In today's volatile economic landscape, the ability to accurately forecast a company's financial future is not just a skill—it's a critical strategic advantage.

Three-Statement Modeling

Revenue Forecasting

Cost Behavior Analysis

Working Capital Management

Capital Expenditure Planning

Debt and Equity Financing

Financial Ratio Analysis

Sensitivity and Scenario Analysis

Dashboard and Management Reporting

In the simulation, participants will:

Analyze a company's historical data and the competitive market environment.

Build a dynamic, integrated 3-statement financial model from scratch.

Forecast key drivers like sales volume, pricing, and operational expenses.

Make strategic decisions on hiring, marketing spend, and capital projects.

Secure necessary funding by choosing between debt and equity options.

Manage the delicate balance between profitability, liquidity, and growth.

Present their financial forecast and strategic rationale to the "board" (instructors and peers).

Compete against other teams to create the most accurate and valuable financial plan.

Construct a fully integrated and dynamic three-statement financial model.

Identify and forecast the key operational and financial drivers of a business.

Analyze the intrinsic linkages between strategic decisions and financial outcomes.

Evaluate a company's financial health and performance using key ratios and metrics.

Develop multiple financial scenarios to assess risk and opportunity.

Communicate financial forecasts effectively to support strategic decision-making.

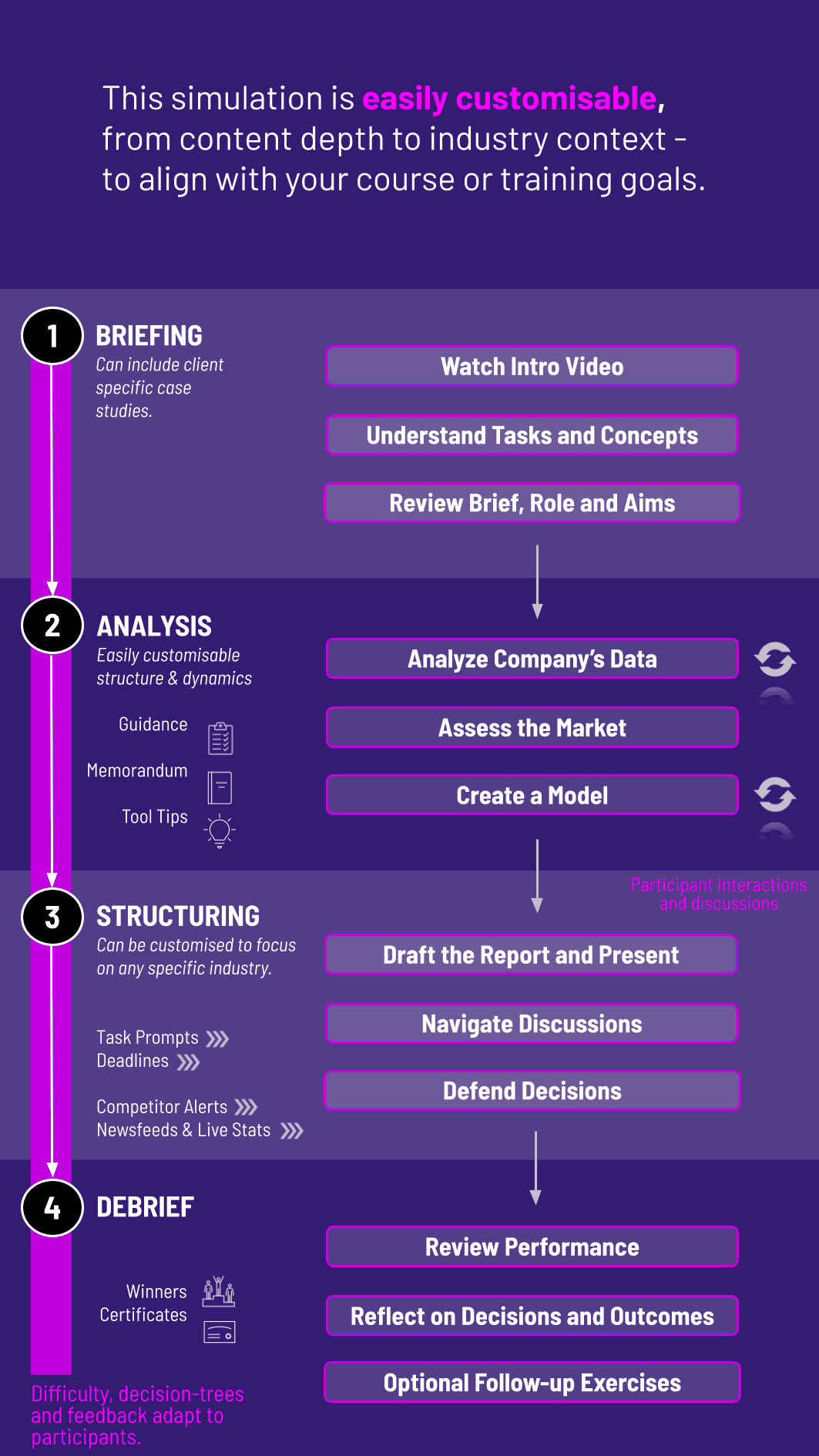

1. Team Formation and Introduction Participants are divided into FP&A teams and introduced to the simulation platform and their company's specific case.

2. Initial Analysis Teams analyze provided historical financials, market research, and industry trends.

3. Model Building Over several rounds, teams build their forecast by inputting assumptions and making strategic decisions for each fiscal quarter/year.

4. Decision Submission At the end of each round, teams submit their financial model and strategic plan.

5. Results and Market Feedback The simulation engine processes all decisions, generating detailed financial statements and market feedback. Teams see their company's valuation, stock price, and key metrics compared to competitors.

6. Analysis and Iteration Teams analyze their performance, identify variances from their forecast, and adjust their strategy and model for the next round.

7. Final Presentation The simulation culminates in teams presenting their multi-year strategic plan and financial forecast to a panel, justifying their assumptions and results.

Who is the Financial Forecasting Simulation designed for? It is ideal for MBA students, finance undergraduates, corporate trainees in FP&A, and any professional seeking to build or enhance their financial modeling and strategic planning skills.

Do I need to be an Excel expert to participate? While basic Excel proficiency is helpful, it is not mandatory. The simulation is designed to teach modeling concepts. The platform is user-friendly, and the focus is on financial logic and strategic thinking, not advanced Excel formulas.

What is the difference between this and a typical "valuation" or "investment banking" simulation? While valuation is an outcome, our simulation focuses on the process of building a forecast from within the company. It emphasizes operational drivers (e.g., unit sales, production costs) and internal resource allocation, mirroring the role of a corporate financial planner rather than an external analyst.

Is this a live, online, or self-paced simulation? The simulation is highly flexible. It can be run as a live, in-person competition, a multi-week online course, or a self-paced module, depending on your program's needs.

How long does the simulation typically take to complete? A standard simulation runs over 3-5 rounds and can be completed in a single intensive day (6-8 hours) or spread out over several shorter sessions (2-ish hour sessions per week).

Can the simulation be customized for our specific industry? Yes, we offer custom case development. Please contact us to discuss tailoring the simulation to your industry, such as technology, manufacturing, or retail.

How is the winning team determined? Performance is multi-faceted. Teams are scored on the accuracy of their forecasts, the financial strength of their company (profitability, solvency), and the strategic coherence of their final presentation.

Accuracy, integrity, and logic of the 3-statement model.

Reasonableness of assumptions.

Achievement of key financial metrics (Revenue Growth, EBITDA Margin, ROIC, Leverage Ratios) and final company valuation.

Quality of strategic choices and the depth of "what-if" analysis performed.

Clarity, professionalism, and justification of the financial forecast and strategic plan.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.