Students step into the role of financial traders and risk managers, using futures and forwards to hedge, speculate, and manage exposures in real time with our Futures and Forwards Simulation.

Futures vs Forwards: Understanding contract structure, standardization, and counterparty risk

Hedging Strategies: Using contracts to offset risk in commodities, interest rates, or FX

Speculative Strategies: Taking directional views to profit from market movement

Basis Risk and Convergence: Managing the difference between spot and futures prices

Margining and Mark-to-Market: Tracking daily settlements and capital requirements

Settlement and Delivery Mechanisms

Risk-Reward Trade-offs: Balancing potential gain with exposure and leverage

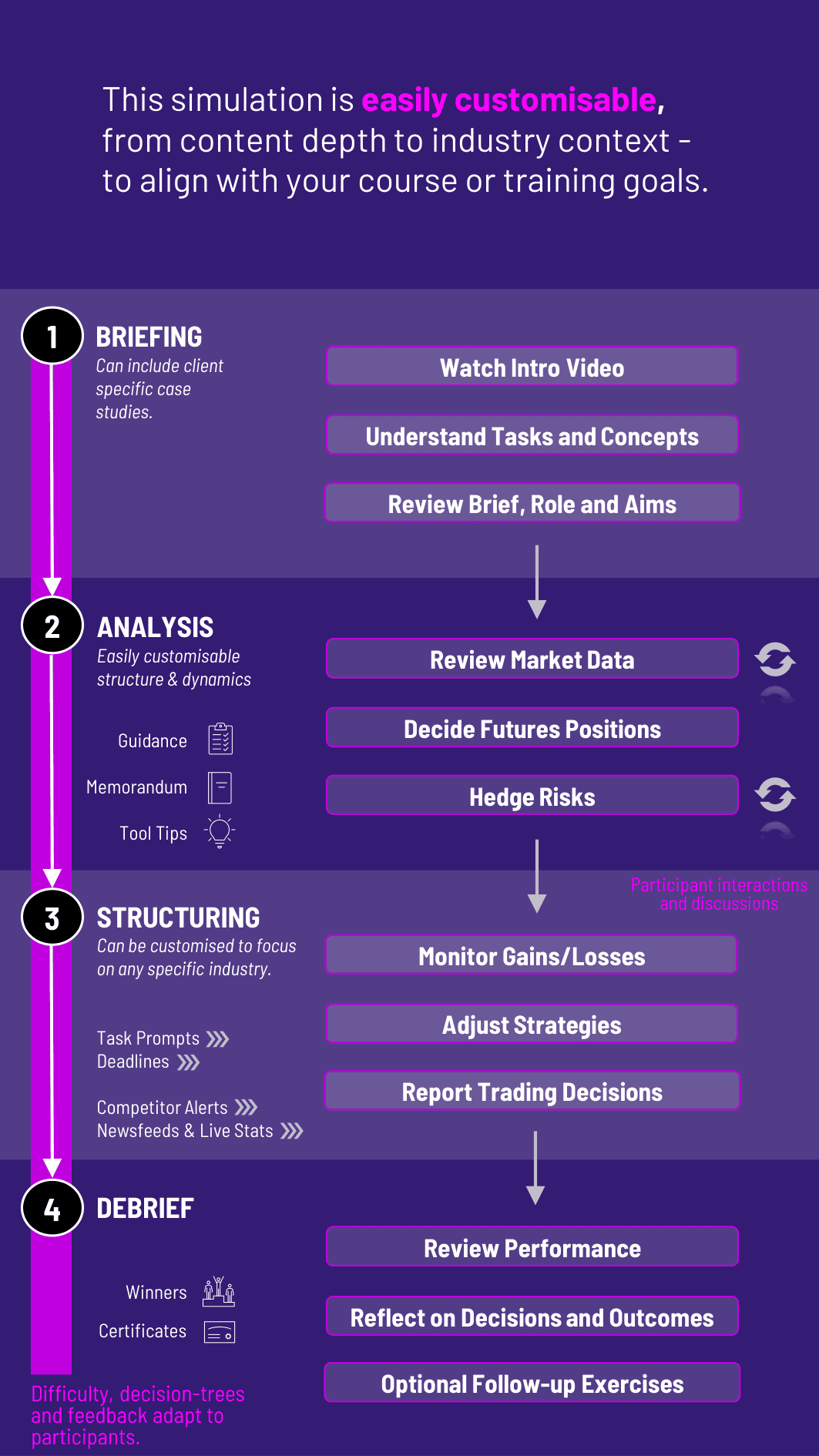

Interpret market data and forecasts across asset classes

Decide when to enter or exit futures and forward positions

Use contracts to hedge price risk or take speculative positions

Monitor gains, losses, and margin calls throughout the simulation

Adjust strategies based on simulated news events or market shocks

Report on the effectiveness of their hedging or trading decisions

This simulation helps students move from theory to practice in derivative markets. Students learn to:

Differentiate between forwards and futures and apply them appropriately

Build effective hedging strategies for common business exposures

Execute trades with discipline under time pressure

Understand the mechanics of margining, settlement, and risk

Evaluate the performance and unintended consequences of their strategies

Communicate derivatives decisions clearly to internal stakeholders

Do students need prior experience with derivatives? No prior trading experience is needed, but familiarity with basic financial instruments and market concepts is helpful.

Can the simulation cover both commodity and financial derivatives? Yes. The simulation includes multiple asset types such as commodities, interest rates, and foreign exchange.

How long does it take? It can be delivered in a 3 - 4 hour session or extended over several rounds for deeper trading and performance reviews.

Is it suitable for MBAs or undergraduates? Both. The simulation can be adjusted for depth, with more technical content for advanced students and simplified versions for introductory classes.

How is performance assessed? Students are evaluated on profitability, effective risk management, responsiveness to news events, and clarity in decision-making reports.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.