An immersive, competitive simulation where participants act as the executive team of a public company, making high-stakes financial policy decisions to maximize shareholder value in a dynamic market.

Capital Structure and Leverage

Cost of Capital

Dividend Policy and Signaling

Share Repurchases

Credit Ratings and Debt Covenants

Market Valuation Multiples

Strategic Investment

Earnings Per Share Management

Financial Flexibility and Risk

Shareholder Value Creation

In the simulation, participants will:

Analyze financial statements, market data, and analyst reports.

Issue bonds or equity to fund operations and growth.

Set dividend levels and execute stock buyback programs.

Allocate capital to strategic projects.

Manage the company's credit rating and debt maturity profile.

Present their financial strategy to a simulated "Board of Directors" or investor audience.

React to macroeconomic shocks, competitor moves, and activist investor demands.

Compete for the highest cumulative shareholder return.

Articulate the impact of financing decisions on firm value, risk, and financial flexibility.

Design a coherent financial policy (debt, dividends, buybacks) aligned with corporate strategy.

Evaluate the trade-offs between different sources of capital and their effect on WACC.

Understand how credit ratings are determined and how they constrain corporate decisions.

Interpret how the market reacts to dividend changes, equity issues, and leverage shifts.

Build integrated financial forecasts to support strategic capital allocation.

Communicate financial policy decisions effectively to stakeholders.

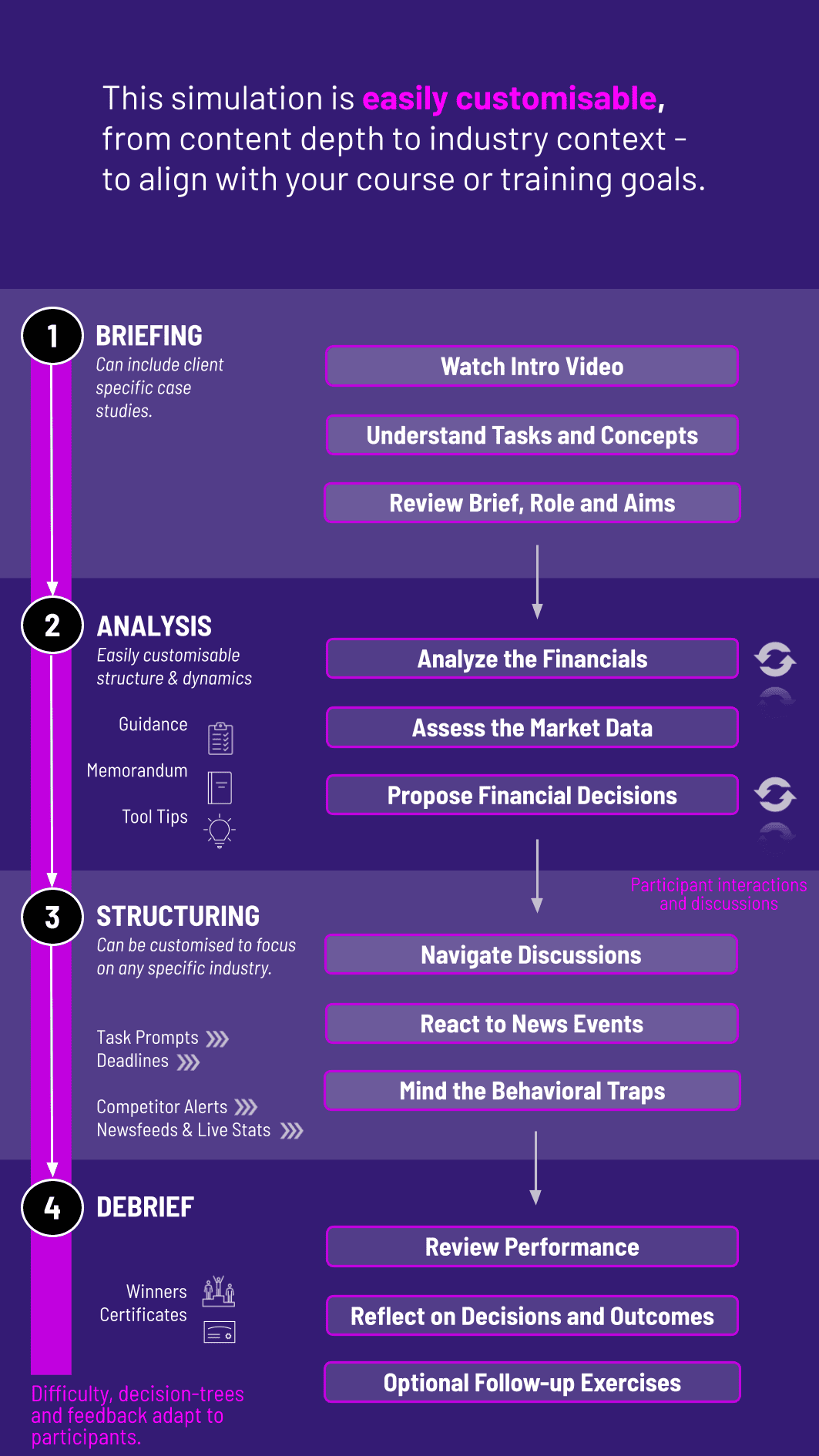

1. Team Formation Participants are divided into management teams of 3-5, each running an identical simulated company.

2. Initial Analysis Teams review starting financials, market conditions, and analyst expectations.

3. Decision Rounds Each round represents a fiscal quarter. Teams submit integrated decisions on financing, payouts, investments, and guidance.

4. Simulation Engine The simulation algorithm processes all team decisions, modeling market reactions, rating agency responses, and competitive dynamics.

** 5. Results and Analysis** Teams receive detailed reports showing their new financial statements, stock price movement, credit rating, and relative ranking.

** 6. Debrief and Iteration** Facilitators guide analysis of outcomes. Teams adjust strategy for the next round, facing new market scenarios.

** 7. Final Assessment** The simulation culminates with a winner based on Total Shareholder Return and a final strategic review.

Is this simulation suitable for students without a finance background? Yes. While a basic understanding of accounting is helpful, the simulation includes intuitive guides, glossaries, and structured decision forms. It is designed to be a learning-by-doing tool for MBA students, executives, and finance professionals alike.

What software or prior installation is required? None. The Financial Policy Simulation is a 100% web-based platform accessible through any modern browser (Chrome, Safari, Edge). No downloads or installations are needed.

How long does a typical simulation session last? A comprehensive session can be tailored from a 3-hour intensive workshop to a multi-week course module. The standard format involves 4-6 decision rounds and can be run over one or two full days.

Can the simulation be customized for our specific corporate training needs? Absolutely. We can customize case parameters, industry settings, and financial metrics to align with your organization's specific learning objectives, whether for a corporate treasury, CFO leadership program, or executive education.

How is the simulation graded or scored? Performance is primarily measured by Total Shareholder Return (TSR), which incorporates stock price appreciation and dividends paid. Instructors also receive detailed analytics on each team's risk management, credit rating stability, and strategic consistency.

Does the simulation include ESG (Environmental, Social, Governance) factors? Yes, optional modules can introduce ESG ratings and sustainable financing elements. Teams may face trade-offs between short-term returns and long-term ESG investment, affecting their cost of capital and investor demand.

How does this simulation differ from a standard case study? Unlike a static case study, this simulation is dynamic and competitive. Teams see the immediate, quantified consequences of their decisions, adapted in real-time by the actions of other teams and a simulated economy. It emphasizes iterative learning and adaptive strategy.

A clear, ranked scorecard of primary performance

Performance across teams, sessions, or against historical data

Ability to adapt and revise valuations in light of news shocks or changes

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.