Master the financial and strategic management of your most valuable asset: people. Step into the world of investment banking from the humane side.

Human Capital Valuation and ROI

Compensation Strategy

Employee Training and Development Investment

Productivity Metrics and Impact on Revenue

Employee Turnover and its Financial Consequences

Talent Acquisition Costs

Linking HR Strategy to P&L and Balance Sheet

Workforce Planning and Budgeting

Employee Engagement and its Financial Correlation Intangible Asset Valuation on the Company's Worth

In the simulation, participants will:

Align talent acquisition and development with overall company financial goals.

Make integrated decisions where HR spending directly impacts revenue and profit margins.

Balance competitive salaries, performance bonuses, and equity grants to attract and retain top talent.

Invest in upskilling the workforce to improve productivity and innovation.

Monitor employee turnover rates, cost-per-hire, revenue per employee, and the ROI of training programs.

Operate in a simulated market where other teams are competing for the same pool of skilled professionals.

Manage real-world scenarios like talent poaching, market downturns, and shifts in labor supply.

Quantify the financial impact of human capital decisions on the company's bottom line.

Design a compensation and benefits structure that balances cost control with talent attraction and retention.

Evaluate the return on investment (ROI) for employee training and development programs.

Analyze the direct link between employee morale, productivity, and revenue generation.

Integrate human capital strategy with overall corporate financial planning and valuation models.

Develop a strategic framework for managing human assets as a source of competitive advantage.

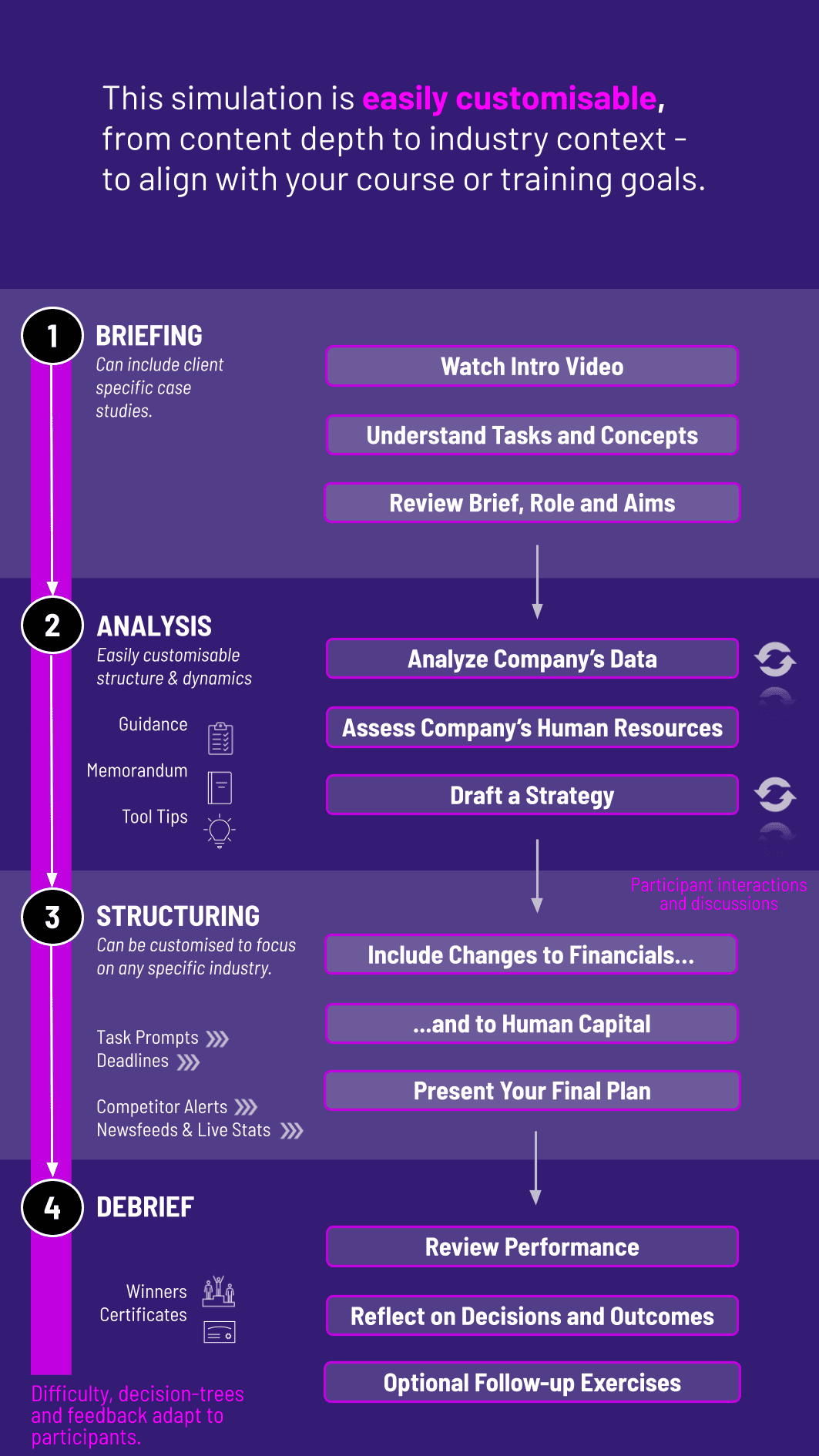

1. Team Formation Participants are divided into management teams running competing firms.

2. Initial Analysis Teams review their company's financials, current workforce data, and market position.

3. Decision Rounds Each round represents a fiscal period. Teams submit a consolidated set of decisions covering Financials (Pricing, R&D, Marketing) and Human Capital (number of hires, salary bands, bonus pools, training budgets, equity allocation).

4. Decision Processing The platform processes all team decisions against a dynamic market engine, factoring in competition for customers and talent.

5. Results and Analysis Teams receive detailed reports showing their financial statements (P&L, Balance Sheet) and human capital metrics (turnover, productivity, employee skill levels).

6. Debriefing Facilitators lead a discussion on the outcomes, highlighting the causal links between human capital choices and financial results, reinforcing key learning objectives.

What is the main goal of this simulation? The primary goal is to bridge the gap between HR and Finance. It teaches financial professionals how to value human assets and HR professionals how their decisions impact the financial health of the organization.

Who is the target audience for this simulation? It is ideal for MBA students, executives in finance and HR, and any manager seeking to understand the financial implications of talent management.

Do I need a finance background to participate? While helpful, a strong finance background is not mandatory. The simulation is designed to be accessible to those with a general business understanding, and it serves as an excellent practical introduction to financial concepts for HR professionals.

Is this simulation relevant for HR professionals? Absolutely. This simulation is crucial for HR professionals aiming to become strategic partners in their organizations. It provides the financial literacy and analytical framework to justify HR initiatives in the language of business: ROI and value creation.

How long does a typical simulation session last? A comprehensive session can be run in a 4-hour workshop, a full-day seminar, or extended over multiple weeks as part of a course curriculum. The timing is flexible based on your program's needs.

Can you run this simulation for corporate training? Yes, we specialize in tailoring this simulation for corporate clients to address specific industry challenges, such as talent management in tech, professional services, or manufacturing.

Company Financial Performance

Team's ability to manage a productive and stable workforce.

Revenue per Employee

Employee Turnover Rate

Average Employee Skill Level

Cost of Human Capital vs. Revenue Generated

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.