Master the Art of Absolute Return in a Dynamic Financial Ecosystem. Compete against other fund managers, making critical decisions on strategy, asset allocation, risk management, and capital raising.

Absolute Return vs. Relative Return

Fund Strategy and Mandate

Long/Short Equity and Market Neutrality

Leverage and Margin Financing

Risk Metrics (Sharpe Ratio, Sortino Ratio, Max Drawdown, VaR)

Portfolio Diversification and Correlation

Alpha Generation and Beta Exposure

Fee Structure (Management vs. Performance Fees)

Capital Raising and Investor Relations

Hurdle Rates and High-Water Marks

In the simulation, participants will:

Define a unique investment strategy and fund mandate.

Analyze company fundamentals, technical charts, and macroeconomic data.

Execute trades across equities, indices, currencies, and commodities.

Employ leverage to amplify returns while managing associated risks.

Monitor key performance and risk dashboards in real-time.

Adjust portfolio holdings in response to market news and economic shocks.

Raise capital from institutional investors by demonstrating performance.

Manage the fund's P&L and justify performance to a board of investors.

Design and articulate a coherent hedge fund investment strategy.

Construct a diversified, multi-asset portfolio designed for absolute returns.

Apply leverage judiciously and understand its impact on risk and return.

Analyze and interpret key performance and risk metrics to evaluate fund health.

Differentiate between alpha (skill-based returns) and beta (market-based returns).

Respond strategically to macroeconomic events and competitive pressures.

Communicate performance and strategy effectively to attract and retain investors.

1. Analyze Review the economic landscape, company research reports, and their current portfolio.

2. Decide Make strategic trading decisions—buy, sell, short, or use derivatives—based on their analysis.

3. Manage Set leverage levels, assess risk exposure, and review performance metrics.

4. Report At the end of the round, teams receive a detailed performance report and must prepare a brief for their virtual investors, explaining their strategy and results.

5. Adapt The simulation engine processes all decisions, creating a new market state for the next round, incorporating random economic shocks and competitor actions.

What is the target audience for the Hedge Fund Manager Simulation? This simulation is ideal for MBA students, finance graduates, and professionals in investment banking, asset management, or private wealth looking to deepen their understanding of alternative investments and portfolio management.

What are the technical requirements to participate? The simulation is web-based and requires only a modern web browser (like Chrome, Firefox, or Safari) and a stable internet connection. No specialized software installation is needed.

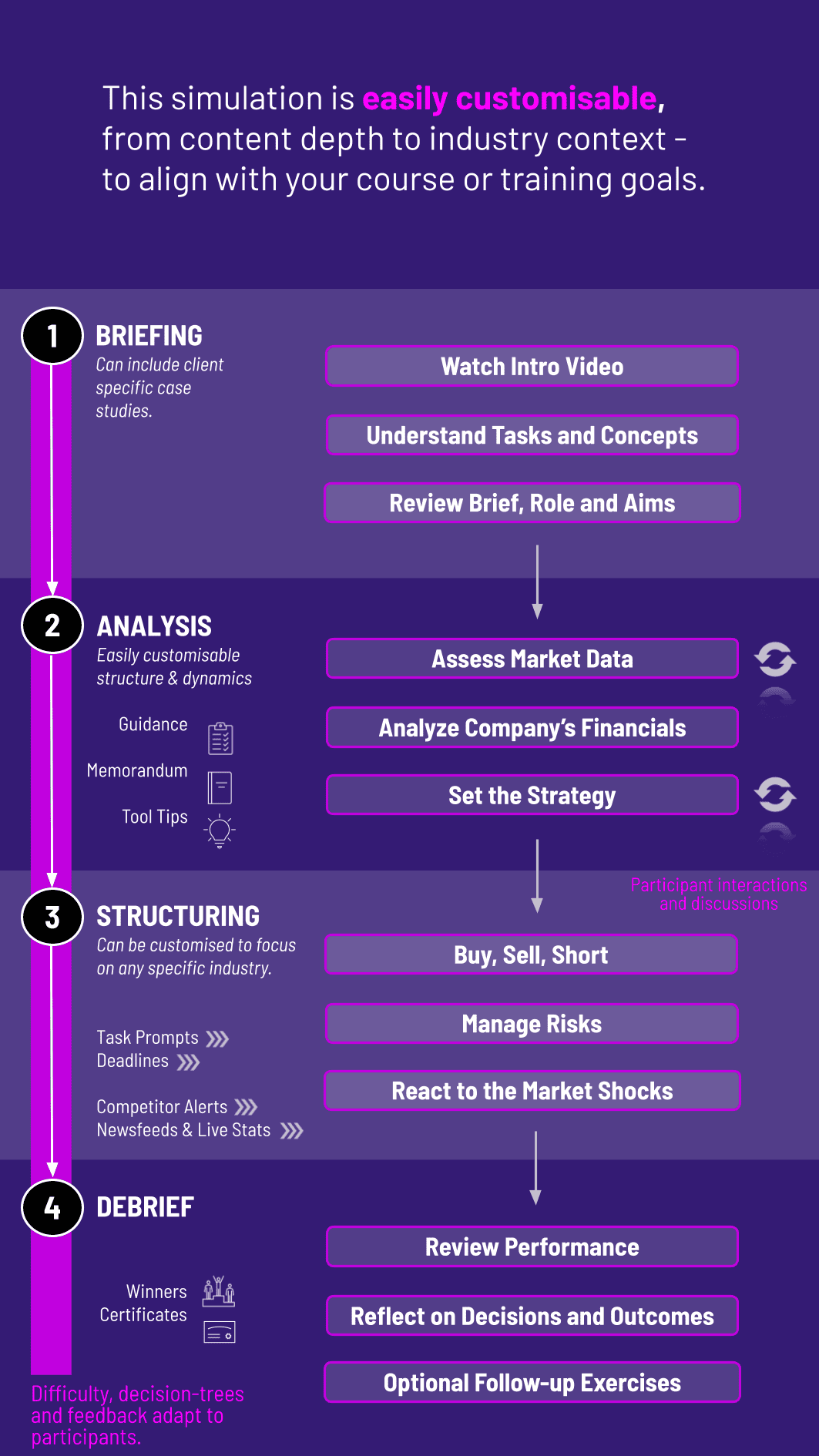

Can the simulation be customized for a corporate training program? Absolutely. We can tailor market scenarios, asset classes, and specific learning objectives to align with your organization's training goals, such as focusing on specific risk metrics or asset classes.

What is the ideal team size for the simulation? We recommend teams of 3-5 participants. This size encourages robust discussion and allows members to specialize in analysis, trading, and risk management roles.

How long does a typical simulation last? A full simulation can be run as a multi-week course module or an intensive 1-2 day workshop, typically involving 6-8 decision rounds.

Do participants need prior finance experience? A foundational understanding of financial markets is beneficial. The simulation includes introductory materials to level-set knowledge on key concepts like short-selling and leverage, making it accessible to motivated learners.

Is this a useful tool for learning about hedge fund careers? Yes, it provides a hands-on insight into the daily pressures, strategic decisions, and performance metrics that define a career in hedge fund management, far beyond what traditional case studies can offer.

Rewarding consistent, risk-adjusted returns over sheer luck. Sharpe Ratio (primary), final Net Asset Value (NAV), and maximum drawdown.

Clarity of thought, justification for actions, and professional communication.

Feedback from within the team on contribution, collaboration, and quality of input. Ensures individual accountability in a team-based environment.

Quality of decision-making observed during the rounds, participation in debriefs, and the ability to adapt strategy effectively.

Evaluation of a capstone presentation to a "board of investors" (the instructor and peers), defending the fund's performance, lessons learned, and strategic roadmap.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.