The Foreign Exchange Simulation replicates the real-time pressures and strategic decision-making required to succeed in the global FX market, the world's largest and most liquid financial marketplace.

Currency Pairs and Quotations

Fundamental Analysis

Technical Analysis

Leverage and Margin

Risk Management

Market Sentiment

Carry Trade

Hedging vs. Speculation

In the simulation, participants will:

Execute live trades in a realistic, web-based trading platform.

Analyze a continuous stream of simulated economic news and data releases.

Monitor real-time price charts and use technical analysis tools.

Develop and present a formal FX trading strategy to their peers or instructors.

Manage a portfolio, adjusting positions in response to market volatility.

Compete against other teams on a dynamic leaderboard.

Prepare a final performance report justifying their trading decisions and outcomes.

Interpret the fundamental drivers of foreign exchange rates.

Execute basic and intermediate foreign exchange trades.

Apply technical and fundamental analysis to inform trading decisions.

Develop a disciplined risk management framework for currency trading.

Evaluate the impact of geopolitical and economic events on currency volatility.

Articulate the rationale behind a trading strategy and its resulting performance.

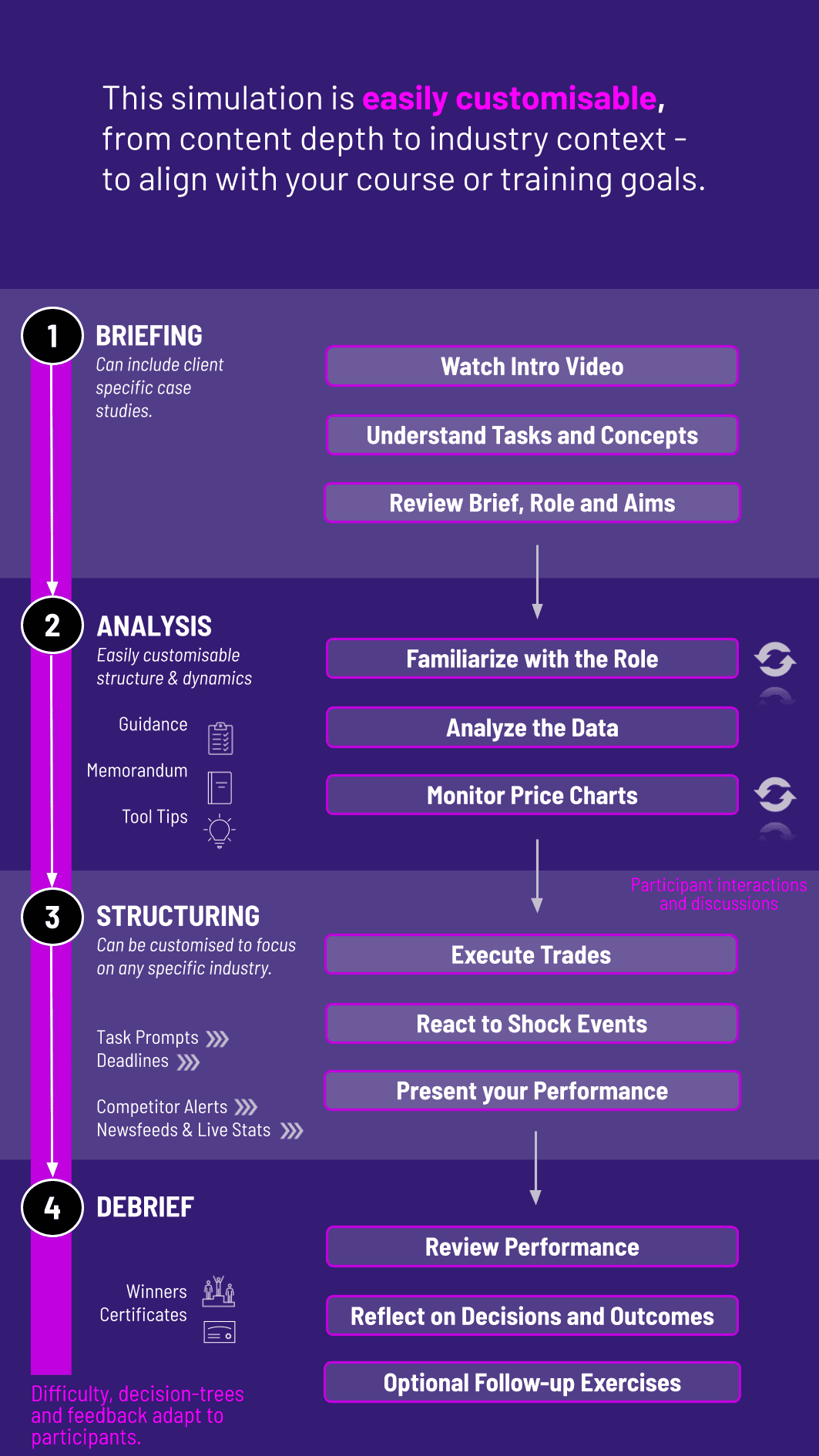

1. Setup and Briefing Participants are divided into teams, assigned a role, and granted virtual capital.

2. Introduction A briefing session covers the simulation platform, key concepts, and learning objectives.

3. Trading Rounds The simulation runs over multiple rounds (e.g., representing weeks or months). In each round teams analyze new market data and news, execute trades and manage existing positions and monitor their portfolio performance and ranking.

4. Debriefing The facilitator leads a discussion on market outcomes, successful strategies, and common pitfalls.

5. Assessment Teams submit a final report and/or presentation, linking their actions to core financial concepts for a comprehensive learning evaluation.

What is a Foreign Exchange Simulation? A Foreign Exchange Simulation is an interactive learning platform that replicates the real-world FX market. It allows participants to trade virtual currencies using real-time data and news feeds in a risk-free environment, making it ideal for education and corporate training.

Do I need prior trading experience to participate? No prior experience is necessary. The simulation is designed with scalable complexity, making it suitable for beginners while offering enough depth to challenge participants with some financial knowledge.

What is the duration of a typical simulation? The duration is flexible. A typical program can run from a single intensive one-day workshop to a multi-week course integrated into a semester curriculum.

What technical requirements are needed to run the simulation? Participants only need a standard web browser and a stable internet connection. No special software or downloads are required.

How does this simulation help with understanding forex risk management? The simulation forces participants to actively use risk management tools like stop-loss orders and position sizing. They experience firsthand the consequences of poor risk management, leading to a much deeper and more practical understanding.

Can the simulation be customized for a corporate treasury team? Absolutely. We can customize scenarios to focus on corporate FX risk, including hedging strategies for import/export businesses, managing transaction exposure, and mitigating the impact of currency fluctuations on financial statements.

Is this a useful tool for teaching online or in hybrid classrooms? Yes, our cloud-based platform is perfectly suited for remote and hybrid learning environments. All participants can collaborate and trade from anywhere in the world, fostering an inclusive and engaging educational experience.

Trading Performance is measured by risk-adjusted returns, consistency, and portfolio growth on the simulation leaderboard.

A written report where teams analyze their trades, explain their strategy in the context of market events, and evaluate their successes and failures.

Evaluation of the team's adherence to their stated risk parameters and their use of tools like stop-loss orders.

Assessment of individual contribution and teamwork within the trading group (optional).

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.