In this hands-on Forensic Accounting Simulation, participants step into the role of forensic auditors investigating financial irregularities. They analyse records, uncover fraud, and present findings with clarity and professionalism.

Fraud Detection Techniques

Red Flag Indicators and Pattern Recognition

Revenue Recognition and Expense Manipulation

Interviewing and Investigative Approaches

Document Review and Evidence Compilation

Legal and Regulatory Context

Ethical Boundaries and Whistleblower Protocols

Internal Controls and Risk Assessment

Report Writing and Board-Level Communication

Review company financials and operational documents for irregularities

Identify red flags across various departments and subsidiaries

Decide which transactions, records, or staff members require deeper scrutiny

Draft preliminary investigation memos

Respond to evolving case facts as new evidence or whistleblower tips emerge

Prepare a final report with clear findings and recommendations

Communicate insights to a mock audit committee or legal advisor

By the end of the simulation, participants will be able to:

Apply forensic techniques to identify and assess fraud risks

Analyse financial data to uncover inconsistencies and unusual patterns

Understand the ethical and legal responsibilities of forensic accountants

Distinguish between poor controls and intentional misstatements

Structure a forensic investigation process from start to finish

Practise interviewing approaches in simulated case scenarios

Improve professional report-writing for audit and legal contexts

Evaluate whistleblower statements and integrate into investigations

Communicate findings effectively to senior stakeholders

Collaborate with cross-functional teams during investigations

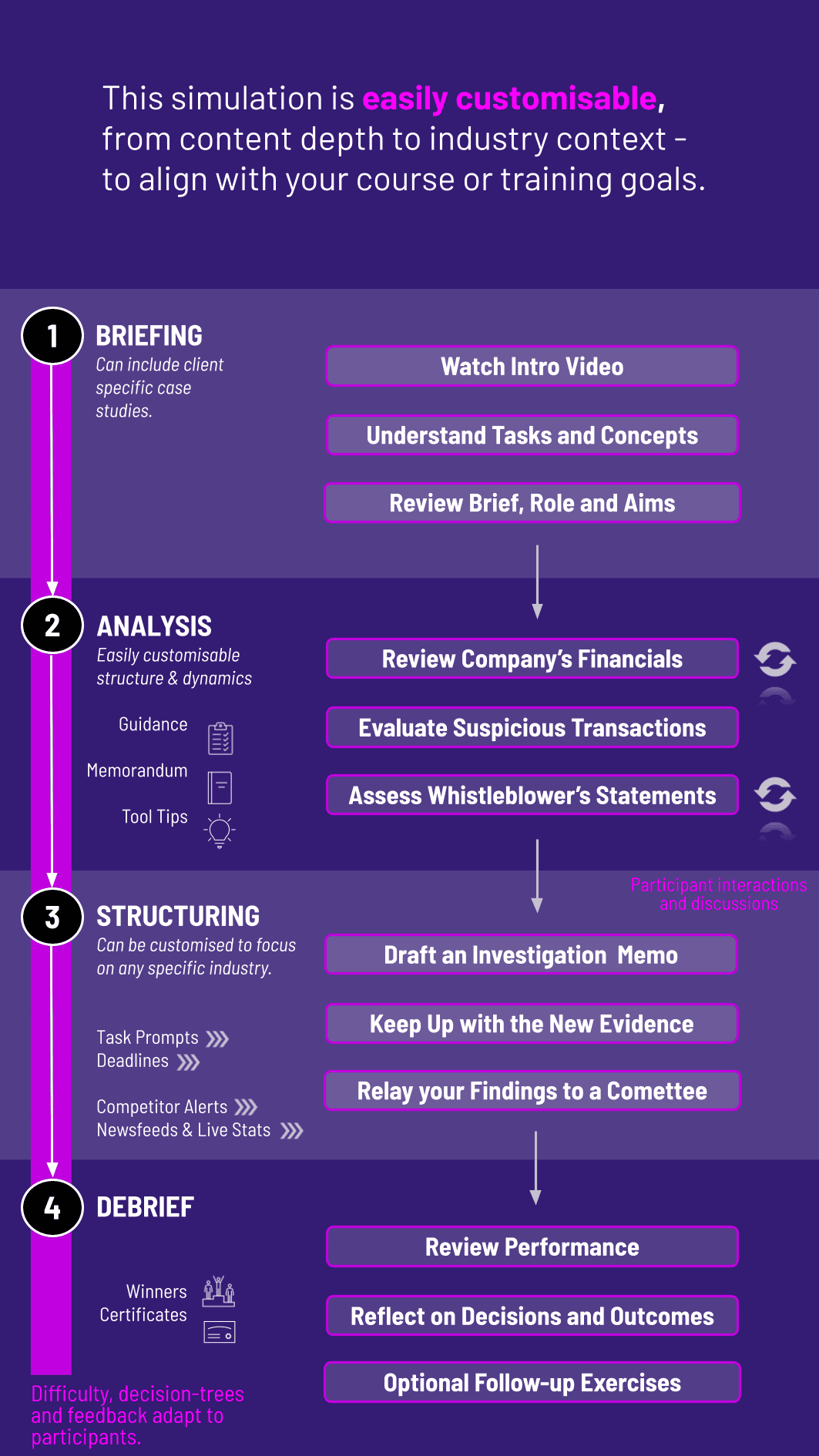

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

This simulation can be run in teams or individually and is ideal for classrooms, corporate training, or assessment centres. Participants move through several investigative rounds, each with new information and growing complexity. Here’s how it works:

1. Receive a Case File or Brief: Each round starts with a scenario - often a tip-off, audit concern, or compliance issue. Participants receive a brief and supporting documents to review.

2. Examine the Evidence: They review financials, transaction logs, emails, and expense reports. The goal is to identify patterns or anomalies that require deeper digging.

3. Make Investigative Decisions: Participants choose areas to investigate, whom to question, and what to cross-check. They decide how to allocate limited time and resources.

4. Adapt to New Developments: As the case unfolds, new evidence is introduced - memos, whistleblower tips, or interview summaries. Participants update their strategy accordingly.

5. Compile and Present Findings: Each team (or individual) drafts a report or memo summarising findings, key risks, and next steps. This may be followed by a simulated boardroom presentation or audit committee Q&A.

6. Reflect and Repeat: The simulation continues over multiple rounds, each building on the last. Participants improve with each cycle - refining judgment, communication, and investigative logic.

Do I need to be an accounting expert to use this simulation? Not at all. A basic understanding of financial statements is enough. The simulation guides you through the rest.

What industries are represented in the cases? You’ll explore scenarios across sectors - retail, manufacturing, tech, and financial services.

Is this simulation suitable for law, ethics, or compliance courses? Yes. It works across disciplines and complements legal, ethical, or risk-focused modules.

Can participants practise writing a real forensic report? Yes. Final deliverables can include memos, summaries, or formal reports tailored to the course level.

Does the simulation include legal or whistleblower scenarios? Yes. Participants may have to navigate whistleblower reports or respond to audit/regulatory scrutiny.

Can the content be localised for different geographies? Absolutely. The simulation can be adapted for regional regulations and fraud norms.

Is the game competitive or collaborative? Both options are available. Teams can compete or work together based on your program’s goals.

How long does it take to run? Anywhere from 2 hours to multiple sessions over a semester - it’s fully adjustable.

Can I combine this with a technical accounting module? Yes. It pairs well with audit, reporting, internal controls, and financial analysis content.

Is this useful for corporate training? Definitely. It’s perfect for onboarding, internal audit upskilling, or compliance refresher programs.

Accuracy and relevance of red flags identified

Structure and clarity of investigative reports

Communication effectiveness under questioning

Ethical judgement and sensitivity to stakeholder impact

Responsiveness to evolving case details

Peer and self-assessments to reflect collaboration and adaptability

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.