The Financial Engineering Simulation uses realistic market data and pricing models, teams design, trade, and hedge sophisticated financial instruments while managing portfolio exposure in real time.

Derivative pricing models

Option Greeks and dynamic hedging

Structured product design

Volatility trading and smile/skew dynamics

Counterparty credit risk and CVA/DVA adjustments

Portfolio margin and capital efficiency

Yield curve modeling and interest rate derivatives

Stress testing and scenario analysis

In the simulation, participants will:

Design and price custom OTC derivatives for simulated client “RFPs”

Execute trades in a live simulated market with shifting volatilities and rates

Dynamically rebalance hedges based on real-time Greeks exposure

Manage P&L and risk limits under changing regulatory conditions

Structure multi-leg derivatives to meet specific client yield/risk profiles

Compete in trading rounds that incorporate market shocks and liquidity events

Present their structured solutions and risk management approach to a simulated “risk committee”

Apply derivative pricing theory to live, noisy market conditions

Develop intuition for managing non-linear risks and tail exposures

Understand the trade-offs between customized OTC solutions and exchange-traded equivalents

Improve decision-making under capital constraints and margin requirements

Enhance ability to communicate complex strategies to clients and risk managers

Experience the interplay between sales, trading, quants, and risk departments

1. Setup Teams receive initial capital, a proprietary book with existing positions, risk limits, and a suite of analytical tools (pricing calculators, risk dashboards).

2. Market and Client Rounds Each round represents a new period: teams analyze incoming market data and client RFPs, they use the platform's tools to design a product, price it, propose a bid/ask spread, and decide if they will warehouse the risk or hedge it instantly in the simulated market.

3. Trading and Hedging Teams enter the simulated market to execute hedge trades, adjust existing positions, or take proprietary views.

4. Risk and Performance Feedback After each round, the platform automatically calculates the team's P&L, updated risk metrics, and collateral calls. Teams see the direct consequences of their engineering choices.

5. Review and Iterate Teams analyze their performance, identify sources of profit/loss, and adjust their strategies for the next round, facing new market shocks and client demands.

6. Final Review The simulation culminates in a management presentation where teams defend their strategy, explain their book's risk profile, and review their overall performance against benchmarks and peers.

What background is needed for this simulation? A foundational understanding of derivatives (options, futures, swaps) and basic quantitative skills is recommended. The platform includes reference guides and model templates.

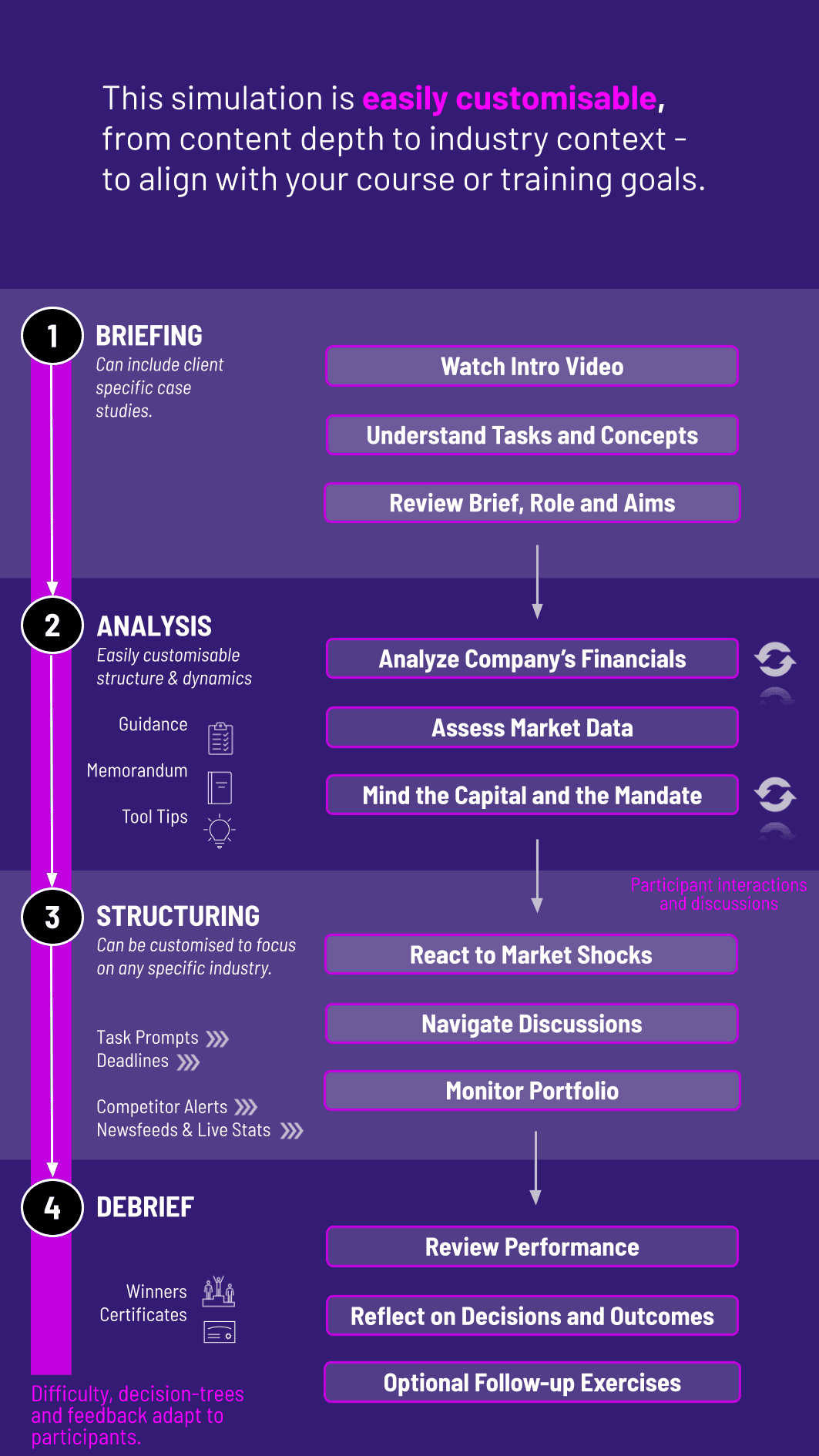

Can the simulation be customized for different skill levels? Yes. Complexity can be scaled—from vanilla derivatives to exotics—and mathematical depth adjusted based on the audience.

How long does the simulation typically run? From 4 hours (condensed version) to multi-day workshops with deeper debriefs.

Is this simulation relevant for fintech or crypto markets? Absolutely. Concepts translate directly to crypto derivatives, DeFi structured products, and algorithmic hedging.

Do participants need to code or build models from scratch? No. The platform includes pricing calculators and risk engines, but advanced groups can optionally input custom formulas.

How is the simulation delivered? Via a web-based platform accessible on any browser, with an instructor dashboard for real-time adjustments.

Can the simulation include real historical crises? Yes. Historical or hypothetical stress scenarios can be integrated into market rounds.

What makes this simulation different from a generic trading game? Focus on engineering and structuring—not just speculation. Teams create OTC products, hedge non-linear risks, and face real-world constraints like collateral calls.

Profitability relative to capital used and volatility taken.

Accuracy and cost of Greek neutralization.

Innovation in meeting client needs within regulatory limits.

Adherence to VaR, stress loss limits, and reporting.

Quality of explanations during risk review meetings.

Join this 20-minute webinar, followed by a Q&A session, to immerse yourself in the simulation.

or

Book a 15-minute Zoom demo with one of our experts to explore how the simulation can benefit you.