This simulation challenges you to deploy capital for measurable social and environmental impact, while also achieving competitive financial returns. Learn to balance the dual bottom line in a realistic, dynamic market.

Dual Bottom Line

Impact Measurement and Management

ESG Integration

Impact Thesis

Blended Finance

Stakeholder Alignment

Portfolio Construction

Impact Washing

In the simulation, participants will:

Screen and evaluate potential investments using integrated financial and impact scorecards.

Structure investment terms to align incentives for impact and financial performance.

Negotiate deal terms with entrepreneurs and co-investors.

Build and manage a diversified impact investment fund portfolio.

Allocate catalytic capital to strategically de-risk high-impact opportunities.

Create integrated financial and impact performance reports for fund investors.

React to external shocks and adjust strategy.

Present a final portfolio strategy and performance review to a mock Investment Committee.

Construct an optimal portfolio based on advanced risk-return optimization techniques.

Evaluate asset performance using factor models and distinguish between skill-based alpha and market beta.

Manage portfolio risk through diversification, hedging, and strategic asset allocation.

Analyze the sources of portfolio return and underperformance through attribution analysis.

Synthesize economic data and market news into actionable investment decisions.

Defend investment choices using the rigorous language and frameworks of professional asset management.

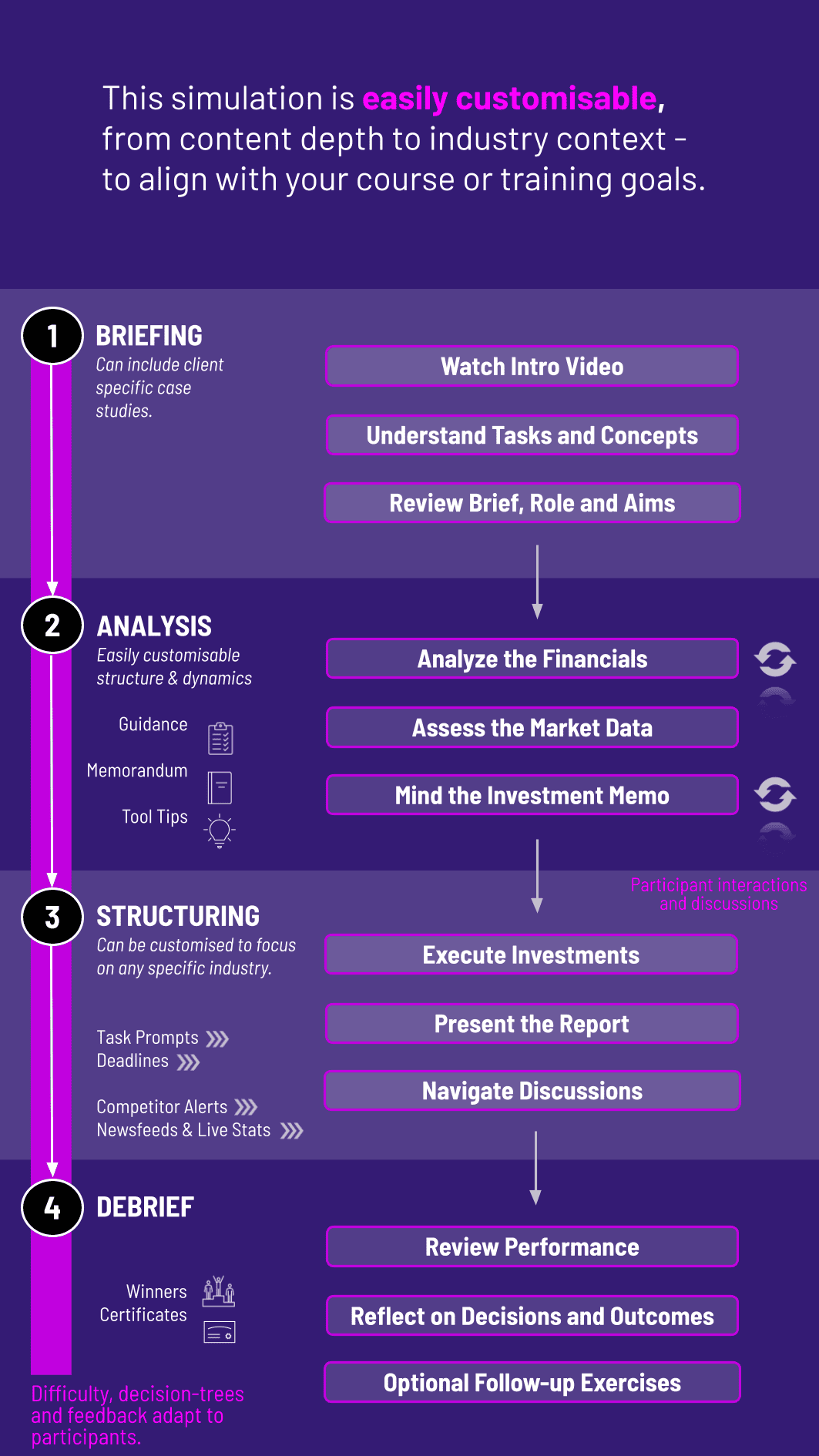

1. Team Formation Participants are divided into teams, each managing a new impact fund with a specific mandate.

2. Initial Briefing Teams receive their fund charter, capital commitments, and access to a dynamic deal pipeline with detailed investment memoranda.

3. Due Diligence and Analysis Teams analyze each opportunity, modeling financial projections and scoring impact potential using provided frameworks.

4. Deal Structuring and Bidding Teams decide on investment amounts, instruments, and terms, then "bid" for deals in a competitive market.

** 5. Portfolio Management** Successful investments are added to the portfolio. Teams monitor performance dashboards showing both financial and impact KPI updates each round.

** 6. Strategic Decisions** Each round presents new challenges: follow-on funding requests, exit opportunities, stakeholder demands, and market news.

** 7. Reporting and Final Review** Teams submit periodic reports and conclude with a final presentation, defending their portfolio strategy and performance to achieve the best blended outcome.

Who is this simulation designed for? It is ideal for business school students, finance professionals, ESG practitioners, and corporate executives seeking practical understanding of sustainable finance and impact investment strategies.

What prior knowledge is required? Basic knowledge of finance is helpful but not mandatory. The simulation includes guides on key impact investing and financial concepts, making it accessible to motivated beginners.

How long does the simulation take to complete? The experience is flexible, ranging from a condensed 3-hour workshop to a multi-week course module, depending on the depth of analysis and debriefing.

What makes this simulation different from a traditional finance simulation? Unlike traditional sims focused solely on profit, this platform forces trade-off decisions between financial metrics and quantified impact outcomes, using real-world frameworks like the UN SDGs.

Can the simulation be customized for our organization? Yes. We can customize sectors, geographic focus, fund size, and specific learning objectives to align with your corporate or university program.

Is this simulation conducted online or in-person? It is a cloud-based platform, allowing for seamless remote or hybrid delivery. All teams access the dynamic market and their portfolios via a web browser.

How is the winning team determined? Success is measured by a balanced scorecard. The winning team typically achieves the best combined score across financial performance (e.g., portfolio IRR) and verified impact performance, demonstrating strategic mastery of the dual bottom line.

A quantitative blend of the team's final financial return metrics and achieved impact KPIs against simulation benchmarks.

Evaluated on the clarity, depth, and justification of their strategy, deal selection rationale, and response to questioning.

Quality and consistency of analysis documented in their investment memos and round-by-round strategic choices, showing understanding of core concepts.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.