Our Financial History Simulation immerses participants in the pivotal crises and breakthroughs that shaped the modern world, from the South Sea Bubble to the 2008 Global Financial Crisis.

Market Manias and Crashes

Monetary Policy and Central Banking

Financial Innovation and Systemic Risk

Regulatory Response and Arbitrage

Sovereign Debt and Currency Crises

Liquidity vs. Solvency Crises

Moral Hazard

Historical Parallels

In the simulation, participants will:

Assume roles such as Central Bank Governor, Investment Bank CEO, Regulatory Head, or Sovereign Debt Manager.

Set interest rates, approve mergers, issue new securities, design bailout packages, or impose capital controls.

Interpret period-accurate financial statements, economic indicators, and news flashes.

Form alliances with other teams, negotiate bailout terms, or lobby for regulatory changes.

Balance short-term survival with long-term stability for your institution.

Justify your team’s decisions to a mock historical "oversight committee".

Identify the root causes and transmission mechanisms of major historical financial crises.

Evaluate the trade-offs and unintended consequences of different policy and regulatory responses.

Articulate how financial innovation can simultaneously drive growth and amplify systemic risk.

Analyze the psychological and behavioral factors (greed, fear, herd behavior) that drive market cycles.

Develop frameworks for crisis management and decision-making under extreme uncertainty.

Draw informed parallels between historical financial events and modern market conditions.

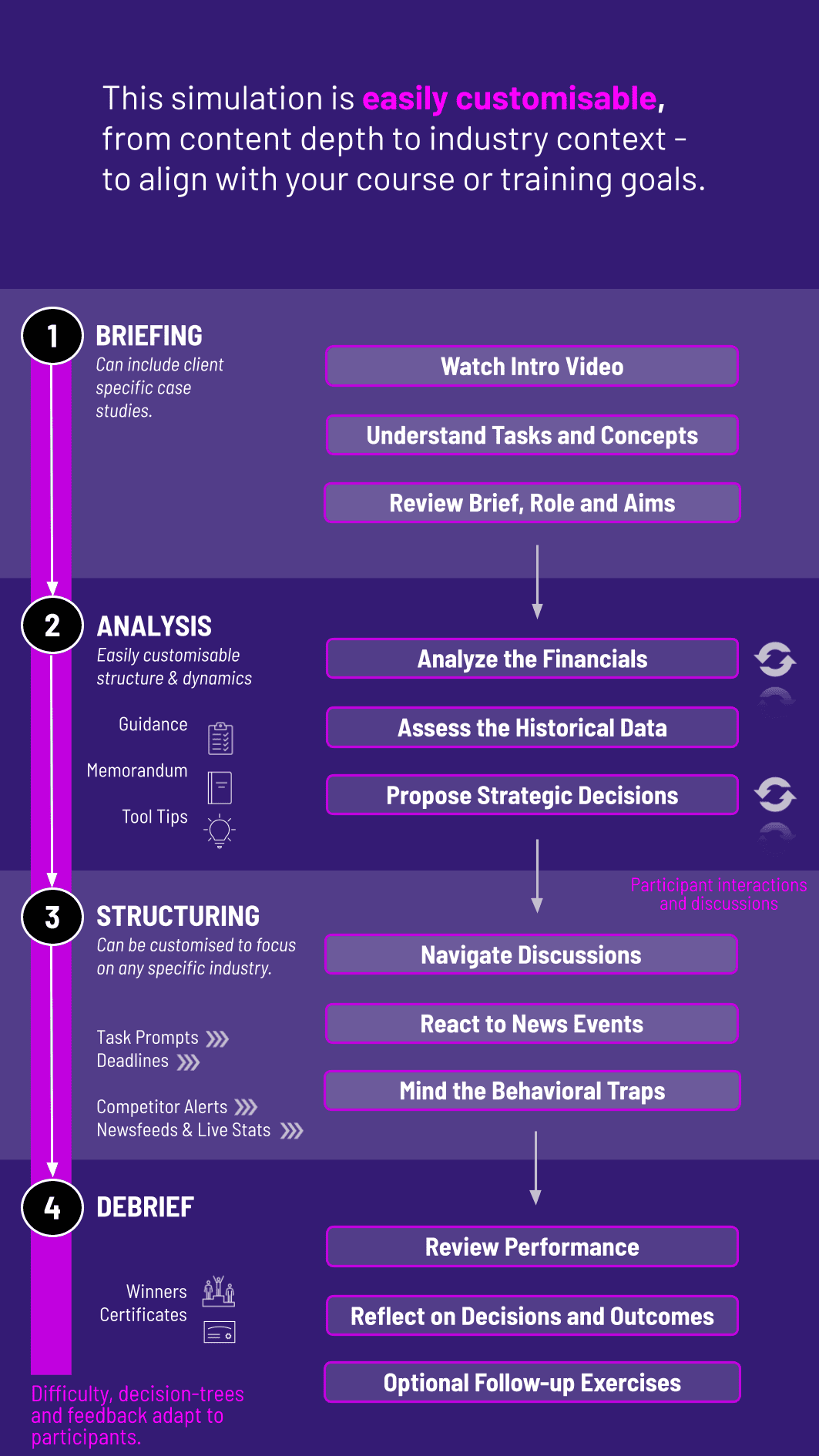

1. Era Selection and Briefing Teams are assigned a specific historical era and receive background on their roles, objectives, and starting financial positions.

2. Decision Rounds The simulation progresses through chronological "rounds," each representing a key phase or year. Each round, teams analyze new economic data and news, then submit strategic decisions via the simulation platform.

3. Market Resolution The facilitator inputs all team decisions into the simulation engine, which calculates outcomes based on historical economic models and inter-team dynamics. Results are broadcast to all.

4. Crisis Injects Unscripted "crisis events" (like a major default or bank run) are triggered, forcing teams to react in real-time.

** 5. Debrief and Historical Comparison** The facilitator-led debrief is crucial. Teams’ results are compared to the actual historical outcome, sparking discussion on why decisions led to different or similar results.

Who is this simulation designed for? It is ideal for university finance and economics programs, MBA students, executive education cohorts, corporate training for finance professionals, and any organization seeking deep insight into risk management and economic cycles.

What prior knowledge do participants need? While helpful, deep historical knowledge is not required. The simulation provides all necessary context. A foundational understanding of core financial concepts (like bonds, equities, and interest rates) is sufficient.

How is this different from a traditional case study? Case studies are static and analyzed post-hoc. This simulation is dynamic, competitive, and forward-looking. Participants make decisions without knowing the outcome, experiencing the pressure, uncertainty, and real-time consequences that historical figures faced.

What historical periods are covered? Modules can cover major events including the Tulip Mania (1637), the South Sea Bubble (1720), the Great Depression (1929), the Latin American Debt Crisis (1980s), the Asian Financial Crisis (1997), and the 2008 Global Financial Crisis or any other.

What technology or setup is required? The simulation is browser-based. Participants need a laptop and internet connection. It can be run in-person in a computer lab or virtually with video conferencing for team breakout rooms and a central briefing plenary.

Can the simulation be customized for our specific curriculum? Yes. We can emphasize specific eras, concepts, or learning objectives to align with your course syllabus, whether it’s focused on macroeconomics, banking, investments, or financial regulation.

How long does the simulation typically last? Core experiences can be condensed into 3-hour workshops. More comprehensive versions, involving multiple crisis eras and deep debriefs, can span 1-2 full days for maximum impact.

Financial stability, profitability, and risk management outcomes relative to their historical objectives.

Quality of the Final Debrief Presentation

Ability to adapt and revise valuations in light of news shocks or changes

Collaboration, division of work, integration of roles, and final coherence

Rating by peers and self-reflection on approach and decisions

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.