The Financial Statement Preparation Simulation immerses participants in the core accounting cycle, showcasing the transformation of the raw financial data into the critical reports that drive business decisions.

The Accounting Cycle

Double-Entry Bookkeeping

Accrual vs. Cash Accounting

Revenue Recognition and Matching Principles

Depreciation and Amortization

Inventory Valuation

Accounts Receivable and Bad Debt Expense

Financial Statement Interrelationships

Working Capital Management

Financial Ratio Analysis

In the simulation, participants will:

Record Journal Entries for a wide range of business transactions.

Post to the General Ledger and prepare an unadjusted trial balance.

Record Adjusting Entries for accruals, deferrals, and depreciation.

Prepare a Complete Set of Financial Statements

Analyze the company's financial health using key performance indicators and ratios.

Reconcile Net Income with Cash from Operations.

Make strategic accounting choices and observe their impact.

Present a summary of the company's financial performance and position.

Execute the full accounting cycle from transaction to report.

Apply GAAP/IFRS principles to record complex business transactions.

Construct a complete and accurate set of financial statements.

Analyze financial statements to assess a company's profitability, liquidity, and efficiency.

Articulate the linkage between the Income Statement, Balance Sheet, and Statement of Cash Flows.

Evaluate the impact of different accounting policies on financial results.

Develop the critical thinking skills necessary to diagnose and correct accounting errors.

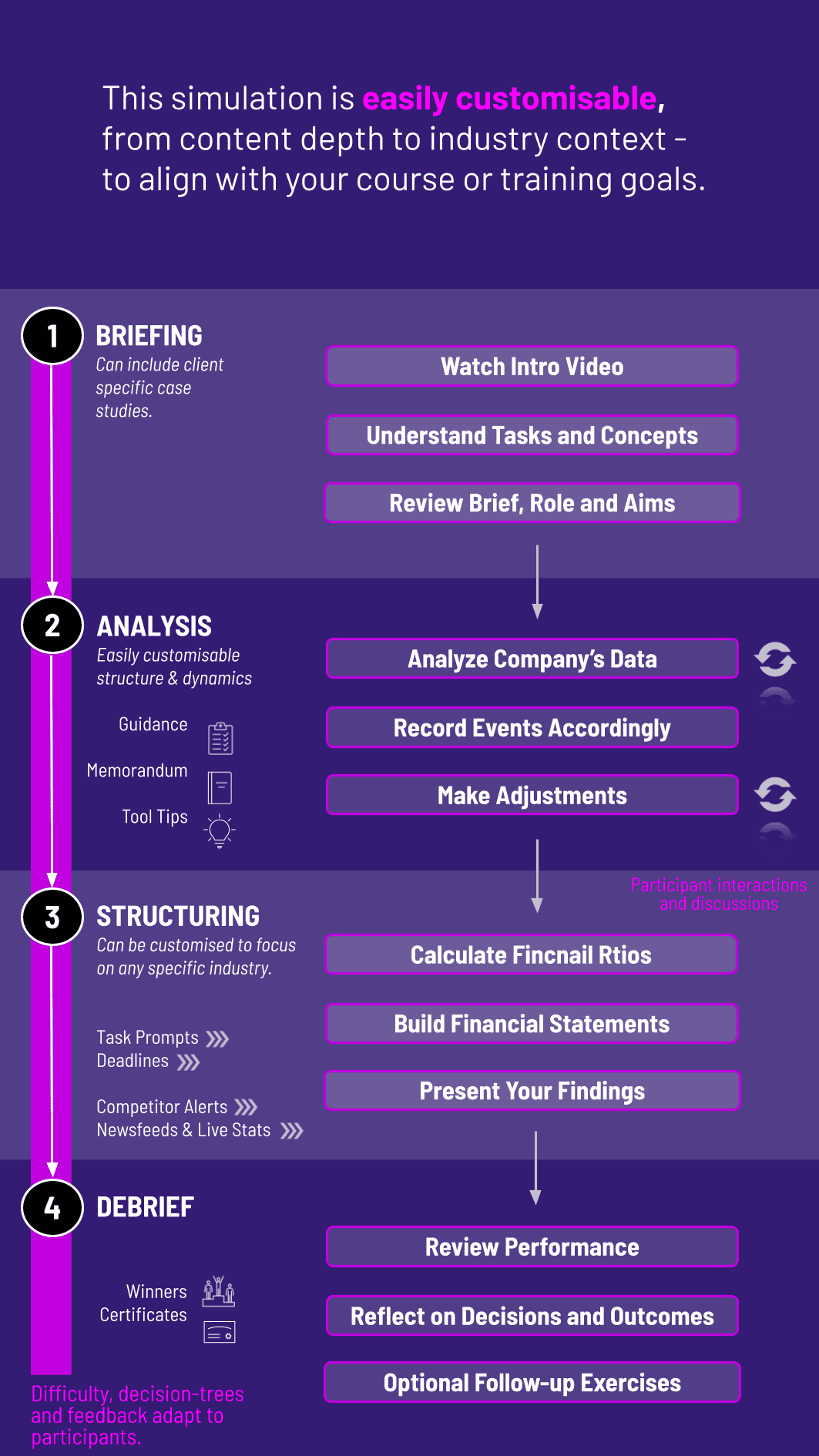

1. Introduction and Case Launch Participants are introduced to their company, its industry, and its initial financial position.

2. Transaction Phase A series of business events are presented. Participants must identify the accounts affected and record the appropriate journal entries.

3. Adjustment and Closing Phase At the period-end, participants will make necessary adjusting entries to reflect accrued and deferred items.

4. Statement Preparation Phase Using adjusted trial balance, participants will build the three core financial statements, ensuring they articulate correctly.

5. Analysis and Reporting Phase Participants will calculate financial ratios, interpret the results, and prepare a brief management commentary.

6. Debrief and Feedback The simulation provides instant feedback on participants’ entries and statements. A comprehensive debrief compares their results to model answers, highlighting key learning points.

Who is the target audience for this simulation? This simulation is ideal for undergraduate and graduate business students, MBA candidates, new hires in finance and accounting roles, and any professional seeking to solidify their understanding of financial accounting fundamentals.

What are the technical requirements to participate? The simulation is entirely web-based and runs on any modern browser (Chrome, Firefox, Safari). No additional software or downloads are required.

Do I need prior accounting experience? Although the simulation is designed for participants with a basic understanding of accounting principles, typically from an introductory financial accounting course, it is designed with a learning curve in mind and can be adjusted to a particular level.

Is this simulation focused on US GAAP or IFRS? The core principles are universal. The simulation can be configured to highlight the key differences between US GAAP and IFRS for specific transactions, making it suitable for a global audience.

How long does it take to complete one simulation round? A typical round, including the analysis and debrief, takes between 2 to 4 hours, depending on the depth of the case and the participant's familiarity with the concepts.

Can this simulation be customized for our specific curriculum or corporate training? Absolutely. We can tailor the company profile, industry, transaction complexity, and specific learning objectives to meet your program's unique needs.

How does this simulation help with finance and investment banking interviews? It builds the foundational muscle memory for technical questions. You will gain an intuitive understanding of how transactions flow through the statements, which is critical for answering questions about valuation, modeling, and financial analysis.

What makes this simulation different from doing textbook problems? Textbook problems are static. Our simulation is dynamic and integrated. You experience the cumulative effect of your decisions and see the direct, tangible link between a journal entry and the final reported numbers, fostering a deeper, more practical understanding.

Quality of the journal entries, ledger postings

Mathematical accuracy of the prepared financial statements.

Accuracy at balancing the Net Income flows to the Balance Sheet

Cash Flows Statement reconciliation with the change in cash.

Quality of the ratio analysis and the insights provided in the management commentary.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.