The Financial Markets Simulation is a dynamic, hands-on platform where participants experience the pressure, strategy, and excitement of real-world financial markets.

Market Mechanics and Price Discovery

Portfolio Construction and Asset Allocation

Risk Management

Macroeconomic Analysis and Sector Rotation

Technical vs. Fundamental Analysis

Behavioral Finance and Herd Mentality

Derivatives Hedging and Speculation

Performance Attribution and Benchmarking

In the simulation, participants will:

Research companies, interpret economic indicators, and assess market sentiment.

Decide on a core investment philosophy.

Place market, limit, and stop orders across various asset classes.

Actively monitor portfolio exposure, set stop-losses, and use options/futures to hedge positions.

Pivot strategies in response to earnings reports, central bank decisions, and geopolitical "market shocks."

Defend their investment decisions and performance to a simulated "investment committee" or peers.

Articulate how different economic variables impact various asset classes.

Construct a diversified portfolio aligned with a specific risk-return mandate.

Execute basic hedging strategies using derivative instruments.

Analyze a trading book, identifying sources of profit, loss, and key risk exposures.

Demonstrate the psychological challenges of trading and the impact of behavioral biases.

Calculate and interpret key performance and risk metrics (Sharpe Ratio, Max Drawdown, Beta).

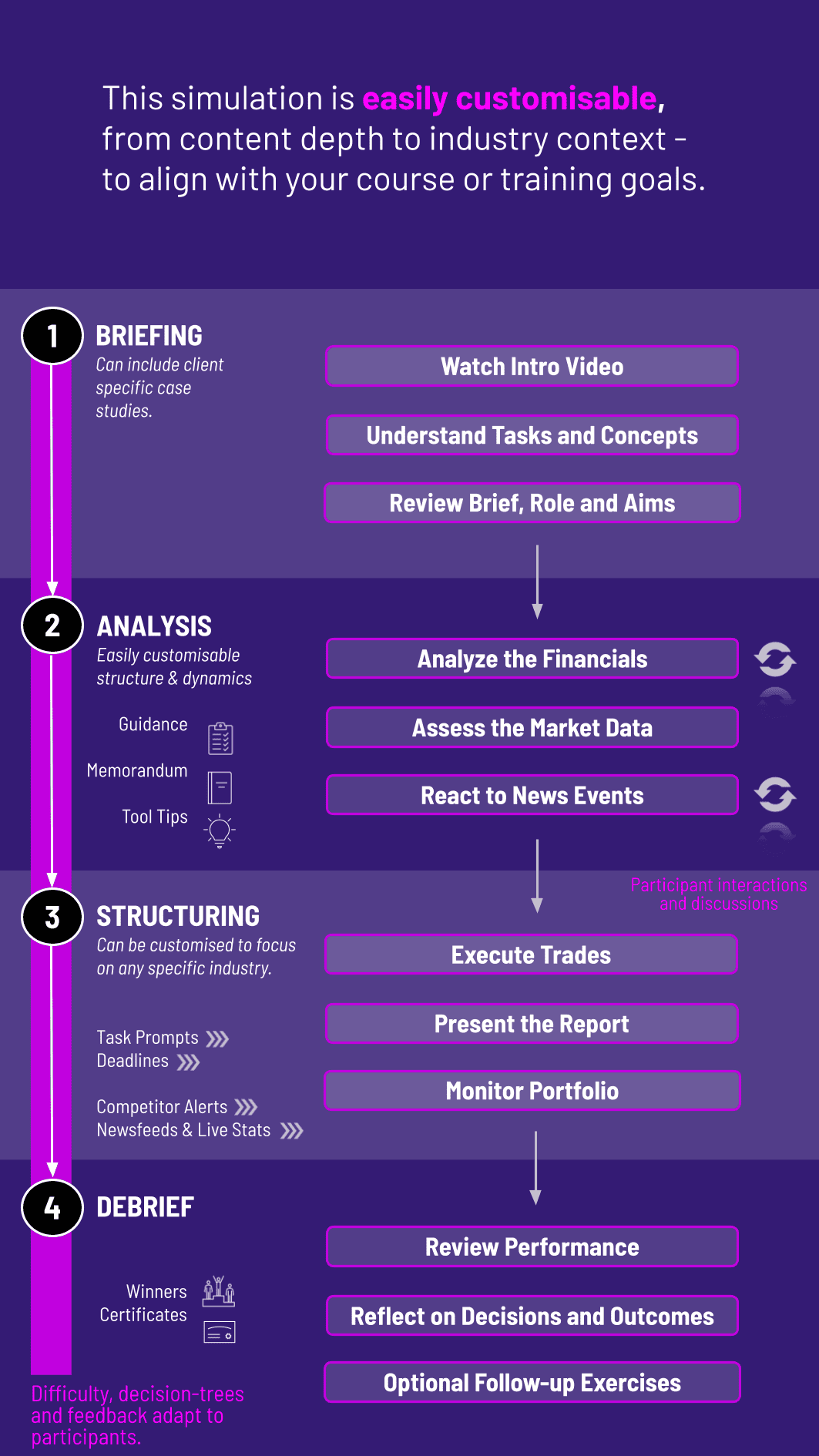

1. Setup and Briefing Participants are divided into teams, assigned a fund mandate, and granted virtual capital. They receive access to the trading platform, market data feeds, and an initial economic briefing.

** 2. News Cycle** Release of economic data, corporate news, and M&A rumors.

3. Trading Session Teams analyze information and execute trades.

4. Market Clear The engine processes all orders, determining new market prices.

** 5. Portfolio Review Teams see their updated P&L, risk metrics, and ranking.

** 6. Shocks** Instructors can inject unforeseen events to test resilience.

** 7. Debrief** A comprehensive review links in-simulation experiences to financial theory and best practices.

What are the benefits of using a simulation for finance education? It transforms passive learning into active experience, building intuition, decision-making under pressure, and practical skills that textbooks alone cannot provide. It’s the bridge between theory and practice.

Is this simulation suitable for beginners with no trading experience? Absolutely. The simulation is designed with guided tutorials and adjustable complexity levels, making it ideal for undergraduates, MBAs, and career-switchers to build foundational knowledge.

What asset classes can participants trade in the simulation? Our platform typically includes global equities, ETFs, government bonds, currencies (forex), and key derivatives like options and futures, depending on the chosen module.

Can this simulation be used for corporate training? Yes. It is highly effective for training analysts, risk managers, and portfolio managers at banks, hedge funds, and asset management firms, fostering a deeper understanding of market linkages and risk.

What technical requirements are needed to run the simulation? The simulation is cloud-based and runs on any modern web browser (Chrome, Safari, Edge). No special software or high-power hardware is required—only a stable internet connection.

How long does a typical simulation program last? Programs can be tailored, ranging from intensive 1-day workshops to multi-week courses embedded within a semester, with trading rounds and debrief sessions scheduled flexibly.

Risk-adjusted returns (Sharpe Ratio), consistency of performance, and adherence to stated portfolio mandates.

Quality of pre-trade analysis, clarity of investment thesis, and justification for entries/exits.

Ability to stay within predefined risk limits (leverage, sector exposure, drawdown controls).

Teams present their portfolio journey, key lessons learned, and a post-mortem analysis of their successes and failures to a panel.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.