In the Green Bonds Simulation, participants are corporate finance professionals or impact investors tasked with designing, issuing, or evaluating green bonds. They balance financial return, regulatory requirements, and environmental outcomes.

Green Bond Principles & Taxonomies: Understanding various frameworks

Project Eligibility: Selecting projects aligned with environmental goals

Use of Proceeds: Communicating how funds will be spent

Verification & Certification: Engaging third-party reviewers

Bond Structuring: Deciding tenor, coupon, pricing, and repayment terms

Impact Reporting: Planning for post-issuance transparency

ESG Integration: Considering the broader impact beyond financials

Stakeholder Communication: Pitching to investors, boards, and regulators

Reviewing environmental goals and capital needs

Designing green bond frameworks and selecting eligible projects

Working with certifiers to validate green credentials

Structuring bond terms and preparing marketing materials

Engaging in simulated investor pitches or roadshows

Reacting to regulatory, media, or market developments

Producing impact reports and post-issuance updates

Participants will strengthen their ability to:

Align financing strategy with sustainability goals

Design a green bond that meets both investor and regulatory expectations

Apply global green bond standards and verification processes

Assess financial and non-financial risks in ESG investment products

Build transparent and defensible ESG communications

Navigate the tension between environmental integrity and market realities

Collaborate across finance, strategy, and sustainability functions

Defend decisions under pressure from multiple stakeholders

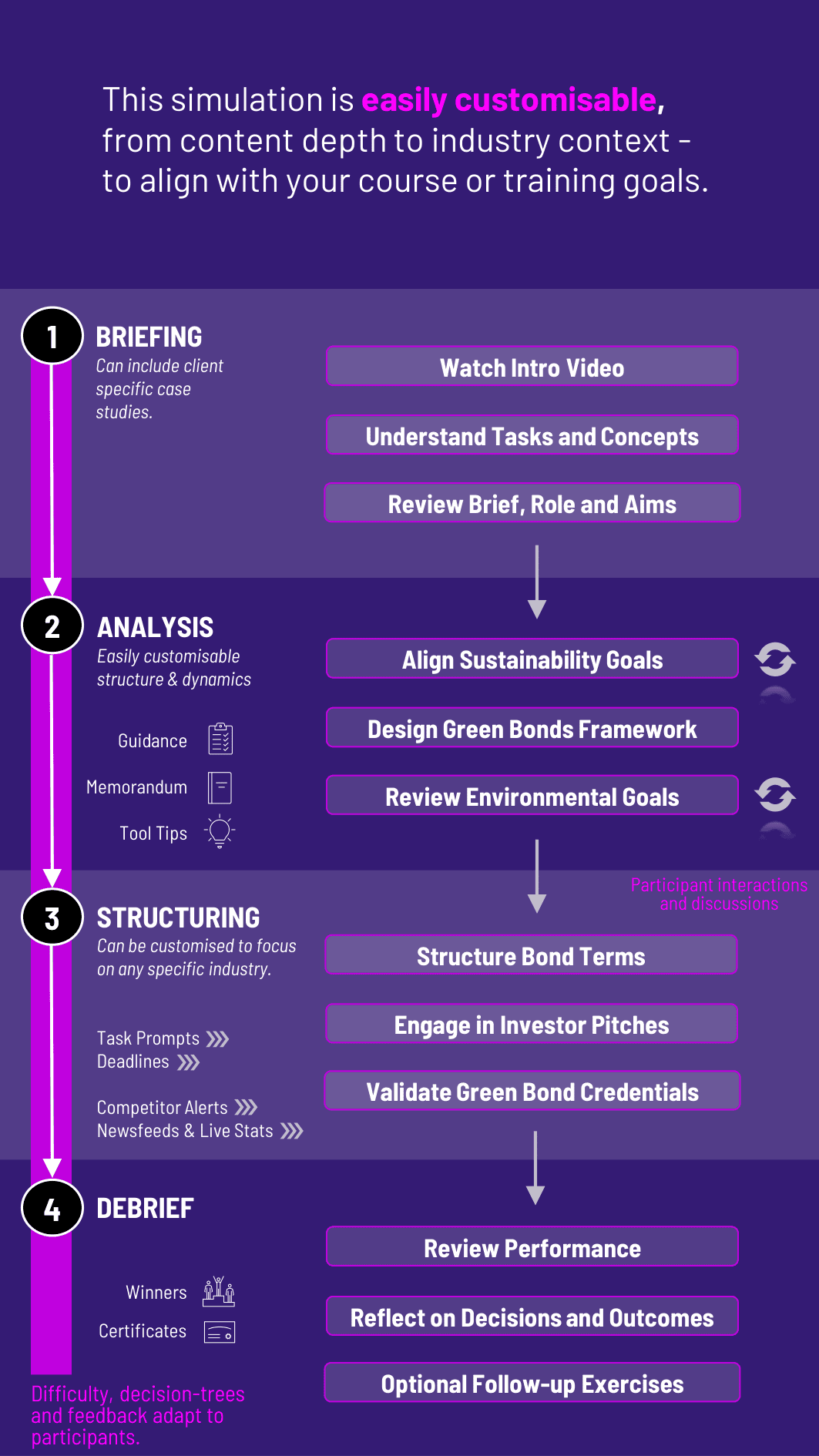

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Brief: Begin with a mandate to finance a green initiative (e.g., renewable energy project, climate resilience infrastructure).

2. Analyse and Design: Assess the project's impact and eligibility, choose structure, pricing, and external verification path.

3. Make Decisions: Submit bond design, including use of proceeds, terms, framework, and communication strategy.

4. Interact: Respond to simulated investor, rating agency, or NGO feedback.

5. Review Outcomes: Evaluate issuance success, investor response, and reputational impact.

6. Repeat: Adjust for future issuances with refined approaches.

Do participants need prior knowledge of ESG finance? No. The simulation is guided and suited for both beginners and experienced learners.

Is this based on real green bond frameworks? Yes. The simulation incorporates current ICMA Green Bond Principles and market trends.

Can it reflect corporate and sovereign contexts? Yes. Cases can be adjusted for different issuers, including corporates, banks, or governments.

How technical is the financial modeling? Moderate. The focus is on structuring and decision-making more than formulaic modeling.

Are investor profiles included? Yes. Participants engage with varied investor types – from climate funds to traditional asset managers.

Can we include external shocks (e.g., climate risk, regulation)? Absolutely. Additional rounds can introduce market volatility or regulatory changes.

Is it team-based or individual? Both formats work well. Teams mirror real ESG issuance committees.

How is performance assessed? Based on bond success, stakeholder feedback, and clarity of communication.

Is it customizable for local markets? Yes. The simulation can reflect region-specific ESG standards and market practices.

Can it be used in short workshops? Yes. It can run as a 90-minute session or be expanded into multi-day learning formats.

Quality of the green bond framework and alignment with goals

Stakeholder management and communication

Responsiveness to feedback and evolving context

Final outcome in terms of bond pricing, uptake, and reputational impact

Peer or instructor feedback on team collaboration

The simulation can include written components (e.g., investor memos, ESG disclosure drafts) and group presentations to encourage integrated learning. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated into by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.