The Fixed Income Analyst Simulation brings participants into the world of bonds and debt markets. Move beyond textbook theories and learn to navigate the complex interplay of interest rates, credit risk, and macroeconomic events in real-time.

Bond Valuation and Pricing

Yield Curve Analysis

Interest Rate Risk

Credit Analysis

Macroeconomic Factors

Portfolio Management

Structured Products

In the simulation, participants will:

Analyze the financial health of various corporate bond issuers to determine default risk.

Forecast the direction of interest rates and adjust portfolio strategy accordingly.

Execute trades in government bonds, corporate bonds, and potentially structured products.

Actively manage the duration and convexity of the portfolio to hedge against interest rate movements.

Monitor economic news and data releases, reacting to events like Fed rate decisions or inflation surprises.

Compete against other teams to achieve the highest risk-adjusted return for your portfolio.

Write an investment memo justifying your portfolio strategy and key positions.

Value a variety of fixed income securities and calculate key risk metrics.

Assess credit risk by performing fundamental analysis on corporate issuers.

Formulate an interest rate outlook and translate it into an actionable portfolio strategy.

Manage interest rate risk by strategically applying duration and convexity.

Construct a diversified fixed income portfolio aligned with a specific investment mandate.

Articulate and defend investment decisions in a professional context.

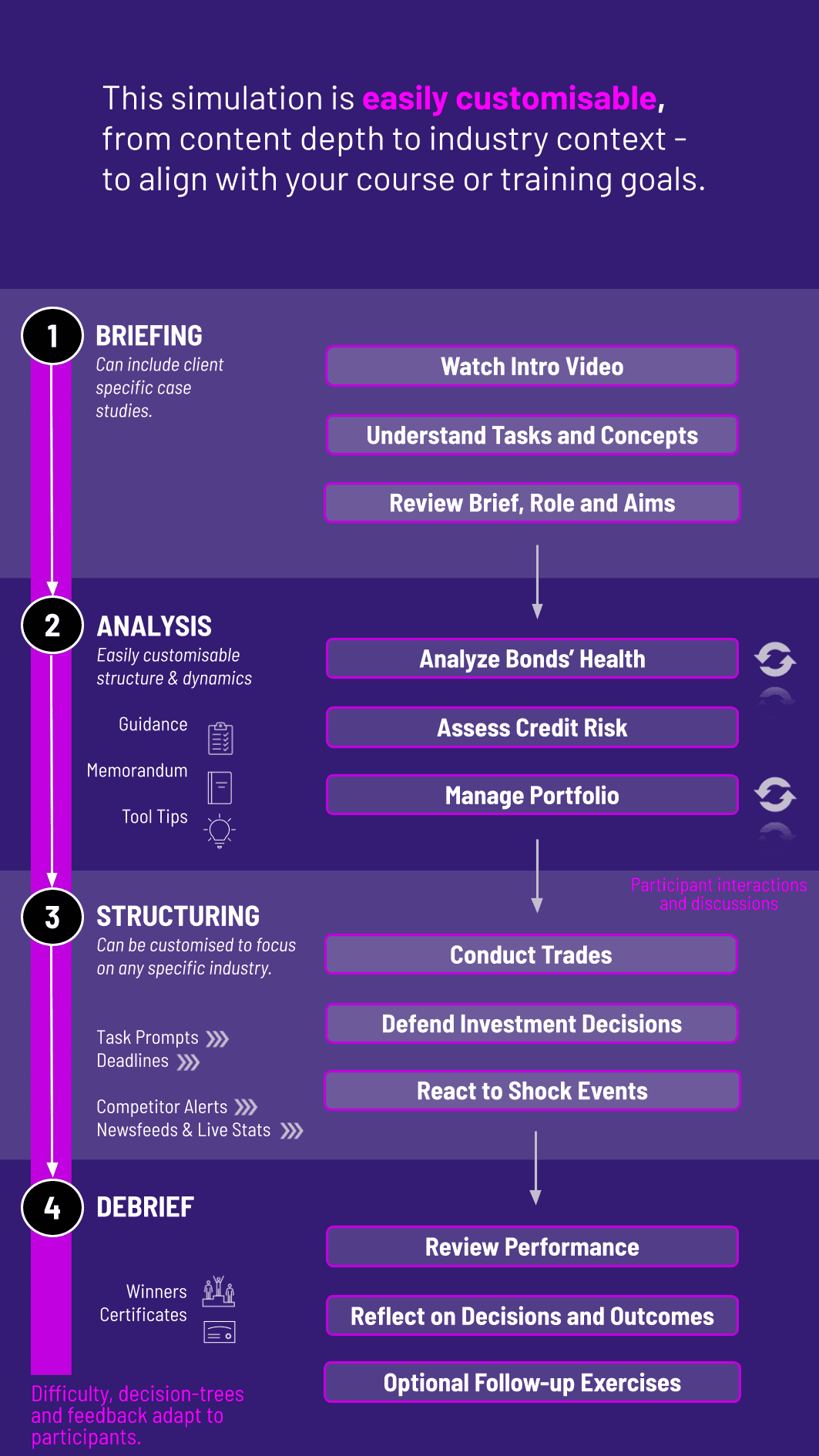

1. Introduction and Mandate Your team is assigned a specific investment mandate.

2. Market Access You gain access to the simulation platform, which features a live trading screen, real-time portfolio analytics, and a research terminal with company financials and economic data.

3. Analysis and Decision-Making You will analyze potential investments, monitor your existing portfolio, and place trades based on your strategy.

4. Rounds The simulation progresses through several "periods," each representing a quarter. At the start of each new period, new economic data is released, and the market environment evolves.

5. Performance and Debrief Your performance is ranked based on risk-adjusted returns against other teams. A comprehensive debrief session led by the instructor connects the simulation experience to core fixed income principles.

Is this simulation suitable for students without prior trading experience? Absolutely. The simulation is designed with a learning curve in mind. It includes tutorial materials and is guided by an instructor, making it accessible for undergraduate, MBA, and executive education students new to fixed income.

What types of bonds are included in the simulation? The universe includes a range of securities, from "risk-free" government bonds to corporate bonds across different sectors (Technology, Energy, Industrials) and credit ratings (from AAA to High-Yield).

Can participants see the impact of duration and convexity in real-time? Yes. The platform provides real-time analytics on your portfolio's key risk metrics. You will see the direct impact of interest rate changes on your portfolio's value, allowing you to test and understand the principles of duration and convexity management firsthand.

Is this a team-based or individual simulation? It is highly effective both ways. It is most commonly run as a team-based exercise to foster collaboration and debate, but it can be configured for individual participation to hone personal analytical skills.

How long does a typical simulation last? A standard program runs over 2-5 rounds, which can be condensed into an intensive one-day workshop or spread out over several weeks as part of a semester-long course.

What technical prerequisites are needed to run the simulation? Participants only need a standard modern web browser (like Chrome, Firefox, or Safari) and an internet connection. No special software or downloads are required.

Portfolio Performance is ranked based on risk-adjusted returns and adherence to the assigned investment mandate.

Team's strategy, analysis of key holdings, performance attribution, and lessons learned.

Assessment of individual contribution within the team, based on peer reviews and facilitator observation.

Quizzes on Core Concepts

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.