In this simulation, participants build financial models, apply valuation techniques, and present investment recommendations - balancing technical rigour with strategic judgment under real-world time pressure and uncertainty.

Three-statement financial modeling

Discounted Cash Flow (DCF) valuation

Trading comparables and precedent transactions

Sensitivity and scenario analysis

Cost of capital and capital structure impacts

Forecasting revenue, expenses, and growth drivers

Market and industry analysis

Communicating valuation insights effectively

Handling external shocks in valuations

Ethical considerations in financial modeling

Develop and adjust three-statement financial models

Apply multiple valuation methods to companies

Test assumptions through sensitivity and scenario analysis

Compare performance against peers and transaction data

Respond to external shocks such as market downturns

Present recommendations in memos or pitch-style presentations

By the end of the simulation, participants will be able to:

Build robust three-statement financial models

Apply DCF, comparables, and precedent analysis effectively

Use sensitivity and scenario analysis to test assumptions

Forecast financial performance with discipline and accuracy

Communicate valuation results persuasively to stakeholders

Recognize the impact of capital structure on valuation

Integrate qualitative insights with quantitative modeling

Adapt models to external shocks and new information

Apply ethical judgment in financial modeling choices

Gain confidence in investment decision-making processes

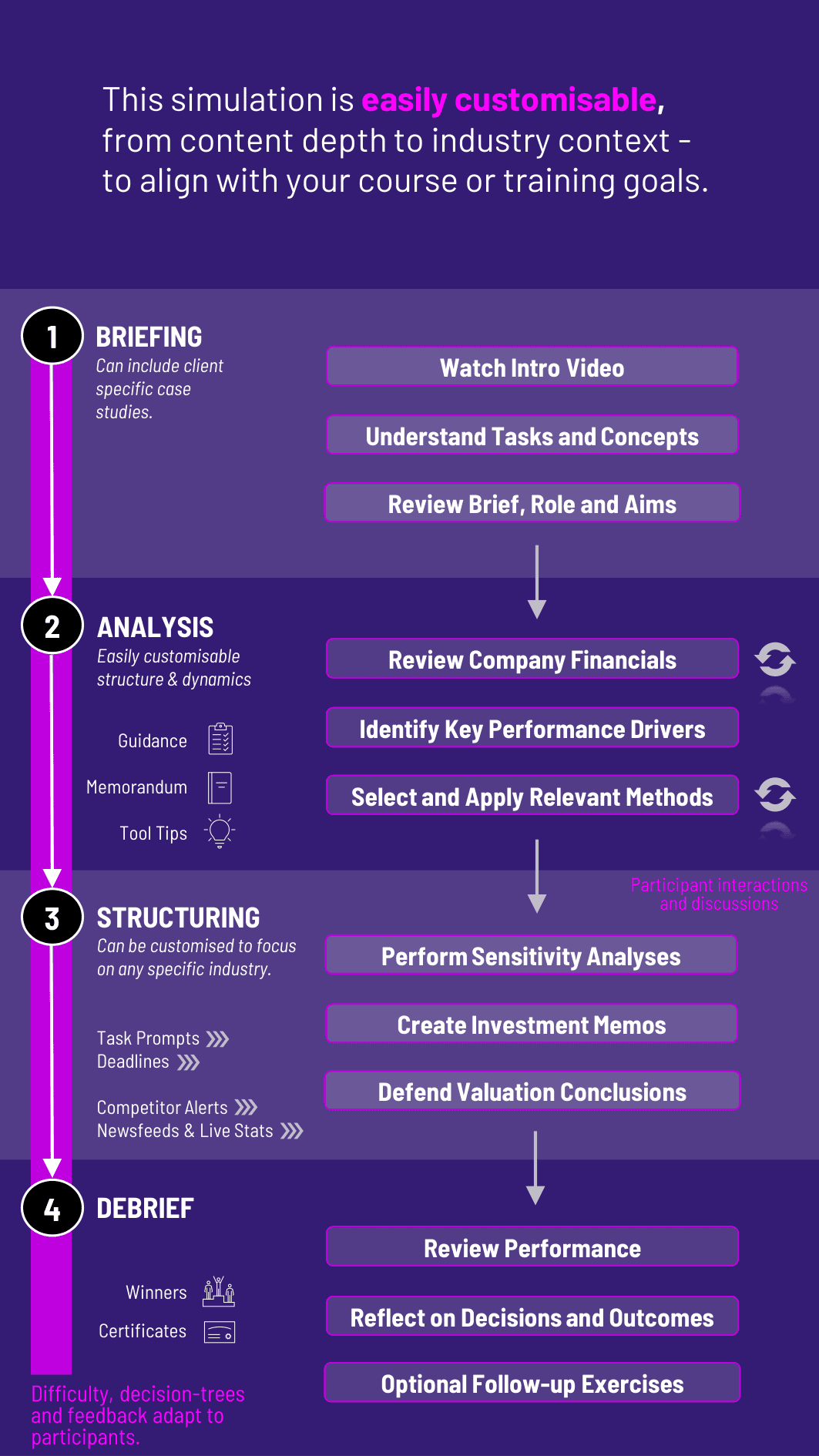

The simulation’s flexible structure ensures that these objectives can be calibrated to match the depth, duration, and focus areas of each program, whether in higher education or corporate learning.

1. Receive a Scenario or Brief: Participants are introduced to a company and given financial and market data.

2. Analyse the Situation: They review financials, forecasts, and industry trends to identify assumptions.

3. Build and Refine Models: Participants develop financial models and apply valuation methods.

4. Collaborate Across Roles: Teams may role-play as analysts, managers, or investors debating assumptions.

5. Communicate Outcomes: Participants deliver pitch decks, memos, or presentations with recommendations.

6. Review and Reflect: Feedback highlights valuation accuracy, presentation clarity, and strategic insights. Participants refine models across rounds.

Do participants need prior modeling experience? No. Guidance and examples are provided for all levels.

What valuation methods are included? DCF, trading comparables, and precedent transactions.

Is teamwork required? Yes. Teams collaborate on assumptions and pitches.

Does it include sensitivity analysis? Yes. Participants test assumptions across scenarios.

How long does it run? It can be delivered as a short workshop or multi-day program.

Is it customizable? Yes. Industry, company type, and complexity can be tailored.

Does it cover external shocks? Yes. Market volatility and disruptions are built into rounds.

Is it suitable for executives? Yes. It’s widely used in corporate and investment training.

Can it be run online? Yes. It supports in-person, hybrid, and online formats.

How is success measured? By valuation accuracy, strategic judgment, and communication clarity.

Assessment can be tailored to focus on technical modeling, strategic insight, or communication. Participants may be evaluated on:

Accuracy and robustness of financial models

Application of multiple valuation methods

Responsiveness to shocks and assumption changes

Clarity in communicating recommendations

Collaboration in building and presenting analyses

You can also include memo writing and debrief presentations as part of the assessment structure. Additionally, you can also add a built-in peer and self-assessment tool to see how participants rate themselves. This flexibility allows the simulation to be easily integrated by professors as graded courses at universities and by HR at assessment centres at companies.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.