The Interest Rate Swaps Simulation plunges participants into the world of over-the-counter derivatives. Move beyond textbook definitions and manage interest rate risk, devise trading strategies, and negotiate terms in a dynamic market environment.

Interest Rate Swap Mechanics

Pricing and Valuation

Yield Curve Analysis

Risk Management

Speculative Trading

Counterparty Credit Risk

Bid-Ask Spread

P&L Attribution

In the simulation, participants will:

Interpret a live, simulated yield curve and economic indicators.

Decide on a primary goal: hedging, speculation, or arbitrage.

Calculate the theoretical fair-value swap rate for various maturities.

Act as both price-takers and market makers, negotiating terms with other teams in a live trading session.

Monitor an evolving book of swap positions and their associated cash flows.

Track the real-time profit and loss of their trading book as market rates shift.

Adapt strategies in response to simulated central bank announcements or economic data releases.

Explain the structure, purpose, and mechanics of a plain vanilla interest rate swap.

Calculate the fair-value fixed rate of a swap based on the current yield curve.

Value an existing swap contract from the perspective of both the fixed-rate payer and receiver.

Design and execute a hedging strategy using interest rate swaps to mitigate a specific risk.

Articulate a speculative trading view and implement it using swap contracts.

Analyze the risk and return profile of a portfolio containing multiple swap positions.

Evaluate the impact of yield curve shifts on the P&L of a swap book.

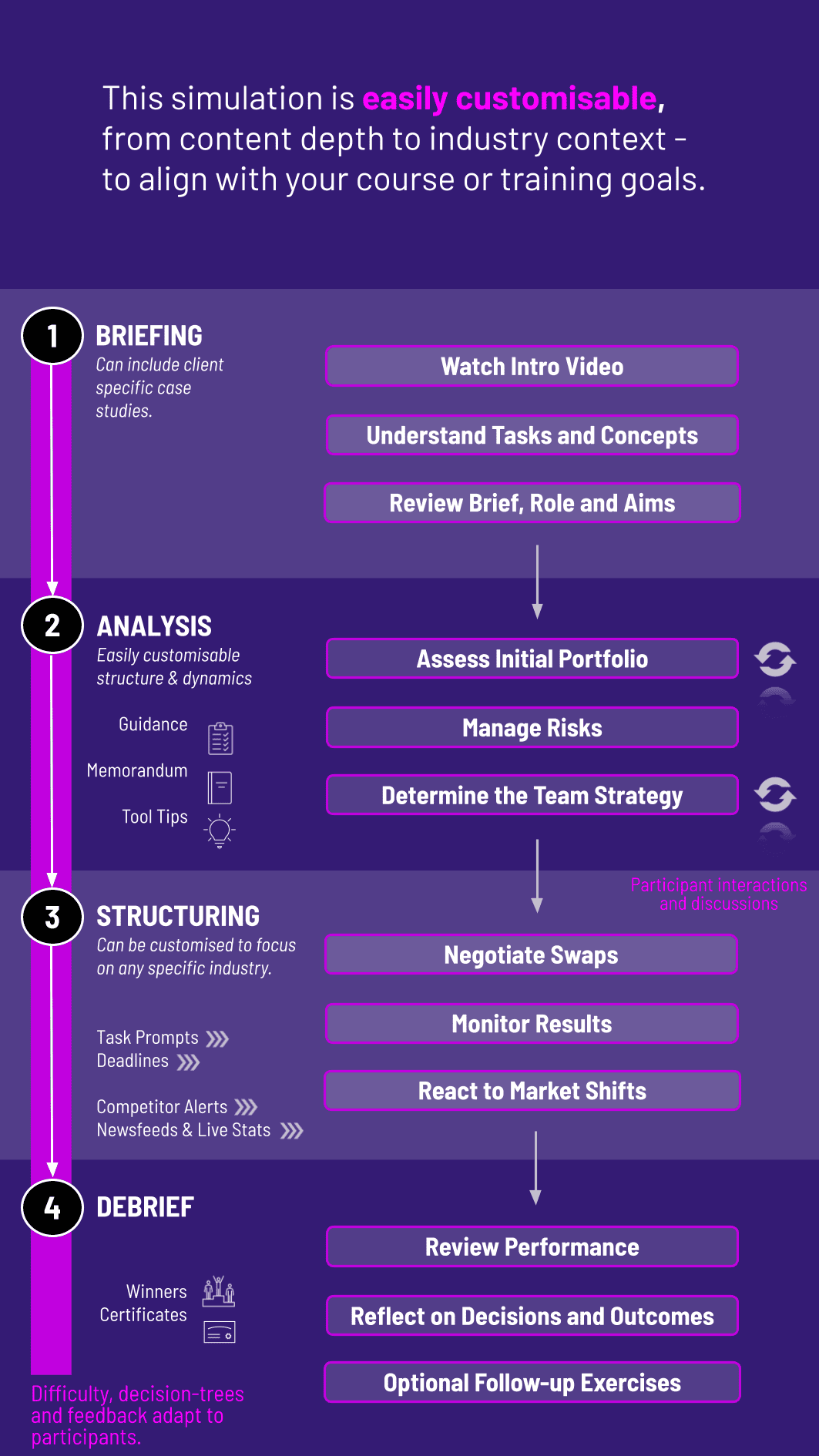

1. Team Formation and Briefing Participants are divided into teams, each representing a fund or bank treasury desk. They receive initial capital and a portfolio with inherent interest rate risk.

2. Market Data Feed A central platform displays a live, simulated yield curve that evolves throughout the session. Economic news alerts can cause sudden shifts.

3. Trading Rounds The core of the simulation. Teams analyze their risk, determine their strategy, and enter a live trading pit to negotiate and execute swaps with other teams. All trades are logged into the system.

4. Position Monitoring and Revaluation After each trading round or in real-time, the system automatically revalues all swap positions based on the new market yield curve, updating each team's P&L.

5. Debrief and Analysis The facilitator leads a debriefing session, analyzing the different strategies employed, the winners and losers, and the key lessons learned about derivatives trading and risk management.

What background knowledge is required to participate in this simulation? A basic understanding of finance concepts like time value of money, bonds, and interest rates is helpful. The simulation includes a primer to get everyone up to speed on swap fundamentals.

Is this simulation suitable for undergraduate students? Absolutely. It is designed for a range of learners, from advanced undergraduates to MBA students and even professionals seeking a refresher. The complexity can be scaled to match the audience's level.

How long does a typical simulation session last? A comprehensive session, including briefing, trading rounds, and debrief, typically runs between 2 to 4 hours.

Can the simulation be run remotely or online? Yes, our platform is fully compatible with virtual delivery. The trading pit can be replicated via breakout rooms and a centralized trading board or chat function.

Do participants need to be good at math? The core concepts require numerical reasoning, but the simulation platform handles complex calculations. The focus is on strategic application and decision-making, not manual computation.

How is the winner of the simulation determined? Performance is primarily judged by the risk-adjusted return on the portfolio. The team that most effectively manages its risk and generates the highest P&L, relative to its objectives, is typically the winner.

Final Portfolio Performance

Team’s trading strategy

Peer Evaluation and Contribution

Reflection on failure and resilience

Iterative improvement across rounds

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.