Participants take on the role of fintech innovators, designing digital financial products, leveraging emerging technologies, and navigating disruption to drive growth under real-world pressures with our fintech training.

The Fintech Training immerses participants in the fast-evolving world of financial technology, challenging them to navigate digital disruption, launch innovative products, and manage fintech-driven financial services. Participants take on roles as founders, product managers, data scientists, or fintech investors - making decisions that mirror real-life challenges faced in high-growth tech-enabled finance environments.

This training blends strategy, analytics, and innovation, exposing participants to the technologies reshaping global finance - from blockchain and robo-advisory to peer-to-peer lending and digital payments. Designed for participants, the experience builds critical thinking, agile planning, and customer-centric design skills essential for thriving in a digital-first financial landscape.

Who is this fintech training designed for? It’s perfect for participants in finance, business, technology, and entrepreneurship programs with an interest in fintech.

Is technical knowledge required? No coding is necessary - financial logic and strategic thinking are the focus, with optional tech deep-dives for advanced users.

How long does the fintech training take? Typically 5-7 hours, but the fintech training can be delivered in modules or extended sessions.

Is this fintech training individual or team-based? It can be run both ways. Team delivery reflects real-world startup collaboration.

Does the fintech training use real-world technology examples? Yes. Participants explore APIs, data tools, and fintech case studies grounded in current platforms.

How is performance assessed? Evaluation is based on product strategy, investor pitches, market outcomes, and innovation.

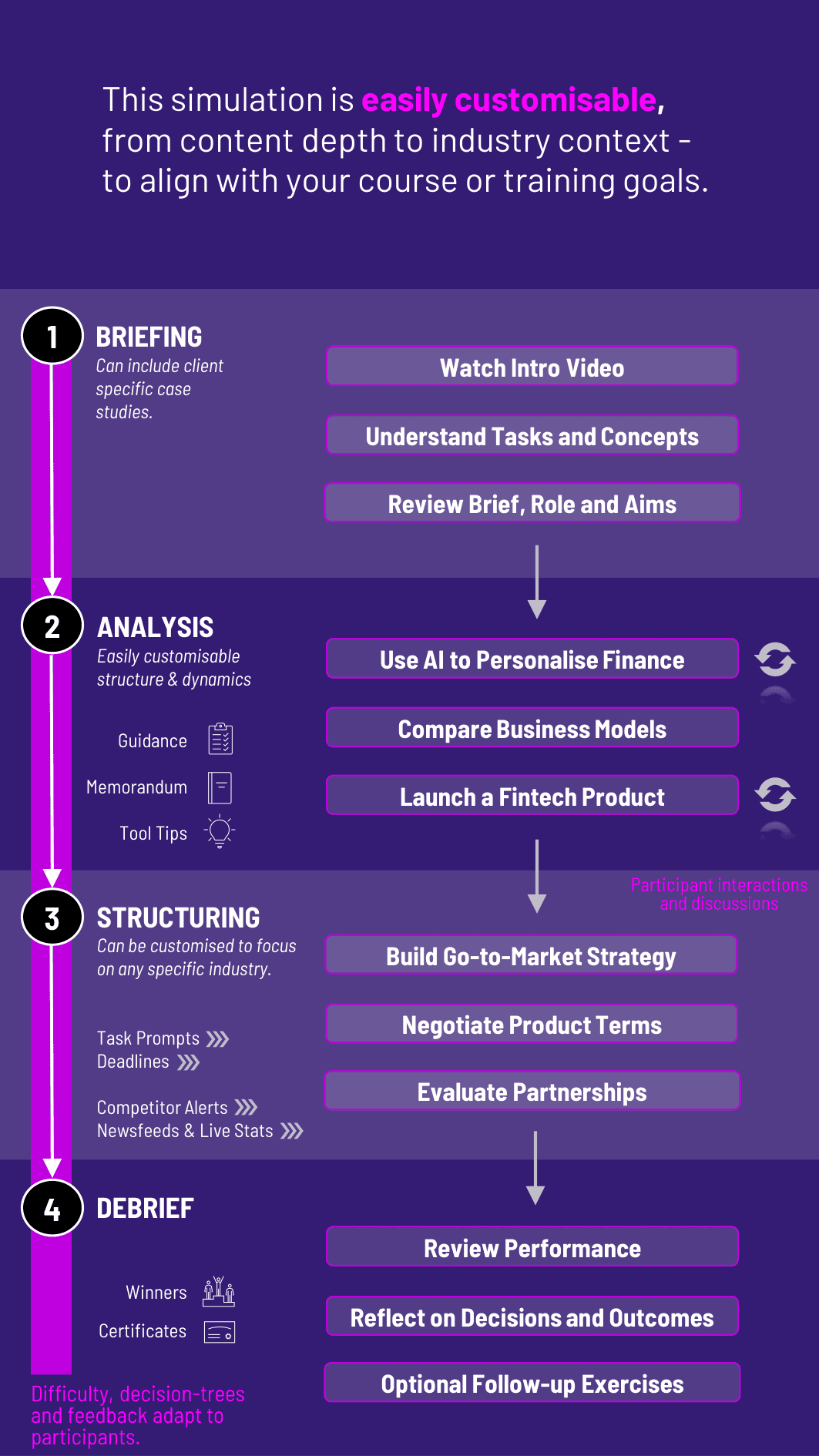

Can it be customized by instructors? Yes, including emphasis on specific sectors (e.g., lending, insurance, blockchain).

Are tools like machine learning and blockchain explained? Yes. The fintech training includes guided explanations and applications tailored to finance.

Does it support hybrid or remote learning? Absolutely. It is fully web-based and accessible from any location.

What careers does this fintech training support? It prepares participants for roles in fintech startups, innovation labs, digital banking, venture capital, and product management.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the fintech training.

or

Book a 15-minute Zoom demo with one of our experts to explore how the fintech training can benefit you.