Master Your Money From Basics to Financial Freedom. Build a virtual life, making real-world financial decisions and experiencing the long-term consequences of the choices made in a risk-free environment.

Budgeting and Cash Flow Management

Debt Management

Saving and Emergency Funds

Investing Fundamentals

Compound Interest

Credit Scores and Reports

Insurance and Risk Management

Financial Goal Setting

Taxes

In the simulation, participants will:

Create a detailed monthly budget based on a simulated salary and living expenses.

Make strategic decisions about housing, transportation, and lifestyle spending.

Manage various forms of debt, choosing between different repayment strategies.

Allocate savings into a diverse portfolio of investment assets.

Navigate random "Life Events" that simulate real-world financial shocks and opportunities.

Analyze their financial performance through dynamic dashboards showing net worth, credit score, and progress toward goals.

Compete individually or in teams to achieve the highest net worth and financial health score.

Construct and manage a personal budget that aligns with financial goals.

Evaluate different debt instruments and formulate an effective repayment plan.

Explain the fundamental principles of investing and asset allocation.

Calculate the impact of compound interest on savings and debt.

Articulate the factors that influence a credit score and how to maintain a good one.

Develop a holistic financial plan that incorporates insurance, emergency savings, and investment for the future.

Make informed, confident financial decisions in a simulated, yet realistic, environment.

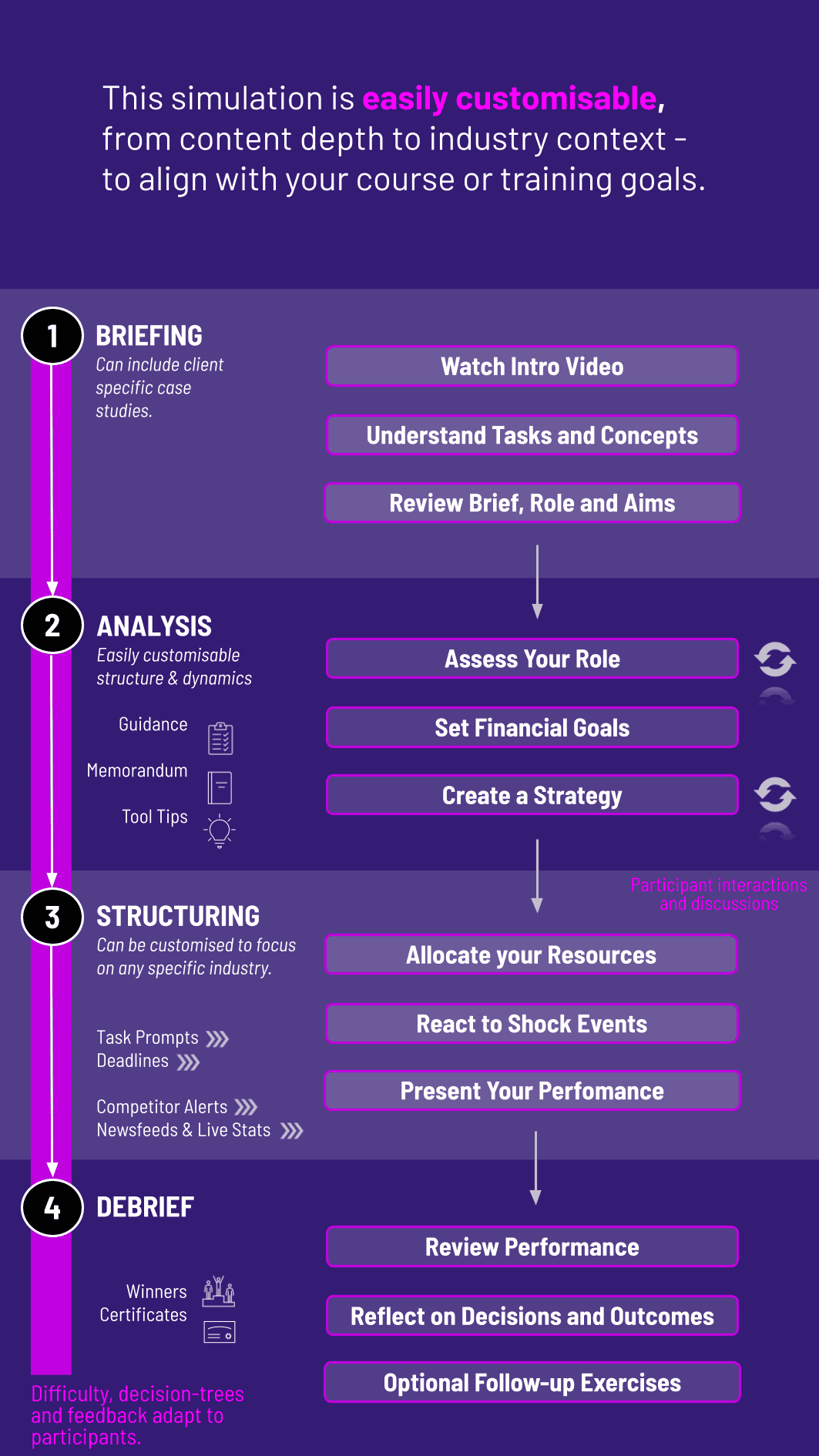

1. Setup and Role Creation Participants are assigned a profile with a career, salary, student loan debt, and initial savings. They set their financial goals.

2. Analyse the Situation: They review the data to prepare best possible strategy.

3. Allocate personal funds: Participants input their decisions for the month: budget allocations, debt payments, and investment trades. The simulation is divided into rounds, each representing several months or a year.

4. Check for results After submitting decisions, the simulation engine processes market movements, applies interest to debt and investments, and triggers random life events. Participants then see the results of their choices on their updated dashboard.

5. Review and Reflect: Feedback highlights portfolio quality, risk assessment, and clarity of narrative.

What is the typical duration of the simulation? A standard simulation runs for 6-10 decision rounds, which can be completed over a few hours in a single workshop or across multiple class sessions.

Do participants need a finance background? No prior background is necessary. The simulation is designed to be an introductory yet comprehensive practical application of personal finance. It makes complex concepts accessible and engaging for everyone.

How is the simulation delivered? It is a 100% browser-based platform. Participants only need an internet-connected device (laptop, tablet) to access it.

Can the simulation be customized for our institution? Yes, we offer various customization options, including incorporating specific local cost-of-living data, company-specific salary structures, or unique financial products.

Is this a stock market simulation? While investing in stocks and other assets is a component, it is only one part of a holistic experience that includes budgeting, debt management, and comprehensive financial planning.

How is this different from a budgeting app? Budgeting apps track your real-life spending. Our simulation is a learning tool that compresses time, introduces controlled challenges, and allows you to experiment with strategies without any real-world risk.

Financial Performance Score

Net Worth Growth

Debt-to-Income Ratio

Credit Score Trend

Goal Achievement

Strategic Decision-Making

Assessment may incorporate peer and self-review components, facilitator scoring, and debrief discussion. Results may feed into grades, executive feedback, certification or development plans.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.