Master the Complexities of the Global Currency Market. Navigate volatile exchange rates, make critical hedging decisions, and protect your multinational corporation's bottom line in this dynamic, hands-on simulation.

Foreign Exchange Risk

Spot and Forward Markets

Hedging Instruments

Cost of Hedging

Market Fundamentals

Strategic Treasury Management

Cash Flow Forecasting

Accounting Implications

In the simulation, participants will:

Assess the company's specific FX risk profile from sales, procurement, and balance sheet items.

Create a comprehensive FX risk management policy defining hedge ratios and acceptable instruments.

Actively trade in a live simulated market, placing orders for forwards, options, and spot transactions.

React to in-simulation economic announcements and news flashes that impact currency volatility.

Oversee a portfolio of hedging positions and underlying exposures, tracking mark-to-market performance.

Compete against other teams, with performance ranked based on risk-adjusted returns, profitability, and effectiveness of the hedging strategy.

Identify and quantify the different types of foreign exchange exposure faced by a multinational corporation.

Evaluate the advantages, disadvantages, and costs of various FX hedging instruments.

Formulate a coherent FX risk management strategy tailored to a company's specific risk tolerance.

Execute hedging transactions using forwards, options, and other derivatives in a live market environment.

Analyze the impact of macroeconomic events and market sentiment on currency movements.

Measure the effectiveness of a hedging program by comparing hedged vs. unhedged financial outcomes.

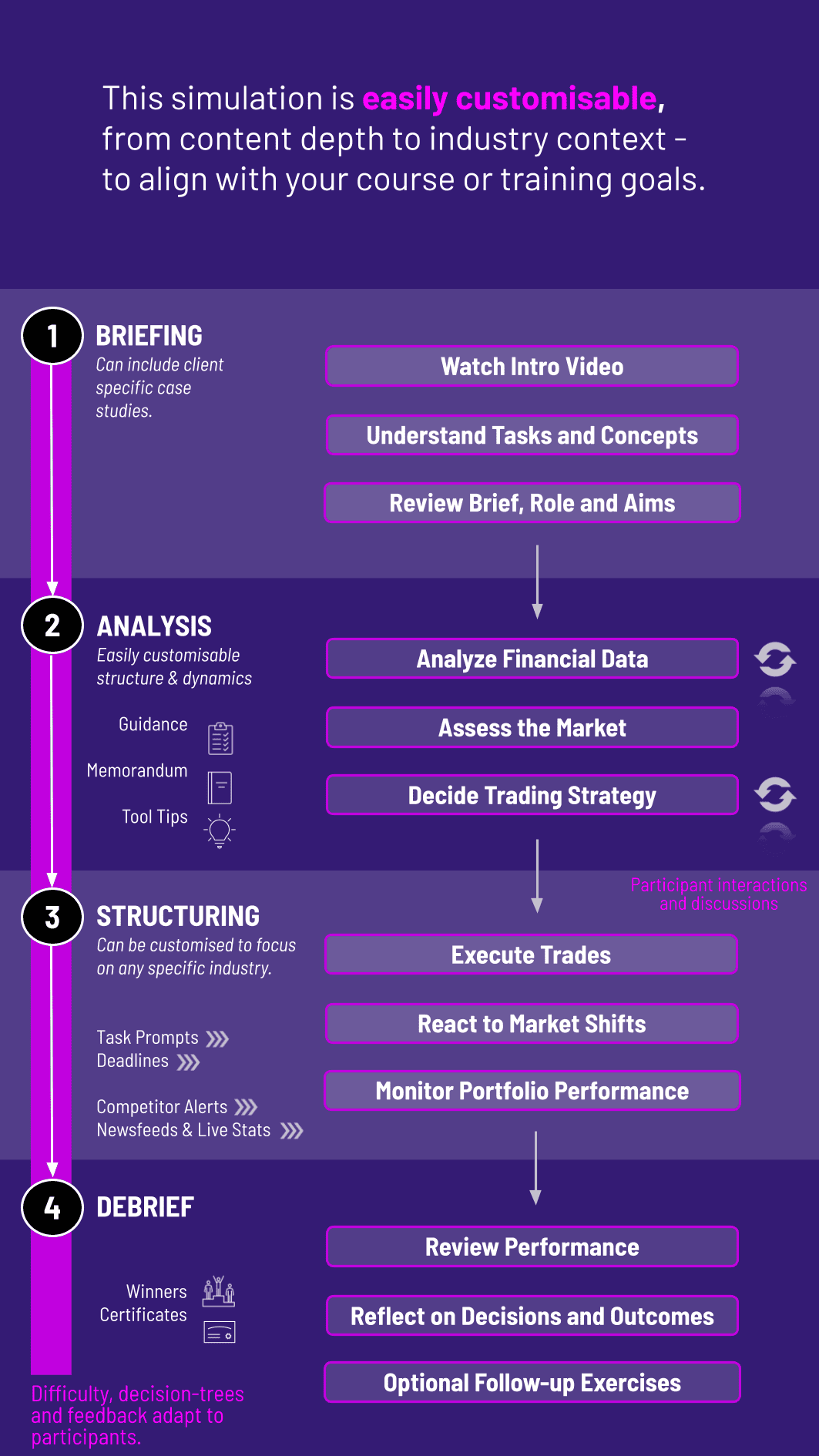

1. Role Assignment and Introduction Participants are divided into teams, each acting as the treasury department for a global company with defined exposures in EUR, GBP, JPY, etc.

2. Initial Analysis Teams receive a company profile, financials, and a forecast of future currency cash flows. They must analyze their risk and draft an initial strategy.

3. Live Simulation Rounds The simulation progresses through several quarters. In each round teams access a real-time market data screen with evolving spot and forward rates and option premiums, economic and political "news events" are released, causing market volatility, teams must decide on and execute their hedging trades for the period.

4. Results and Feedback After each round, teams receive a detailed performance report showing their P&L, the impact of their hedging decisions, and their remaining exposure.

5. Debrief A comprehensive debriefing session led by the instructor connects the simulation experience to theoretical concepts, highlighting best practices and key lessons learned.

Who is the target audience for this FX Risk Simulation? This simulation is ideal for students in finance, MBA programs, and executives in corporate finance, treasury, and accounting roles who need to understand and manage international financial risk.

What are the technical prerequisites to participate? A basic understanding of corporate finance and financial markets is helpful, but not mandatory. The simulation includes tutorial materials on core FX concepts, making it accessible to motivated beginners.

What specific financial instruments can we trade in the simulation? Participants can trade in the spot market, execute forward contracts for various maturities, and buy/sell European-style currency put and call options.

Is this a pure hedging game, or is there a speculative element? The primary focus is on prudent risk management and hedging. However, teams must decide their hedge ratios, and the choice of instruments (forwards vs. options) involves a trade-off between cost and flexibility, introducing strategic depth that goes beyond simple hedging.

How long does a typical simulation session last? A comprehensive session can be run over a single full day or split across multiple shorter sessions, depending on the number of rounds and depth of debriefing.

Can the simulation be customized for a specific industry? Yes, we can customize the company profile and exposure scenarios to reflect industries like manufacturing, import/export, or technology, making the learning experience highly relevant.

Do we need a dedicated computer lab to run the simulation? No. The simulation is cloud-based and accessible from any modern web browser on laptops, tablets, or desktop computers, facilitating both in-person and remote learning.

How is the winning team determined? Performance is typically measured by a combination of key metrics: final profit/loss, stability of cash flows, reduction in volatility of earnings, and adherence to a well-defined and justified risk management strategy.

The risk-adjusted profitability of the company at the end of the simulation.

A written report submitted by the team outlining their initial risk assessment, hedging strategy, and justifying their trading decisions in response to market events.

Assessment of individual contribution within the team.

A brief test to ensure understanding of the fundamental FX and hedging concepts covered.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.