Participants build end-to-end financial models from scratch - forecasting performance, valuing businesses, and presenting deal-ready outputs - in our Financial Modeling and Valuation Course.

Three-Statement Modeling: Building and linking income statement, balance sheet, and cash flow statement

Forecasting Drivers: Revenue growth, margins, working capital, and capex assumptions

Valuation Techniques: DCF (discounted cash flow), precedent transactions, and public comparables

WACC and Terminal Value: Calculating discount rates and perpetuity/growth exit methods

Sensitivity and Scenario Analysis: Testing key drivers and downside cases

Model Accuracy and Integrity: Circularity, audit checks, and dynamic formula design

Executive Summaries: Creating board-level outputs from detailed financial work

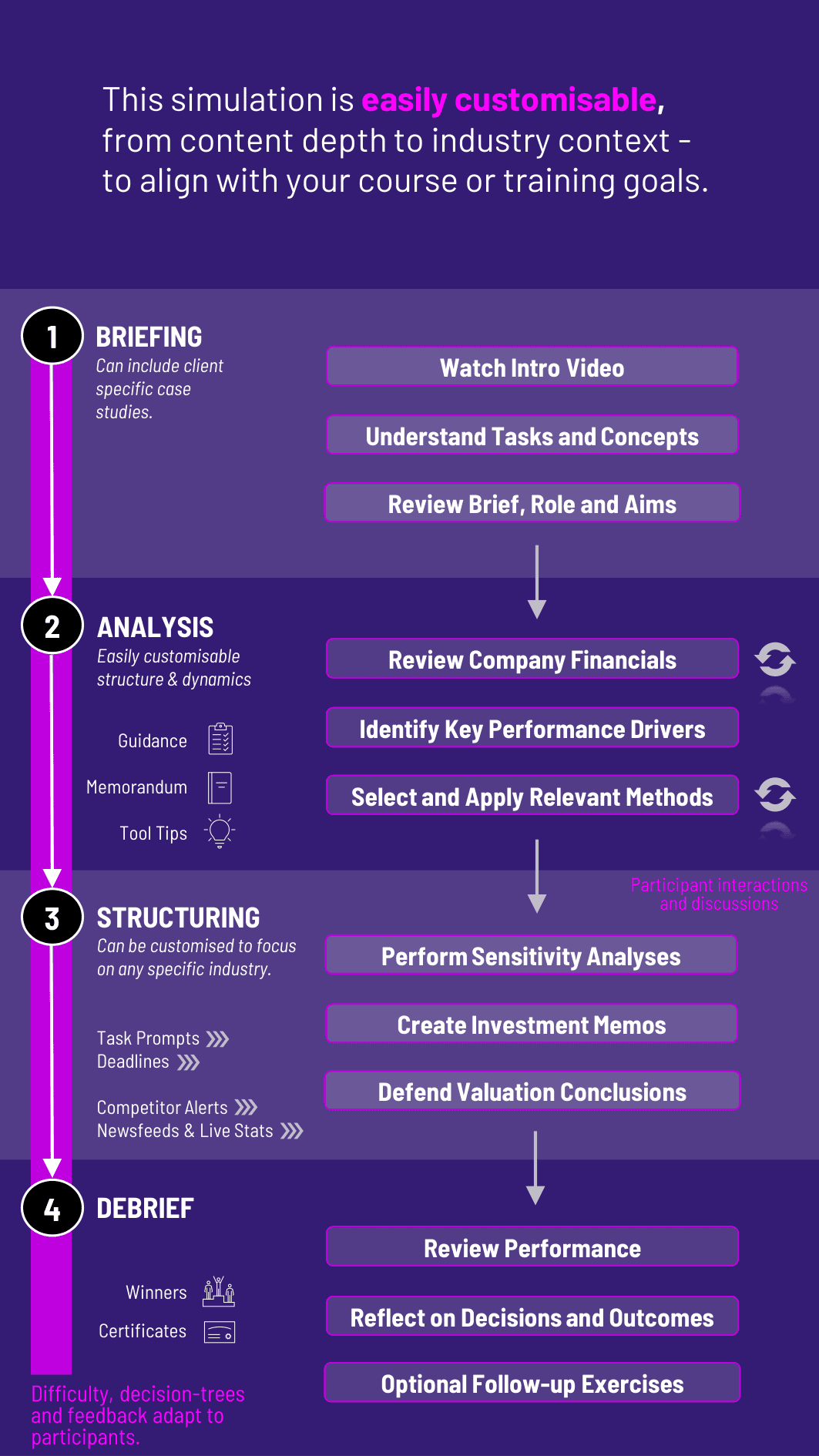

Receive a company’s historical financials and qualitative background

Identify key performance drivers and build a fully integrated financial model

Select and apply relevant valuation methods (DCF, comps, transactions)

Perform sensitivity analysis and calculate valuation ranges

Create investment memos, board decks, or client-ready valuation summaries

Defend modeling logic and valuation conclusions to simulated stakeholders

The course builds technical mastery and decision-making confidence. Participants learn how to:

Translate financial statements into dynamic forecasting tools

Think critically about business assumptions and valuation logic

Choose appropriate methodologies for different types of companies or deals

Structure clear, audit-proof models used in real investment settings

Communicate complex models in a concise, strategic format

Understand the expectations of investors, clients, and senior executives

Do participants need Excel modeling experience? Basic spreadsheet fluency is recommended. The course includes guided steps and audit tools for newer users, but is challenging enough for advanced participants too.

Is this course technical or strategic? Both. participants build detailed models and use them to form business conclusions and investment recommendations.

What company types are included? The default course uses a mid-market operating business with real-world complexity. Other sectors (e.g., SaaS, manufacturing, retail) are available upon request.

Can participants use different valuation approaches? Yes. They can apply DCF, trading comps, and precedent transactions and are encouraged to triangulate valuation outcomes.

How long does the course take? 6 - 8 hours for a full build, with optional extensions for deeper reporting, investor pitches, or presentation rounds.

Is it better for individuals or teams? Both formats work well. Teams can split model building, memo drafting, and valuation defense roles to mimic real-world team workflows.

How is performance evaluated? Assessment includes technical accuracy, valuation rationale, model structure, and communication clarity - both written and verbal.

Does the course include pitch presentations? Yes. Participants deliver summary presentations or memos justifying their valuation, which are evaluated for clarity, realism, and insight.

Are there error-checks or audit tools? Yes. Built-in features help participants debug formulas, check linkages, and ensure output consistency.

Can instructors customize scenarios or assumptions? Absolutely. Instructors can choose company types, set custom scenarios (e.g. IPO, M&A, growth capital), and adjust inputs for different participants levels.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the course.

or

Book a 15-minute Zoom demo with one of our experts to explore how the course can benefit you.