Navigate the volatile world of foreign exchange. In this dynamic simulation, participants step into the role of a treasury manager at a multinational corporation, making critical decisions to protect profitability from adverse currency movements.

Foreign Exchange Risk

Spot vs. Forward Exchange Rates

Currency Forwards and Futures

Foreign Currency Options

Money Market Hedging

Hedging Ratio and Strategy

Cost of Hedging vs. Cost of No Hedging

Currency Forecasting and Market Analysis

Impact of Central Bank Policies and Geopolitical Events

Accounting for Hedges

In the simulation, participants will:

Identify and quantify the company's transaction exposure in various currencies.

Create a formal strategy dictating which exposures to hedge and to what extent.

Actively use the simulated trading platform to execute forward contracts, options, and money market operations.

Track live FX rates, interest rates, and react to breaking economic news.

Oversee a portfolio of hedging instruments and existing exposures.

Present their hedging strategy and financial results to the board, explaining the impact of their decisions on the P&L and balance sheet.

Identify the different types of foreign exchange risk faced by a multinational corporation.

Evaluate the advantages, disadvantages, and costs of various hedging instruments (forwards, options, money markets).

Construct a proactive hedging strategy tailored to a company's risk tolerance and financial objectives.

Execute hedging transactions in a simulated live market environment.

Quantify the financial impact of hedging decisions on corporate earnings and cash flow stability.

Analyze how macroeconomic news and interest rate changes influence currency values.

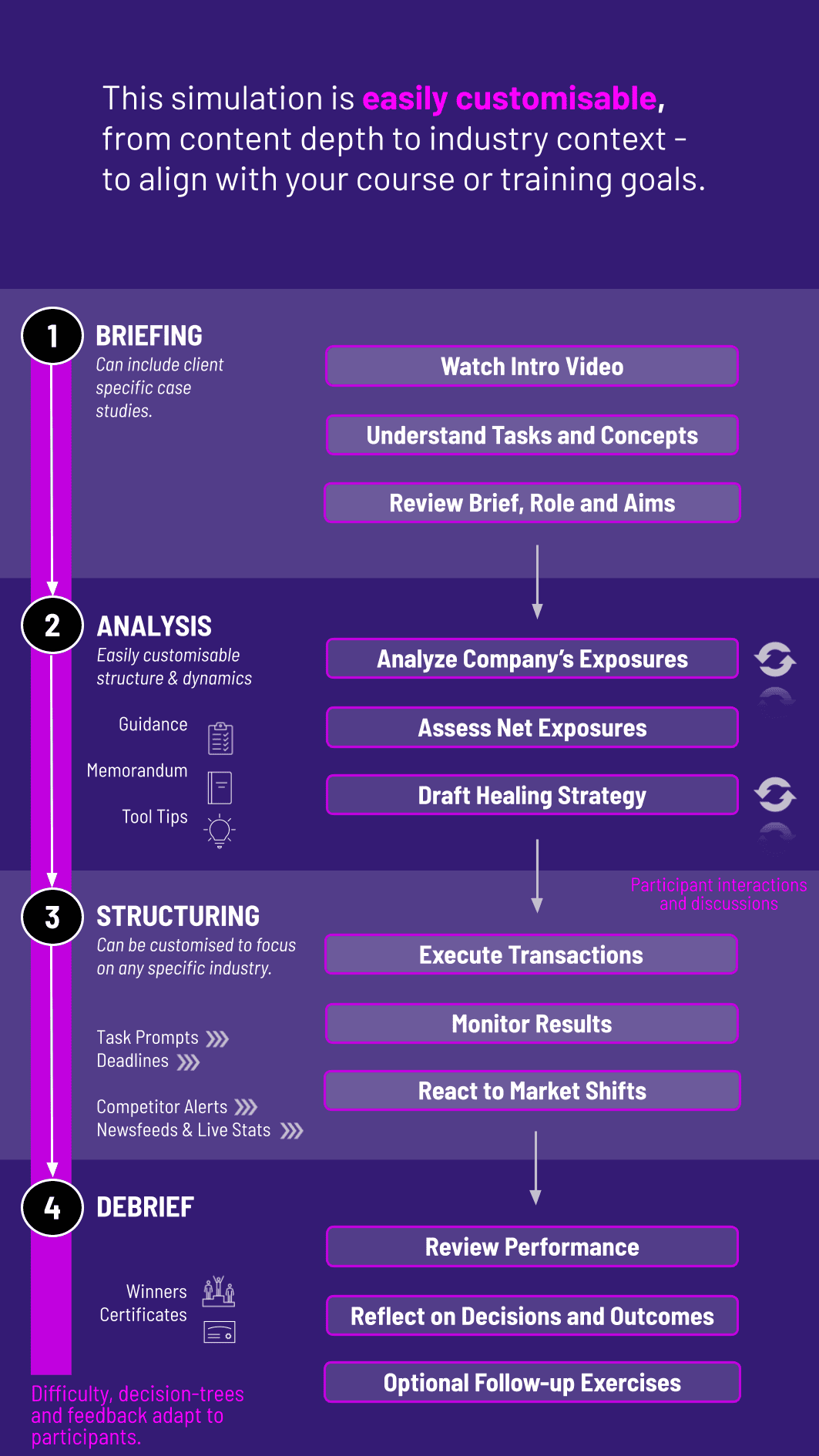

1. Team Formation and Briefing Participants are divided into treasury teams for a global company and receive a detailed case study outlining their exposures.

2. Initial Strategy Development Teams analyze their net exposure across different currencies and time horizons and draft their initial hedging policy.

3. Live Simulation Rounds The simulation progresses through several quarters (rounds). In each round, teams will receive new order books and cash flow forecasts, analyze updated market data and news feeds, and execute their hedging decisions via the platform.

4. Market Resolution At the end of each round, new spot rates are revealed based on the simulated market's evolution. The P&L impact of all hedging and exposure positions is automatically calculated.

5. Performance Review and Debrief Teams review their performance dashboard, comparing their results against competitors who took different strategic approaches. A comprehensive instructor-led debrief links the simulation outcomes to core financial theories.

Who is the target audience for this FX simulation? It is ideal for MBA students, finance professionals, corporate treasurers, and anyone in business roles who needs to understand how currency fluctuations impact global operations and financial performance.

Do I need prior experience in trading or derivatives to participate? No prior experience is necessary. The simulation includes foundational learning materials on FX markets and hedging instruments, making it accessible to beginners while offering deep strategic complexity for advanced learners.

What is the duration of a typical simulation session? A comprehensive session can be run over a 3-4 hour workshop, a full-day session, or integrated into a course over multiple weeks, with rounds representing fiscal quarters.

How is the performance of participants measured? Performance is primarily measured by the stability of cash flows, the net profitability after hedging costs, and the risk-adjusted returns compared to an unhedged position and other competing teams.

Can this simulation be used for corporate training? Absolutely. It is highly effective for training programs in multinational corporations, banks, and financial institutions to upskill treasury, finance, and sales teams in practical risk management.

What makes this simulation different from a simple lecture on FX hedging? Unlike passive learning, this simulation forces participants to make and live with their decisions. The immediate feedback from market movements creates a powerful, memorable learning experience that lectures cannot replicate.

Is the simulation platform web-based and accessible? Yes, the simulation is entirely web-based. Participants only need an internet connection and a standard web browser to access the trading platform, market data, and their team's dashboard from anywhere.

Net P&L Impact

Cash Flow Volatility

Sharpe Ratio of returns.

Initial hedging policy

The rationale behind their choices

Adaptation of their strategy in response to market events.

Grasp of the strategic concepts

Ability to analyze own performance.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.