In today's competitive business environment, financial statements are more than just historical records—they are a treasure trove of insights waiting to be unlocked.

Liquidity Analysis

Profitability Analysis

Efficiency Analysis

Leverage and Solvency Analysis

Valuation and Market Performance

DuPont Analysis

Trend Analysis and Benchmarking

Linking Operational Decisions to Financial Outcomes

In the simulation, participants will:

Analyze complete financial statements for multiple simulated companies.

Calculate a comprehensive set of financial ratios across several reporting periods.

Interpret ratio results to diagnose company strengths, weaknesses, and trends.

Benchmark company performance against industry rivals and historical data.

Synthesize findings into a professional-grade investment report or analyst presentation.

Make a data-driven investment recommendation and justify their thesis.

Compete with peers to see whose analysis yields the most accurate and profitable insights.

Calculate a wide array of essential financial ratios accurately and efficiently.

Interpret the meaning and strategic implications behind ratio results, not just the numbers.

Evaluate a company's overall financial health by integrating insights from liquidity, profitability, efficiency, and leverage analyses.

Benchmark a company's performance against its competitors and industry standards.

Forecast potential future performance and risks based on historical trends and current financial positioning.

Communicate complex financial analysis in a clear, concise, and persuasive manner to support decision-making.

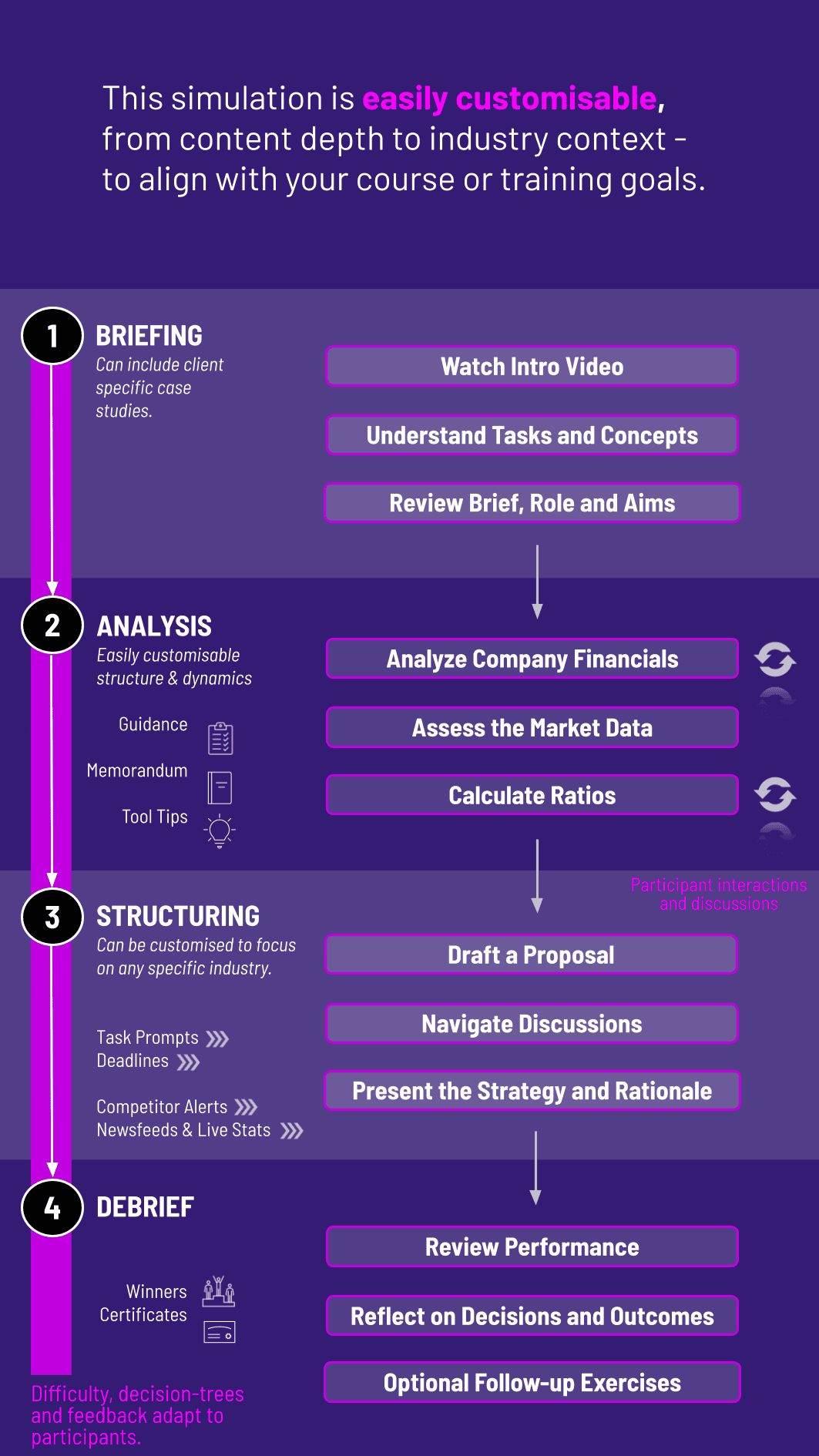

1. Introduction and Role Assignment Participants are introduced to the simulated industry and assigned as financial analysts for a specific firm or fund.

2. Access Financial Data Each round, participants receive the updated financial statements for all major companies in the simulation market.

3. Calculate and Analyze Using the provided data, participants calculate key ratios and perform trend and cross-sectional analysis.

4. Make Decisions and Recommendations Based on their analysis, participants formulate an investment strategy and submit their recommendation.

5. Get Results and Feedback The simulation engine processes all decisions, generates new market results, and provides quantitative feedback on the performance of their recommendations.

6. Debrief and Compete The facilitator leads a debriefing session to discuss key learnings, while a leaderboard showcases the most successful analysts.

What is the primary focus of the Financial Ratios Analysis Simulation? The simulation focuses on the practical application of financial ratio analysis. It teaches participants to move beyond calculation to interpretation and strategic decision-making, linking operational performance directly to financial outcomes and valuation.

Is this simulation suitable for beginners in finance? Absolutely. The simulation is designed with scalable difficulty. It starts with foundational concepts and progressively introduces complexity, making it ideal for undergraduates, MBA students, and professionals new to financial analysis.

What makes this simulation different from a traditional case study? Unlike a static case study, our simulation is dynamic and multi-period. The companies' financials change based on market competition and management decisions, requiring participants to analyze trends and adapt their strategies over time, just like in the real world.

Can this simulation be used for corporate training? Yes, it is highly effective for corporate training. It sharpens the financial acumen of employees in non-finance roles and serves as excellent continuous training for junior analysts in finance and accounting departments.

What technical requirements are needed to run the simulation? The simulation is 100% browser-based. Participants only need a modern web browser (like Chrome, Firefox, or Safari) and a stable internet connection. No additional software or downloads are required.

How long does a typical simulation session last? A comprehensive session can be tailored to fit your schedule. A full experience typically ranges from 2 to 4 hours, which can be run in a single day or split across multiple sessions. Longer, expanded workshops are available.

Do participants work individually or in teams? The simulation supports both individual and team-based participation. We often recommend teams of 3-4 to encourage collaboration, debate, and the development of a consensus-based investment recommendation.

Accuracy of ratio calculations.

Depth and insight of ratio interpretation.

Clarity of communication and logical argumentation.

Strength of the evidence-based justification.

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.