Balance ethical and beneficial decisions in the Incentives and Agency Conflict Simulation. Navigate trade-offs, incentive structures and potential conflicts inherent to real life when interests collide.

Principal–agent relationship

Incentive alignment vs. misalignment

Information asymmetry

Agency cost

Monitoring and control mechanisms

Risk-taking and moral hazard

Reward systems and behavioural effects

Governance and contract design

Stakeholder dynamics

Decision-making under uncertainty

Review organisational context, contract terms, historical performance, risk profile, stakeholder expectations

Make strategic operational decisions, choosing how much risk to take

Negotiate contract amendments, monitoring intensity or disclosure policies

Make deals while being presented with tasks that push for personal gain or in principal’s best interest

Design incentive schemes, choose performance metrics, reward timings, monitoring frameworks and governance structures

Navigate the push and pull of different power dynamics between principals and agents

Understand the principal–agent framework and why agency conflicts arise.

Recognise how incentive design and reward structures can drive agent behaviour.

Analyse the impact of information asymmetry and monitoring limitations on organisational performance.

Evaluate different contract and governance mechanisms for aligning agent and principal interests.

Make decisions about risk-taking, reporting, transparency and stakeholder trade-offs in an agency context.

Communicate effectively between principals and agents, negotiate contract terms and adjust governance frameworks.

Develop a mindset of designing incentives not just for performance, but for alignment, accountability and long-term value creation.

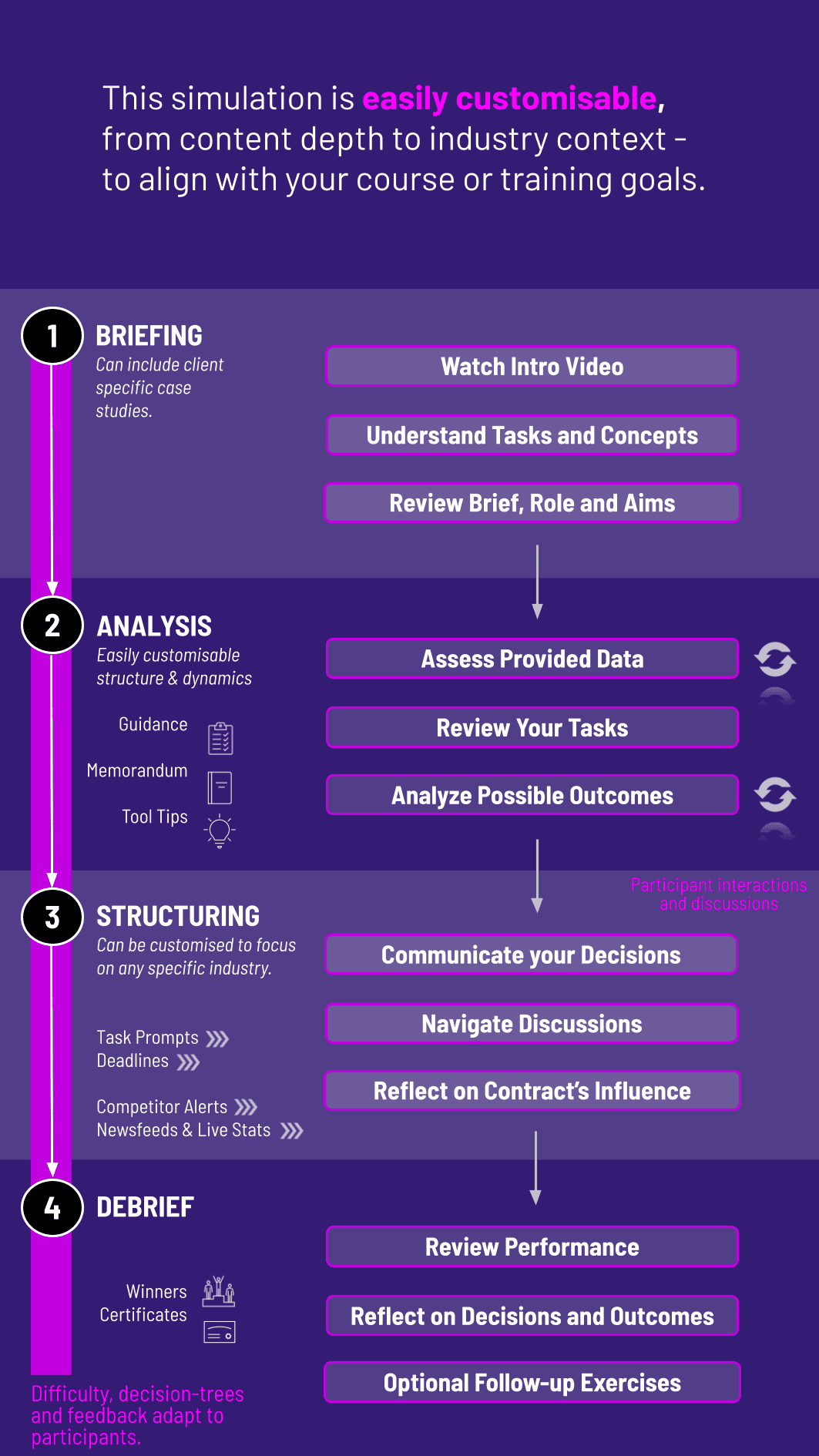

1. Identify the tasks and stakes Participants receive a scenario background, role descriptions (principal, agent, board, auditor), tasks contract terms and organisational context.

2. Tasks Execution Agents propose operational plans, risk levels and request incentive schemes; principals (or boards) evaluate proposals, design contract/incentive packages, set monitoring protocols.

3. Strategy adjustments Agents may alter strategy, principals/boards may amend incentive structure or tighten oversight.

4. Outcome & Performance Metrics The simulation calculates outcomes (return on investment, risk exposure, etc) and presents them to participants. Agents may use different metrics to present those outcomes to principals.

5. Present to the Principals Agents present their decisions, defend their rationale all while principals assess the outcomes.

6. Review and Reflect Feedback highlights participants’ flexibility, ability to communicate clearly, and strategic thinking under the pressure.

Ability to design incentive schemes that align agent behaviour with principal objectives.

Appropriate oversight, reporting and control mechanisms given the risk profile and scenario context

Effectively in deploying strategies, make risk-reward trade-offs, and adapt to events?

The abikity to alignt agent' actions with principal interests

Negotiating contract terms, communicating with stakeholders and managing divergent interests

Participants may evaluate their own and peers’ performance on collaboration, leadership, negotiation and decision-making behaviours.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.