting, and international financing strategies, preparing them for roles in multinational finance, global investment, and treasury functions.

Through interactive decision-making, participants develop not just technical proficiency, but also the adaptability and global awareness essential for international financial roles. The international finance training’s focus on scenario-based learning ensures that theory is reinforced with practical, memorable experiences.

Who should take this training? This international finance training is ideal for participants and professionals interested in global finance, multinational operations, or international investment.

Is prior knowledge of international finance required? A foundational understanding of corporate finance is helpful, but the international finance training includes introductory materials to bring all learners up to speed.

What types of decisions do participants make? Participants will make decisions about currency hedging, project evaluation, financing, and international compliance.

How long does the training take? The full training runs 6–8 hours, but it can be broken into modules for flexible delivery.

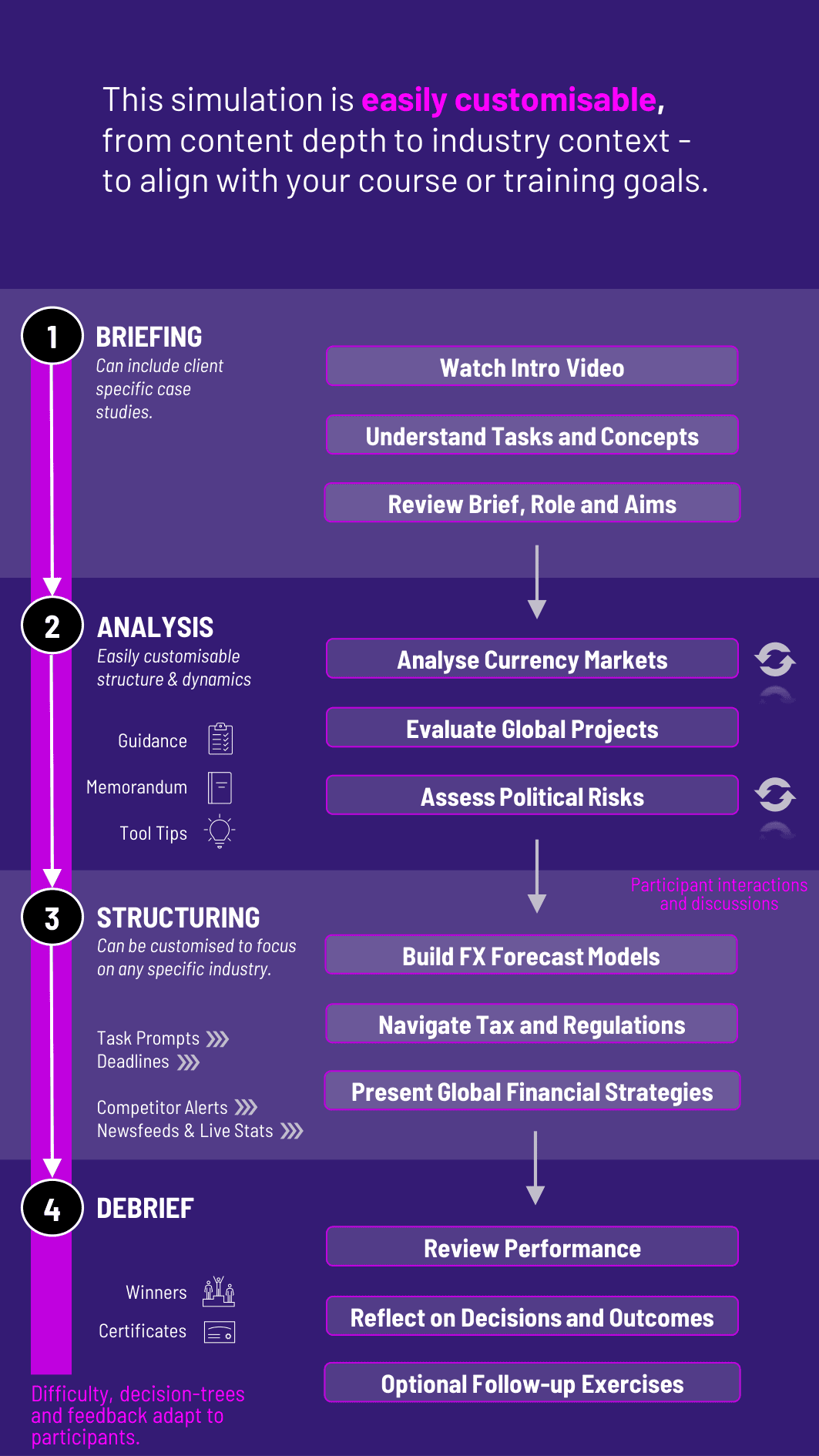

Can the training be tailored to different regions or industries? Yes, instructors can choose scenarios and case studies focused on specific markets or sectors.

What skills will I gain from this experience? You'll develop practical skills in global cash flow management, FX hedging, political risk assessment, and strategic financing.

Is the training individual or team-based? It can be run as either a solo experience or in teams to reflect real-world collaboration.

Does the training include real-time data? Yes, participants interact with simulated real-time data, including exchange rates, interest rates, and global economic indicators.

What technology is needed to run the training? The international finance training is entirely web-based and accessible through any modern browser.

How is performance evaluated? Performance is assessed based on the quality of strategic decisions, risk management effectiveness, and stakeholder communication.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the international finance training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the international finance training can benefit you.