In this hands-on Insurance Product Pricing Simulation, participants step into the role of insurance product managers. They set premiums, model risk, and balance profitability, competition, and customer retention under shifting market conditions.

Risk pooling and segmentation strategies

Premium pricing and reserve setting

Loss ratios, claims trends, and underwriting margins

Product design trade-offs: deductibles, limits, co-pays

Adverse selection and moral hazard

Lapse risk and customer lifetime value

Regulatory constraints on pricing and solvency

Competitor benchmarking and dynamic repricing

Cross-sell and bundling strategies

Profitability forecasting and actuarial modeling fundamentals

Review claims data, policyholder behavior, and historical performance

Adjust pricing levers for various products and customer segments

Decide on reserve levels, policy terms, and reinsurance needs

Respond to external changes like new competitors, regulations, or climate risks

Monitor how pricing decisions impact sales, profitability, and risk exposure

Communicate pricing rationale to executives or board-level stakeholders

By the end of the simulation, participants will be able to:

Apply actuarial and business principles to insurance product pricing

Balance growth and profitability while managing long-term risk

Understand how pricing strategies impact claims experience and customer behavior

Analyze loss ratios, retention trends, and lapse risks

React to market shifts with pricing agility

Evaluate reinsurance as a risk mitigation strategy

Integrate financial, regulatory, and marketing considerations

Justify pricing decisions through clear communication

Forecast the impact of pricing changes on reserves and solvency

Manage trade-offs in product design across deductibles, limits, and coverage

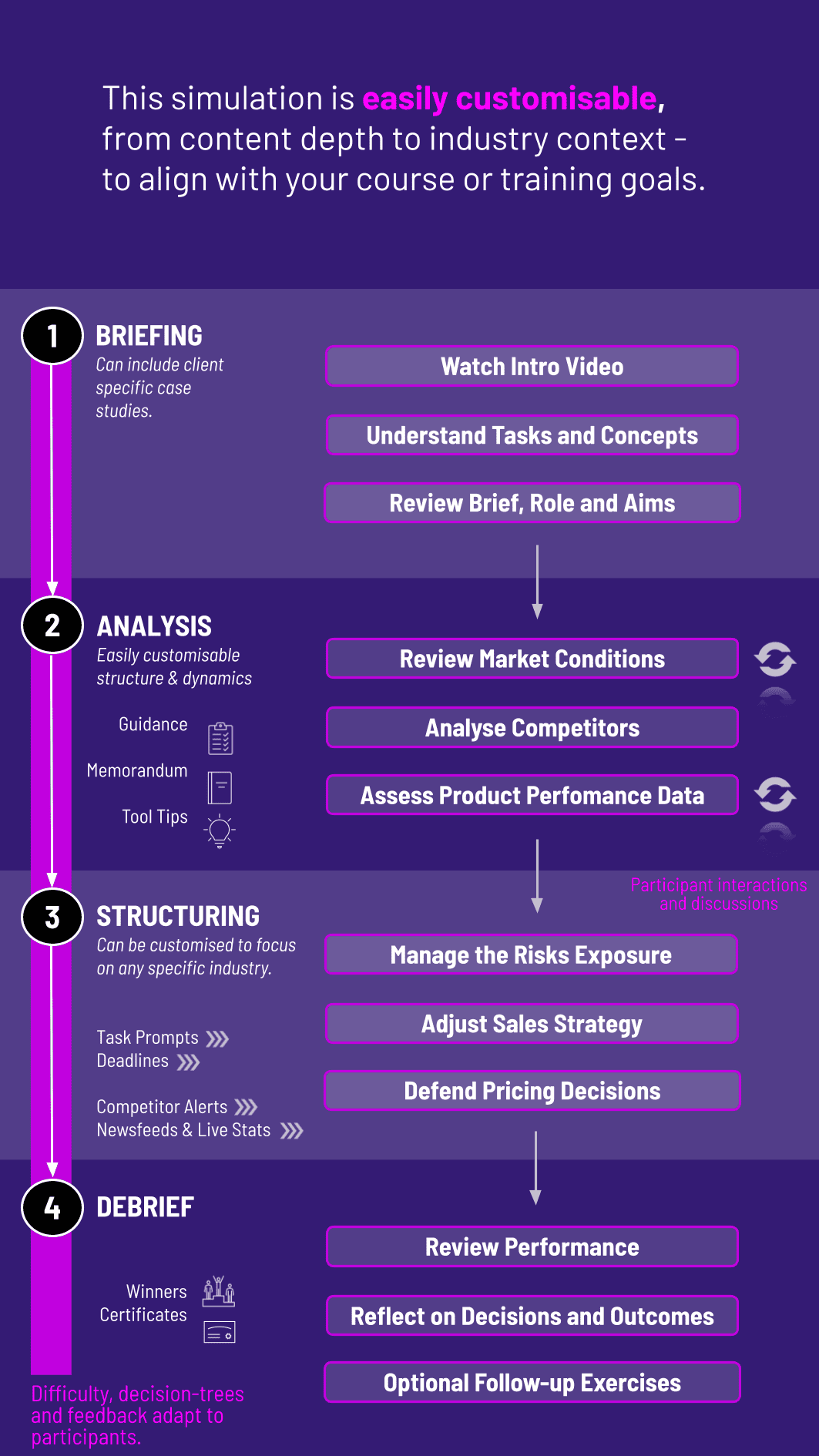

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can be used for individual learners or team-based sessions in academic, onboarding, or corporate training contexts. Each round simulates a product cycle or market year.

1. Receive a Brief: Each round begins with new market conditions, product performance data, and objectives. Participants review the insurance landscape, risks, and product line focus areas.

2. Analyze Portfolio Performance: Participants assess policy retention, claim ratios, and profitability metrics. They examine historical patterns and competitor benchmarks to inform pricing choices.

3. Make Pricing and Product Decisions: Participants adjust premiums, limits, deductibles, and reserve assumptions for each product segment. These choices impact risk exposure and profitability.

4. Respond to Market Shifts: Events like regulatory changes, climate trends, and competitor pricing shake up the market. Participants must adapt and iterate on strategy.

5. Communicate Internally: Participants may be tasked with drafting executive summaries or board memos to justify their pricing decisions or reserve strategy.

6. Repeat the Cycle: Each round introduces new variables, building strategic complexity. Teams refine their pricing strategy based on past results and stakeholder feedback.

Do participants need actuarial backgrounds? No. The simulation explains relevant pricing and risk concepts in simple terms. It can be tailored for non-technical audiences or actuarial learners.

What kinds of insurance are covered? Life, health, auto, and commercial products can be simulated. You can focus on one area or compare across product lines.

Is this good for actuary training programs? Yes. It’s a useful tool for actuarial and underwriting trainees to apply theoretical knowledge in practical decision-making.

Can we simulate regulation or solvency rules? Yes. You can add regulatory constraints like pricing caps, solvency ratios, and capital buffers into the simulation.

Can teams be assigned different roles? Yes. Teams can split into pricing, risk, and product leads to reflect cross-functional decision-making.

Does it include reinsurance? It can. Optional modules allow participants to model reinsurance as a tool for pricing and reserve protection.

What metrics determine success? Retention, loss ratio, risk-adjusted returns, customer lifetime value, and reserve adequacy are commonly used.

Is the simulation customizable? Absolutely. You can adjust complexity, industry focus, number of rounds, and pricing levers.

Can I use this in MBA or exec ed programs? Yes. The simulation is equally relevant for graduate business programs and corporate pricing teams.

How long does it take to run? Anywhere from 90 minutes to a multi-day course, depending on how many rounds and reflections you include.

Pricing accuracy and portfolio profitability

Retention and product-mix optimization

Responsiveness to external changes and competitor moves

Strategic use of reserves and reinsurance

Communication of rationale in pricing memos or debriefs

Peer collaboration and iteration across cycles

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.